Too Early to Bury the UK Economy, Recession is Not Inevitable

- Written by: Gary Howes

Image © Adobe Stock

A cost of living crisis and fears of stagflation underpin a bearish consensus towards the UK economy and the Pound amongst economists and investors, but some warn it is too early to write off the UK economy.

"Such are the numbers of those predicting that the UK’s economic growth figures are set to tumble and bury the economy with them, one imagines they have clubbed together to pay for a simple headstone carrying the words 'RIP UK economy, 2009-2022'," quips head of research at Toscafund Asset Management Savvas Savouri.

Savouri joins a small number of other economists in saying it is too soon to write off the UK, "reports of the UK economy’s approaching demise are greatly exaggerated."

UK the Poster-Child of Stagflation

Sentiment on the UK economy is particularly poor, with analysts and commentators suggesting it is in a worse place than its developed market peers:

In a recent note foreign exchange strategists at JP Morgan say the UK is the poster-child of stagflation: an unenviable position an economy finds itself in when it is struck by low growth and surging inflation.

Bloomberg report on May 19, "in a world reeling from soaring inflation and weak growth, the UK holds a special place. It’s on track to be the advanced nations’ stagflation capital."

Domestic media meanwhile talk of a very real 'cost of living' crisis as households come under the strain of surging costs.

The Bank of England has warned the UK economy will slide into recession this year at their May 05 Monetary Policy Report, citing higher energy prices that will push inflation above 10%.

Economists at UniCredit expect GDP to contract 0.2% quarter-on-quarter in 2Q22 as the squeeze in households’ real disposable income intensifies amid a surge in inflation and higher taxes. They expect the downturn to be so bad they now expect the Pound-Euro rate to fall to 1.05 and the Pound-Dollar to below 1.20.

But Beware the Pessimism

UK economic growth will inevitably slow from racy rates seen at the turn of the year, but will they slow sharply enough to trigger a genuine recession?

Furthermore, will the UK be in any worse off position to its developed market peers? This is a particularly important question to consider when approaching the Pound given exchange rates are a relative game.

Shahab Jalinoos, Head of G10 FX Strategy at Credit Suisse has long been wary of what he describes as a 'perma bear' approach by the economist community towards Sterling and the UK economy.

This bearish 'default' approach to the UK emerged after the UK voted to leave the EU in 2016 and remains intact.

The UK Will Avoid Recession say Some

While the majority of research assessed by Pound Sterling Live is consistent with a poor outcome for the UK economy in 2022 and 2023, there are some counter-trend takes that warn against being overly pessimistic towards the UK economy.

If they are correct the findings would offer a useful source of 'alpha' in approaching the Pound and other UK assets.

Toscafund's Savouri says the three crucial elements of the UK economy (labour, property and banks) are fundamentally sound shape, "I am confident, as things stand (sic), there is no chance of the UK toppling into recession."

"Weak confidence doesn’t make a spending crash inevitable," says a new research note from Capital Economics, the independent economic research consultancy.

"A consumer-led UK recession is not inevitable," says a new note from investment bank and lender Investec.

Toscafund: Three Pillars of Support Intact

Savouri says "recessions do not just happen," and one of either the labour market, banking sector or property market must collapse before a recession emerges.

"With over 1.3m vacancies, the UK’s labour market problem is one only to be envied," he says of the labour market.

Figures out this week showed the UK added 83K jobs in the three months to March, far more than the 5K the market was looking for.

The unemployment rate unexpectedly fell to 3.7% from 3.8%, which is the lowest level in 50 years and vacancies reached a new record; in fact there are now more vacancies than unemployed.

Average Earnings, with bonuses included, surged 7.0% in March, far higher than the 5.4% the market was looking for.

"Rather than view rising wages as a threat, we should see them as before too long delivering real wage growth; further supporting the UK’s residential market."

Above: UK real wage growth, with Toscafund forecasts. Image courtesy of Toscafund.

"What then of UK banks? Well, they came into coronavirus in as macro prudentially good shape as they have really ever been. They did so thanks to conservative stewardship from the BoE, a far cry from the period up to '08 when they were light-touch regulated by the FSA. Indeed, rather than fear a rising base rate, banks will welcome such moves," says Savouri.

"There is no risk of a UK recession, neither its mild form nor its far, far worse version, stagflation," he concludes.

Capital Economics: Job Security and Accrued Savings Matter

Nicholas Farr, Assistant Economist at Capital Economics, says the recent collapse in consumer confidence to a near-record low has added to the probability that the UK experiences a recession this year.

"But households’ large stock of savings and the tightness in the labour market means that weak confidence may not weigh on consumer spending as much as in the past," says Farr.

Capital Economics also cite precedent: during 2011 rising inflation meant that real household disposable income fell and consumer confidence dropped sharply below -30, but a recession was avoided. Despite a 1.5% decline in real household disposable income over the year, consumer spending fell by only 0.2%.

Above: Consumer Confidence & Consumer Spending. Image courtesy of Capital Economics. Sources: Refinitiv, Capital Economics.

Furthermore, households have not yet spent the excess savings they accrued during the pandemic.

Capital Economics estimate the stock of excess savings sitting in households’ bank accounts in March stood at around £160BN, or 7% of GDP.

"It seems likely that (similar to 2011) lower consumer confidence won’t lead to a big rise in precautionary savings. In fact, we expect the saving rate to fall from 6.8% in Q4 2021 to 3.0% in Q3 2022," says Farr.

This assumption is made all the more likely as a higher level of job security offers reason to think households are likely to be more willing to reduce their saving rate to support their spending.

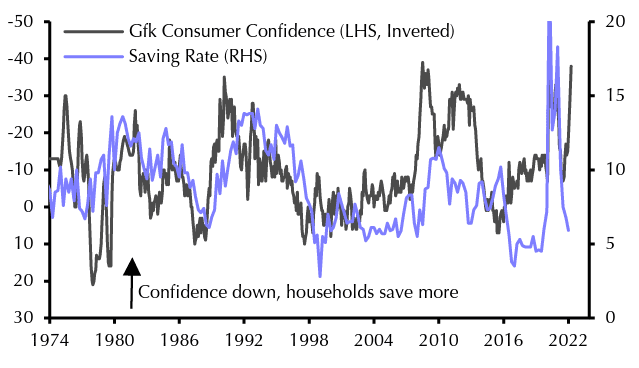

Above: Falling confidence doesn't always result in a jump in savings. Image courtesy of Capital Economics. Sources: Refinitiv, Capital Economics.

Investec: Household Consumption will Still Grow

Economist Sandra Horsfield at Investec says households may initially choose to save a smaller share of their current income in the face of the jump in inflation.

"This is a type of ‘consumption smoothing’ in the face of income fluctuations that economic theory predicts," says Horsfield.

As of the final quarter of 2021 the household saving ratio was 6.8%, well above the Q1 2017 trough of 3.5%. (In the first quarter of 1999 it plummeted to 2.8%).

Investec forecasts a trough of 3.9% in the savings ratio will be reached in the second quarter of 2023.

"Under this assumption, household consumption growth is predicted to run at +3.9% in 2022, even though real household disposable incomes fall by 2.4%," says Horsfield.

Above: "A smaller proportion saved would help households sustain consumption" - Investec. Image courtesy of Investec, sources: Macrobond, Investec.

In short households will consume at the expense of saving.

"In our forecasts we are actually looking for the level of consumption to fall below its current level for the rest of the year, although only slightly," says Horsfield.

Investec also see the significant stock of savings accrued during the pandemic being tapped by households, which they reckon amounts to 6.5% of UK GDP.

"Our hunch is that, given these savings were unplanned, households may be prepared to spend a far larger part of them than usual rather than sacrificing discretionary spending," says Horsfield.

"It is by no means a certainty, but it looks plausible to us that a lower saving rate will prove enough of a buffer to most of the hit, leading consumer spending only slightly lower through the remainder of 2022," she concludes.