Bank of England's Ramsden Errs on the Side of the Hawks

- Written by: Gary Howes

Image © Bank of England

The Deputy Governor of the Bank of England said further interest rate rises are needed as there is a risk the UK jobs market proves more resilient than the Bank's current expectations.

“Given what we know about the UK labor market, I wouldn’t be surprised if it turned out to be a bit tighter," said Dave Ramsden. "I think there are upside risks on inflation the medium term."

Ramsden's comments were made in an interview with Bloomberg a week after he voted to hike rates by 25 basis points.

His colleagues James Haskell, Michael Saunders and Catherine Mann voted for a more hefty 50 point rise and are the obvious candidates to vote for further rate hikes at upcoming meetings.

But Ramsden's comments put him in the 'hawkish' camp, even if he is not quite prepared to vote for a more swingeing 50 basis point hike.

The evidence suggests the Bank is not quite ready to pause its hiking cycle, as some economists are saying.

"Certainly on the basis of my current assessment of prospects, we're not there yet in terms of how far monetary policy has to tighten," Ramsden said.

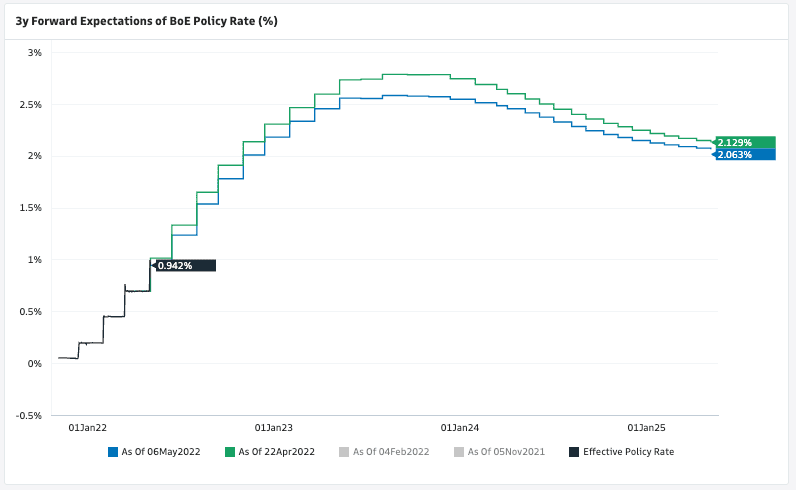

Above: Market implied expectations for future BoE Bank Rate. Pricing has come down since last week's policy update. Image courtesy of Goldman Sachs.

Pound Sterling sold off sharply in the wake of the Bank's May policy update that suggested UK economic growth would slow dramatically over coming months, lessening the need for further rate hikes.

Economists routinely say the market's current expectations for approximately 125 further basis points of hikes to be delivered in 2022 is too aggressive and must come down further, which provides a mechanical conduit to further GBP weakness.

But if anything Ramsden's latest comments would offer some support for hike expectations.

"I‘m still very, very supportive of the forward guidance that there may well need to be further tightening in the coming months," he said.

Ramsden's interview was released on the day UK economic growth was shown to have shrunk in May, prompting economists to warn the economy will likely record a decline in the second quarter.

The UK's inflation rate is running hot and the Bank forecasts a peak at 10% in the final quarter of 2022, which would typically prompt a series of interest rate hikes.

But the Bank's economic projections show inflation will start to fall as the economy slows and consumer demand fades, which suggests less hikes might be needed to achieve the 2.0% medium-term inflation goal than the market currently anticipates.