Savouri: The Bank of England Got it Wrong

- Written by: Gary Howes

"To put it politely, the closer we look into the report, the greater our disappointment with the MPC."

Image © Adobe Images

The specialist fund manager Toscafund Asset Management is not impressed by the Bank of England's latest gloomy economic projections, saying they have made some glaring mistakes.

"We have now had a few days to digest the MPC’s latest offering, chiefly their Monetary Policy Report. To put it politely, the closer we look into the report, the greater our disappointment with the MPC," says Savvas Savouri, Chief Economist for Toscafund Asset Management.

Savouri joins a host of economists who have pored over the Bank of England's May Monetary Policy Report (MPR) and found the projections to be too pessimistic and reliant on flawed assumptions.

"We believe the BoE failed miserably to produce anything close to the standards required," says Savouri.

The Bank sent the Pound hurtling lower and lit up the financial pages of the nation's newspapers after releasing projections that showed the UK economy would shrink 0.25% in 2023 and grow just 0.25% in 2024, on current estimates.

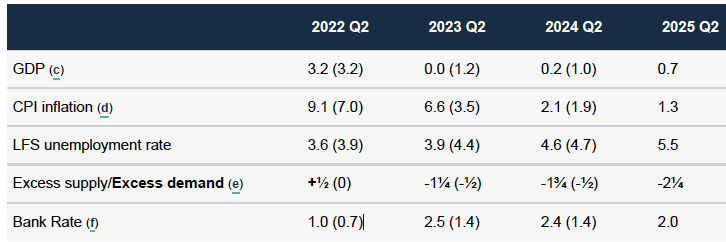

Above: Bank of England projections.

Inflation was meanwhile seen peaking at 10% in the fourth quarter of the year as the impact of another rise in the energy cap feeds into the data.

Economists have queried a key assumption made by the Bank relating to energy prices when computing their inflation forecasts:

The Bank's economists rely on market expectations for future energy prices via futures contracts.

But the Bank only follows these contracts to six months out, beyond which they assume prices remain constant.

But were they to keep following the futures market beyond six months they would see prices actually start to come down.

"If the Bank were to assume that energy prices fall back to the levels implied by futures curves, then GDP growth would be about 0.3 percentage points (ppts) higher in both 2023 and 2024," says Ruth Gregory, Senior UK Economist at Capital Economics.

Therefore it is almost as if the Bank's economists have cherry-picked the gloomiest signals from the energy markets.

Savouri says in the current climate "this assumption is beyond absurd. Energy prices will fall back materially over the coming years, acting as a large downwards force on inflation – the MPC fail to account for this."

Assumptions on the future of government spending are also deemed unrealistic.

"They persist in their forecasts with an assumption to only use announced government fiscal policy. Whilst we understand the reason for this in normal times, it is highly misleading to just assume a further 40% hike in the energy price cap in October, but no fiscal response from the Chancellor," says Savouri.

Gregory at Capital Economics agrees: "It is hard to see the Chancellor holding off on more help for households. A similar sized fiscal package to that unveiled in March could add up to 0.5% to the level of GDP".

Above: The Bank of England's forecasts are outliers in terms of their gloominess.

Another key component of the Bank of England's forecasting methodology is the market's expectations for future interest rates.

Money market pricing shows where investors expect interest rates to be at certain points in the future: this is a similar concept to energy market pricing, however the Bank chooses to follow this curve beyond six months.

In the May MPR the Bank's economists saw the market was pricing a peak Bank Rate of 2.50% in 2023 which was then inputed into their models.

Such a high Bank Rate would inevitably impact economic activity as it forces up the cost of lending and therefore contributes heavily to the dour GDP forecasts.

"Their forecast is conditioned on a mis-priced base rate path implied by markets, which rose to over 2.5% by mid-‘23. There is no chance rates will rise from here that sharply as the MPC well knows," says Savouri.

He also notes the Bank expects underlying pay growth to increase to around 5% in the second quarter of 2022 and moderate beyond that; Toscafund believes they severely underestimate wage growth over the coming year or so.

He says the Bank also underestimate the resilience of the labour market as they assume unemployment rises in the fourth quarter of 2022 and eventually reaches a peak of 5.5%.

"We believe this is a significant over-estimation and that they unbelievably continue to underestimate the strength of the UK labour market. Labour demand is far stronger, and the labour market will remain far tighter, than they assume," says Savouri.

Holger Schmieding, Chief Economist at Berenberg Bank, agrees.

"With strong balance sheets, robust labour markets and a high stock of savings, most households should be able to hold their noses and expand consumption in real terms even as inflation outstrips wage growth for a while," says Schmieding.

In a note to clients, Schmieding says the relevant question is whether or not the BoE’s headline-grabbing projections are plausible, "in our view, the answer is that they probably are not," he concludes.

Toscafund, Berenberg and Capital Economics believe real incomes over the next year or so will come in significantly higher than the Bank expects, saying household savings built up during Covid will provide support.

"In short, we would advise those seeking to find out where the UK economy is heading to dispose of the MPR and seek credible analysis from elsewhere. When the OBR next updates on its UK economic outlook, we have no doubt it will provide more reasoned forecasts for growth ahead," says Savouri.