"The Market Continues to Price in too Many Hikes": Macro Hive's Bank of England Take

- Written by: Henry Occleston, Strategist at Macro Hive

- A 25bp hike brings bank rate to 1%

- More votes for 50bp than expected

- Updated forecasts set out a much stronger path for inflation into year-end

- But comes alongside a very bearish 2023 for UK growth

- The market responded by reducing pricing for hikes

- Driving GBP weakness.

- The rates move was quickly pared, though.

- I expect the market continues to price in too many hikes.

Image © Adobe Stock

As expected, the MPC voted to hike rates by 25bps to 1.0%.

However, the extent of the hawkish dissent was a surprise.

I had expected Catherine Mann to vote for 50bps, but Michael Saunders and Jonathan Haskel also joined her.

Meanwhile, doves Jon Cunliffe and Silvana Tenreyro voted for a 25bp hike (I had seen a risk that one or both vote for no change).

However, it is likely that these two doves do not see a need for any additional hikes.

In the forecasts, as expected, the near-term inflation outlook was significantly increased in the wake of recent CPI outturns, the likelihood of a further Ofgem price cap rise in October, and the continued tightness in the labour market.

However, the rise was much greater than expected.

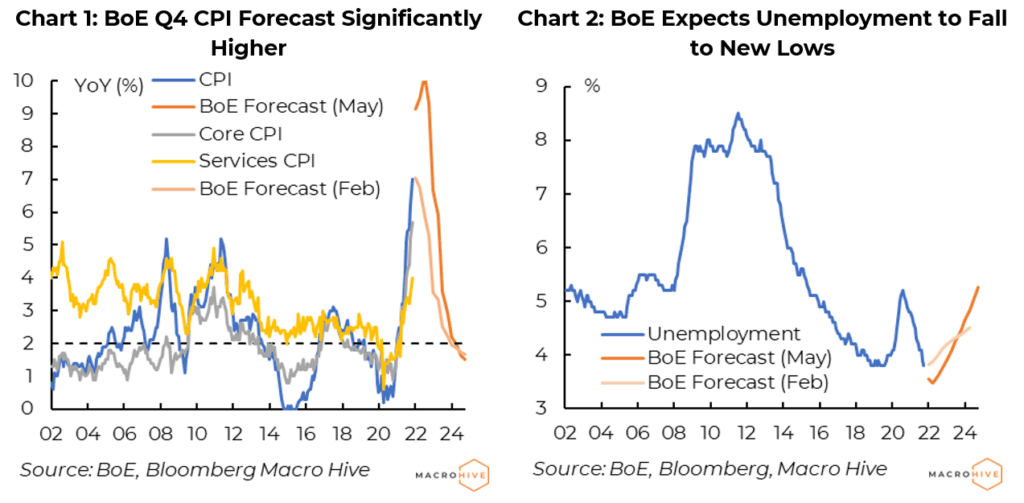

Economists are currently looking for Q4 inflation around 7-8%, but the BoE has set a path that would leave it above 10% (Chart 1).

The BoE is clearly signalling the need for more tightening, helped by the tight labour market (Chart 2).

However, somewhat surprisingly (given its track record), the market looked through these headline-grabbing hawkish elements to pare the hiking schedule priced (something we have been waiting to occur for a while).

The driver of this dovish tilt largely came from the significantly more bearish forecasts of UK economic growth.

The BoE now expects a 0.25% reduction in UK GDP in 2023, 1.5ppts lower than in February).

Real income compression is a large driver of this more bearish economic outlook, compounded by weaker outturns in housing and business investment, and exports.

Markets are finally taking this as a sign they have priced too much in terms of rates hikes.

However, there remains a lot more room to go on this front.

The immediate reaction saw 2Y gilt yields drop 20bps, down through 1.4%, but this has since pared to around 1.5%.

At the same time, the GBP OIS curve continues to price six more hikes in the next 12 months.

I think it is more likely the BoE pauses come August as they assess their updated MPR and begin to move into active gilt sales.

On this front, the timeline of active gilt sales was pushed out a little further than I had anticipated. An update is now scheduled for August, with a decision expected after that.

This delay may have provided marginal support to the gilts curve on the day, although probably the bull-steepening we saw was more of a mechanical reaction to the strength in the short-end.

Further tightening is needed ahead. The UK consumer remains under pressure, but financial conditions look relatively stable.

I continue to believe that as the pain from the current crisis continues, the BoE will need to increasingly lean on QT rather than rate hikes to tighten policy into the end of the year.

This article first appeared on Macro Hive.

Henry Occleston is a Strategist, who focuses on European markets. Formerly, he worked in European credit and rates strategy at Mizuho Bank, and market strategy at Lloyds Bank