GBP/CAD Forecast: Hugging the 50-day MA Ahead of Bank of England

- Written by: Gary Howes

Image © Adobe Stock

The Pound's near-term setup against the Canadian Dollar is one of consolidation but with an eventual upside bias.

The Pound to Canadian Dollar exchange rate was relatively steady last week; this despite a host of other Pound-based exchange rates taking a pasting in the wake of a benign Federal Reserve update and softer-than-forecast U.S. jobs report.

This relative stability points to equal measures of GBP and CAD underperformance linked to rising expectations that both the Bank of Canada and Bank of England could cut interest rates as soon as June.

Following Friday's U.S. jobs report, the market brought forward the expected timing of the first Federal Reserve rate cut to September from December. In response, the market also raised expectations for the scale of rate cuts at the BoC and BoE, judging both central banks will feel emboldened to cut with the cover of the big Fed.

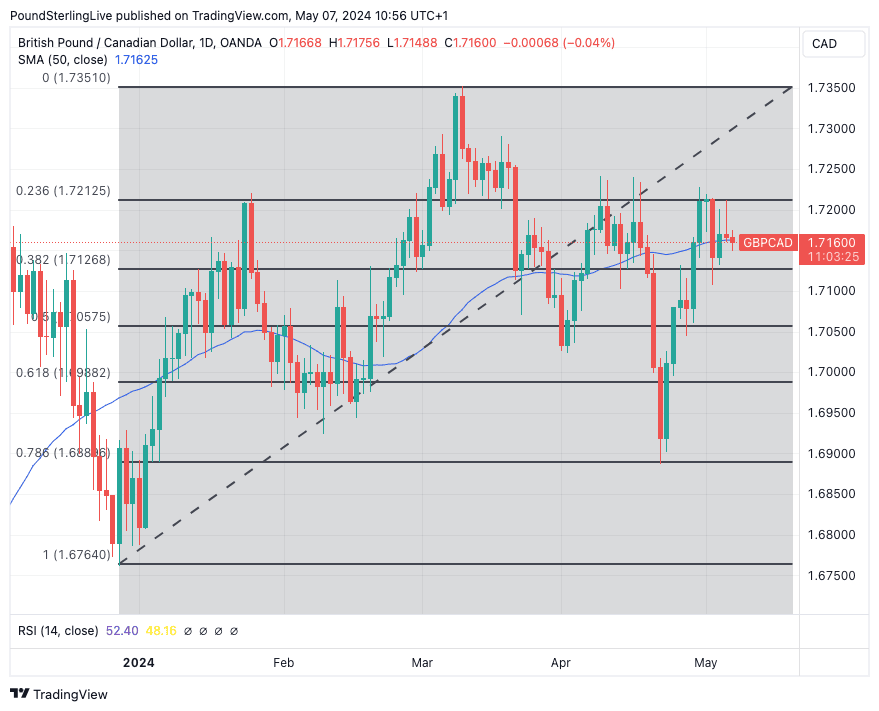

This has weighed on both the Pound and Canadian Dollar in equal measure, leaving the cross (GBP/CAD) hovering around its 50-day moving average at 1.7162.

The near-term picture suggests the exchange rate can hover around the 50-day fulcrum, which is also bounded by the 38.2% and 23.6% Fibonacci retracement of the 2024 rally:

Track GBP/CAD with your own custom rate alerts. Set Up Here

The exchange rate nevertheless resides above both the 100-day and 200-day moving averages which suggests a broader uptrend remains intact, and once the current consolidation is complete we would look for further gains to the 2024 highs at 1.7350 (a multi-week target).

But be aware that this week sees the Bank of England deliver its latest decision and there are risks the central bank signals it is ready to cut in June, which would lead to a further readjustment in financial markets and a weaker Pound.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

"The pound is susceptible to BOE risks into the May 9 meeting," says a note from the foreign exchange strategy team at Barclays. "The MPC is gradually pivoting more dovish, as evidenced by Ramsden's recent speech but also more measured statements by Governor Bailey at the IMF meetings."

A clearly 'dovish' outcome for the Pound would involve the Bank pointing to a June rate cut, as this would involve a significant amount of repricing in financial markets. Such pointers could come in the form of more than one vote on the MPC for an immediate rate cut. The statement could also signal such intentions, as would a downgrade in the Bank's inflation forecasts.

When we consider an upside scenario for Sterling, we imagine it would involve the Bank being at pains to signal that nothing much has changed and that while it is pleased with progress on inflation, it remains guarded.

This could solidify expectations for an August rate cut. Here we would imagine the Pound recovers, with the scale of any recovery depending on how deep this current immediate-term selloff extends.

Any outcome that the market considers 'hawkish' could allow Pound-Canadian Dollar a shot at breaking the 23.6% Fibonacci level at 1.7212, the first hurdle in the quest for fresh 2024 highs.