Canadian Dollar Outperforms Following Steady Bank of Canada Call & U.S. Inflation Surprise

- Written by: Gary Howes

Above: File image of Tiff Macklem. Image source: Bank of Canada.

The Canadian Dollar was amongst the top-performing currencies in the G10 after the Bank of Canada held its benchmark overnight rate at 5.0%, but this could have more to do with the U.S. Dollar's rally.

The decision to keep rates at 5.0% was expected, but there was some uncertainty as to how the central bank would approach the question of a potential rate cut in June.

The answer is it is still in no mood to talk about cuts. Guidance was largely unchanged and the market still sees the first cut taking place in June.

Although the Canadian Dollar is down against the U.S. Dollar in the wake of the decision, it is finding support against the other major currencies, helped by a robust U.S. inflation report from earlier in the day. News that U.S. inflation is rising again prompted markets to radically lower expectations for the number of Federal Reserve rate cuts in 2024.

The Pound to Canadian Dollar is lower on the day at 1.7185 and the Euro to Canadian Dollar at 1.4712. The Dollar-Canadian Dollar exchange rate is higher by 0.80% at 1.3686.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

The firm U.S. inflation print has lent the Canadian Dollar a hand as the resultant fall in U.S. rate cut expectations has lowered the odds of Canadian rate cuts, independent of what the BoC did or said today.

The Bank of Canada appears reluctant to allow markets to raise market expectations for imminent rate cuts to avoid any financial risks that might come from moving before the Federal Reserve does.

This 'higher for longer' stance can support the Canadian Dollar near-term, but the Bank's credibility is at risk if economic data continues to deteriorate and it becomes obvious that it is merely outsourcing its monetary policy to the Federal Reserve.

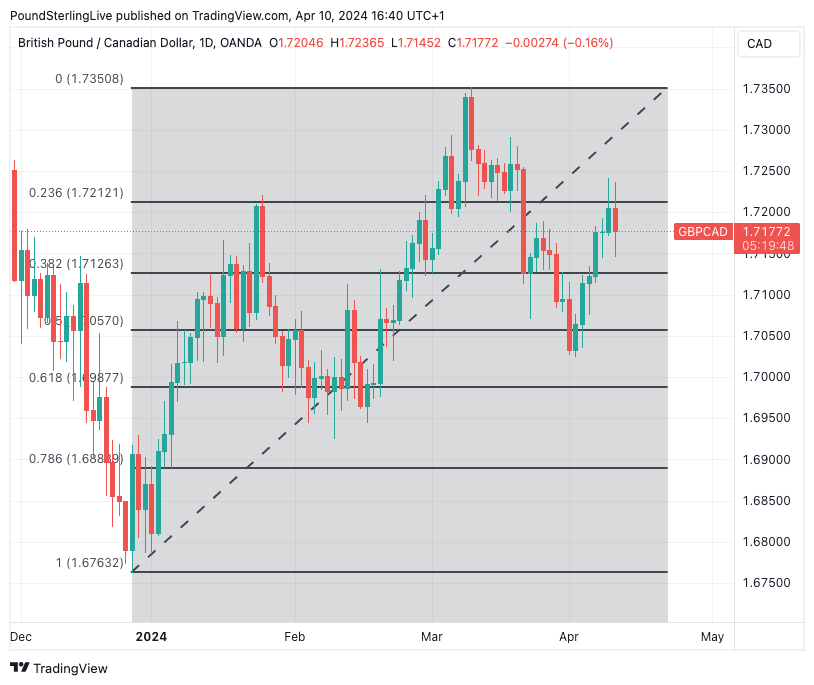

Above: CAD strength means GBP/CAD has failed at the 23.6% Fibonacci retracement of the 2024 rally. Track GBP/CAD with your own custom rate alerts. Set Up Here

The Canadian Dollar slid after Statistics Canada said last Friday that the country's unemployment rate unexpectedly rose to 6.1% in March from 5.8%, exceeding the 5.9% the market expected, and signalling the time for BoC rate cuts was approaching.

The deterioration in the Canadian data contrasted with the strong labour market print from the U.S., which showed an emerging divergence in economic fortunes between Canada and the U.S. and suggests the odds of Canadian and U.S. central bank policy diverging is a very real prospect in future months.

Should Canadian interest rates stay at restrictive levels for too long, the economy will deteriorate, meaning deeper cuts down the line will be required.

For now, the Bank of Canada doesn't appear concerned about growth. Updated projections in the Monetary Policy Report showed the Bank’s economists expect growth to hit 1.5% in 2024, up from the previous 0.8% estimate.

Growth is expected at a strong 2.2% in 2025 as household spending recovers in the second half of this year and business investment ramps up on stronger export demand.

"This aligns with the better-than-expected data delivered thus far this year, with growth tracking well above the Bank’s January projections," says Karl Schamotta, Chief Market Strategist at Corpay.

The Bank of Canada could have leant on last week's weak jobs report to prepare the market for a June rate cut, which would support the economy and result in a weaker Canadian Dollar.

While this turning point will inevitably come, the current steady-as-she-goes stance can keep the Canadian Dollar supported against the majority of G10 currencies for a while longer.