Canadian Dollar Slumps After Cracks in Canada's Jobs Market Widen

- Written by: Gary Howes

Image © Adobe Stock

The Canadian Dollar was sold across the board as fissures in Canada's jobs market opened, leading to increased bets the Bank of Canada can no longer afford to delay cutting interest rates.

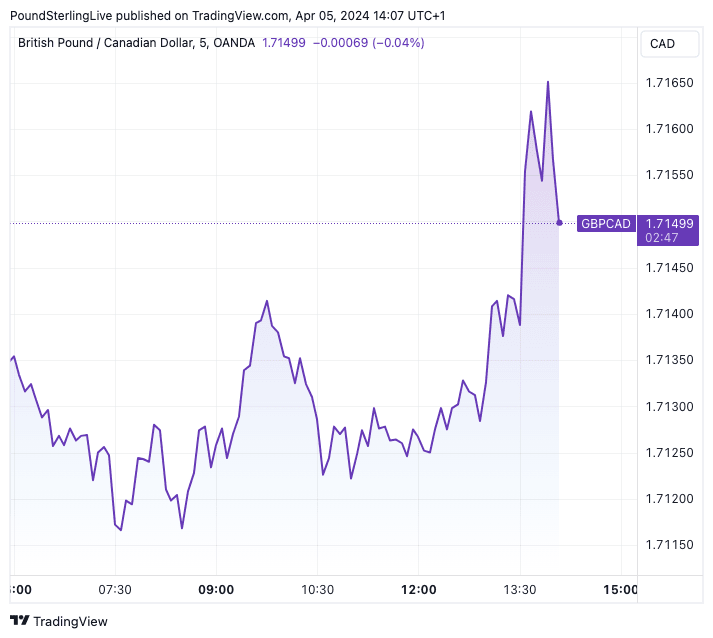

The Pound to Canadian Dollar exchange rate (GBP/CAD) rallied 0.20% to 1.7158, its highest level in ten days after Statistics Canada said the country's unemployment rate unexpectedly rose to 6.1% in March from 5.8%, exceeding the 5.9% the market expected.

This after Canada shed 2.2K jobs in the month, a marked deterioration from the 4.7K it created in February and far below the 25.9K expected.

The Canadian Dollar fell 0.60% against the U.S. Dollar in the minutes following the report's release, taking USD/CAD up to 1.3644, its highest level since November 2023.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

These data come days ahead of the Bank of Canada's April policy update, and there is now a chance the central bank will issue decisive guidance that it stands ready to cut interest rates.

"We might have hit a turning point with the Canadian economic data here - this is a weak report, and the Bank of Canada already has a difficult challenge next week in terms of reconciling the hawkish stance from March with the low inflation figures," says Kyle Chapman, FX Markets Analyst at Ballinger Group.

Above: GBP/CAD at five-minute intervals showing the post-jobs report price action. Track GBP with your own custom rate alerts. Set Up Here

The Bank of Canada could be among the first to cut interest rates, which will pressure Canadian bond yields and the CAD.

The central bank, like most other central banks, might have preferred to enter a rate cutting cycle alongside the Federal Reserve to minimise any devaluation of its domestic currency, but this is now a distant prospect in light of the bumper U.S. jobs report also released today.

"The cracks that had been emerging within the Canadian labour market suddenly got a lot wider," says Andrew Grantham, an economist at CIBC Bank.

Above: USD/CAD at daily intervals.

Looking into the data, accommodation & food services and retail & wholesale led the employment declines by industry, which suggests to CIBC's economists that sluggishness in consumer spending is now impacting hiring plans.

"While markets had been pushing back expectations for a first Bank of Canada interest rate cut following strong GDP data to start the year, today's labour force data should see them pulling those expectations forward again closer in line to our expectation for a first move in June," says Grantham.