Canadian Dollar Surges After Bank of Canada "Slams Door on April Cut"

- Written by: Sam Coventry

Above: File image of Tiff Macklem. Image source: Bank of Canada.

The Canadian Dollar surged after the Bank of Canada indicated that interest rates would not be cut in April.

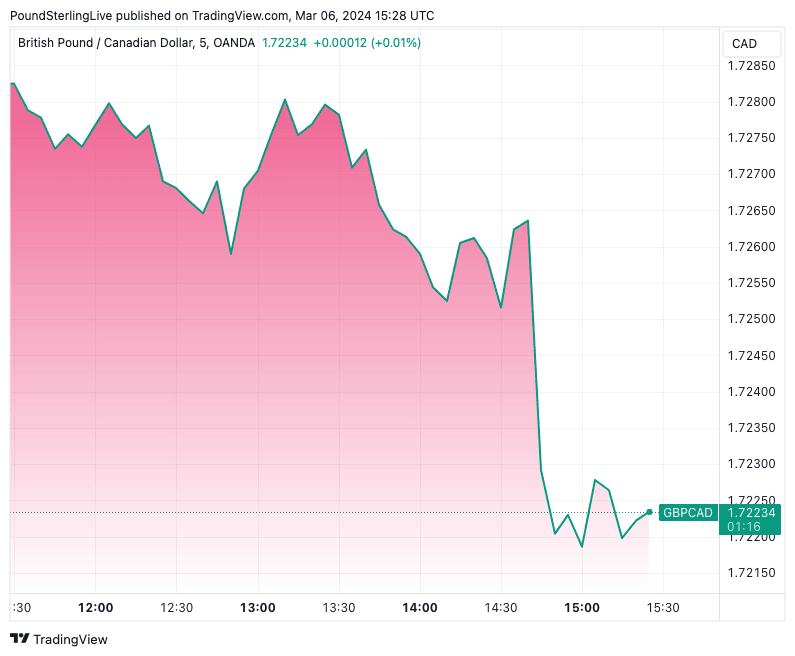

The Pound to Canadian Dollar exchange rate retreated a quarter of a per cent to 1.7222 after the Bank kept interest rates and issued a relatively 'hawkish' statement, designed to ease expectations for imminent rate cuts.

Kyle Chapman, FX Markets Analyst at Ballinger Group, says CAD has surged after "the Bank of Canada has slammed the door shut on the April cut."

"If anything, the statement read more hawkish than last month, and the repeated reference to a slow and uneven path to 2% indicates to us that there are real concerns in the Governing Council about the persistence of inflationary pressures," he says.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

Markets had raised expectations that the Bank of Canada would be amongst the first central banks to cut interest rates after Canadian inflation undershot expectations in January, falling to 2.9% year-on-year from 3.4% in December (consensus was 3.3%).

The Bank of Canada appears to have leant on the firmer Q4 GDP jobs and retail sales data, which all came in stronger than expected.

"Improving growth prospects certainly seem to have emboldened policymakers in retaining a wait-and-see stance, which they are right to do so given the mixed evidence of sustained disinflation in the data," says Chapman.

Above: GBP/CAD at 5-minute intervals. Track GBP/CAD with your own custom rate alerts. Set Up Here

Avery Shenfeld, an economist at CIBC, says the Bank acknowledged some signs of easing in wage pressures but balanced that by saying growth was a bit better than expected while still weak.

On inflation, while it mentioned that the overall pace had slowed, it judged that underlying inflation pressures persist, led by shelter, and maintained its message that it is still “concerned” about that persistence and wants to see more progress.

"Look for greater clarity to come in April’s Monetary Policy Report, which in addition to a fresh forecast, should show enough optimism in the battle against inflation to set markets up for a rate cut in June, assuming the data in the coming month point in that direction. But for now, the overall message is that its too early to cut, and that they need to see more progress on inflation," says Shenfield.