Canadian Dollar Under Pressure As Inflation Print Opens Door to April Rate Cut

- Written by: Gary Howes

Image © Adobe Stock

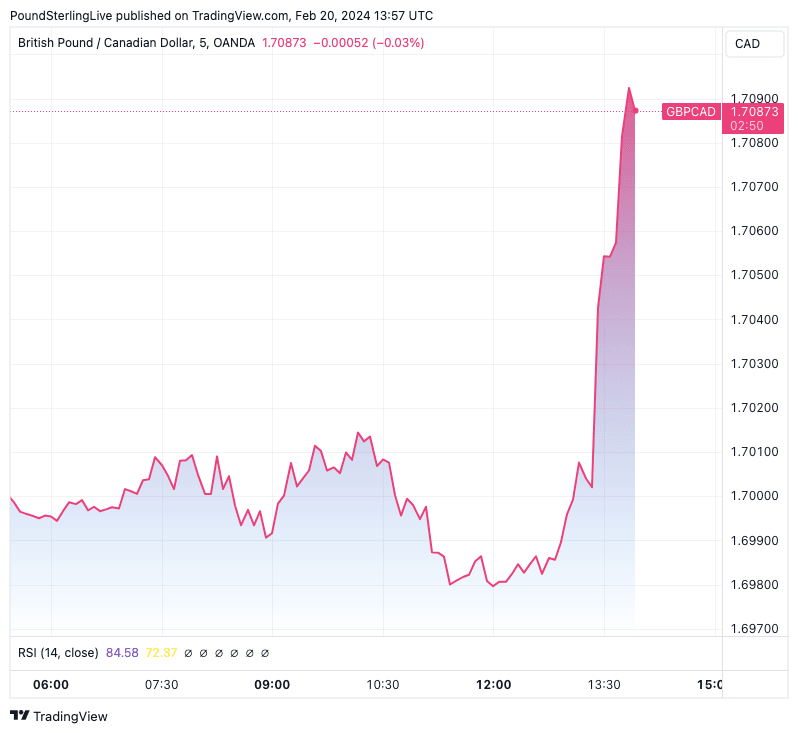

The Canadian Dollar fell across the board after Canadian inflation numbers for January undershot expectations and raised the odds of a rate cut at the Bank of Canada happening as early as April.

The Pound to Canadian Dollar rose half a per cent in the minutes following Statistics Canada announcing the consumer price index fell to 2.9% year-on-year in January, below expectations for 3.3% and down from 3.4% in December. The Dollar to Canadian Dollar exchange rate was higher by 0.20% on the day at 1.3515.

The Canadian inflation numbers were soft across the board, with the monthly change in CPI flat at 0%, whereas a rise to 0.4% was expected. Core inflation fell to 2.4% from 2.6% following a 0.1% m/m increase.

"At roughly 30%, markets are seriously underpricing the BoC easing in April," says Simon Harvey, Head of FX Analysis at Monex Europe. The fall in Canadian bond yields and CAD is a result of markets revising expectations on the outlook for domestic interest rates.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

The Bank of Canada has said it will maintain interest rates at 5.0% for some time as it wants clear evidence inflation will fall to 2.0% on a sustained basis.

These inflation data will give the central bank a little more confidence that it has succeeded and that it could soon be time to allow the economy to breathe by lowering interest rates.

Above: GBP/CAD at 5-minute intervals. Track GBP and CAD with your own custom rate alerts. Set Up Here

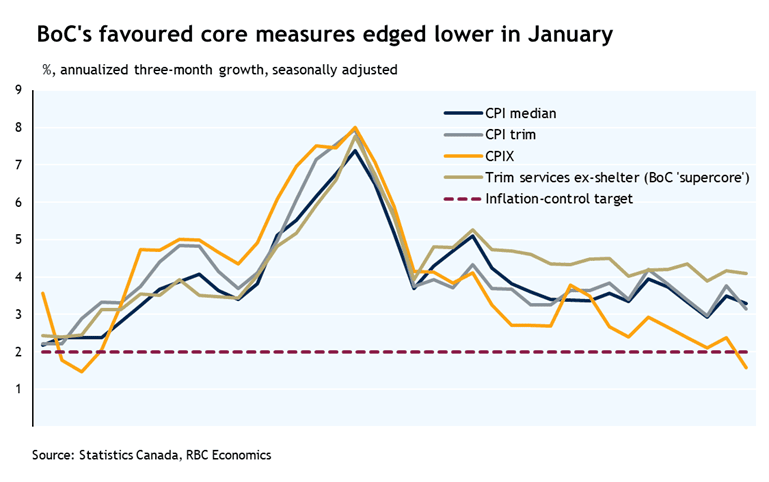

Two key measures watched by the Bank of Canada, CPI trim and median, remained elevated at 3.4% and 3.3%, respectively, although these were a couple of ticks lower than consensus expectations.

"Overall, it appears that the sluggishness in consumer demand is finally impacting pricing in areas of more discretionary spending. That is a positive sign for the Bank of Canada, and will have financial markets pulling forward expectations for a first interest rate cut today, which we see being delivered in June," says Andrew Grantham, an economist at CIBC.

Despite the declines, economists at Royal Bank of Canada say it would be risky to read the numbers and conclude that the Bank of Canada will cut as soon as April.

"The breadth of inflation still showing signs of gradual easing, but also still wider than would be consistent with the Bank of Canada’s 2% inflation target. Shelter inflation will remain sticky as higher interest rates feed through to mortgage interest costs with a lag and undersupply of housing continues to boost rent prices," says Abbey Xu, an economist at Royal Bank of Canada.

Xu says a strong start to 2024 for labour markets gives the Bank more leeway to wait for firmer signs that inflation is getting back under control before pivoting to interest rate cuts.

"As of now, our base case assumes the BoC starts to lower interest rates around mid-year," she adds.