Canadian Dollar: Employment Disappointment

- Written by: Gary Howes

Image © Adobe Images

Canada added fewer people to its workforce in April than the markets were expecting as a solid run of employment gains came to an end.

Following two months of sizeable gains April saw 15.3K people added to the jobs market, down on 72.5K in March and less than the 55.0K the market was expecting.

There was some weakness noted in Canadian Dollar exchange rates following the release, although for now the losses appear limited.

"Disappointing Canadian data have been a rarity recently, but today's employment data managed to deliver a modest downside miss relative to consensus expectations," says Andrew Grantham, an economist at CIBC.

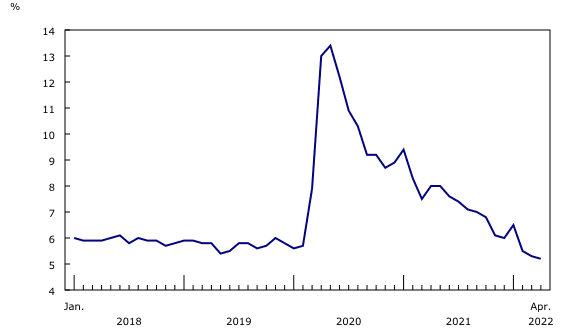

Above: Canada's unemployment rate is back below pre-Covid levels. Source: StatCan.

Canada's participation rate slipped to 65.3% said StatCan, which was below expectations and the previous month's 65.4%.

The unemployment rate nevertheless fell to 5.2%in April, another record low, in line with what the market was looking for.

Total hours worked fell 1.9% in April, driven in part by absences related to illness or disability.

Average hourly wages were up 3.3% (+$0.99 to $31.06) year over year, down on the growth observed in March (+$1.03; +3.4%).

This represents a steady deceleration for wages, given February's figure stood at 3.7%.

The data nevertheless confirms Canada's jobs market is incredibly tight and will offer further incentive for the Bank of Canada to continue raising interest rates.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

The strong economy, elevated oil prices and the promise of further hikes hints at the potential for further Canadian Dollar outperformance going forward.

It would take a number of significant labour market disappointments before the market begins to sit up and express concern regarding the country's economic trajectory.

Only then would expectations for Bank of Canada rate hikes start to correct lower, taking the Canadian Dollar down alongside.

"Overall, the slightly weaker than expected employment report today doesn't change the overall picture of a much stronger labour market than at the start of the year, and as such shouldn't deter the Bank of Canada from delivering another 50bp hike at its next meeting," says Grantham.

The Pound-Canadian Dollar rate is quoted at 1.5862 in the wake of the data release, the U.S. Dollar-Canadian Dollar rate is quoted at 1.2836. (Set your FX rate alert here).