Pound-Canadian Dollar Downside Limited as UK Data Offers Scope for 1.7150

- Written by: James Skinner

- GBP/CAD’s range holds with losses limited to 1.7050

- After UK Gov delays final stage of reopening process

- But UK data offers upside scope for 1.7150 this week

- As CAD looks at CPI data, commodities for direction

Image © Adobe Stock

- GBP/CAD reference rates at publication:

- Spot: 1.7096

- Bank transfer rates (indicative guide): 1.6498-1.6617

- Money transfer specialist rates (indicative): 1.6940-1.6976

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Pound-to-Canadian Dollar exchange rate may be susceptible to slippage as far as 1.7050 on Tuesday if the latest decision from Downing Street has any impact on Sterling, although an action-packed UK economic calendar could also see GBP/CAD testing 1.7150 again.

Pound Sterling entered the new week having recently traded around 1.7170 against the Canadian Dollar and near its highest level since April, although GBP/CAD was approaching the 1.71 handle by Tuesday while at risk of edging lower toward 1.7050 and the bottom of its six-week range.

The Pound-to-Canadian Dollar exchange rate has spent the vast majority of that period bouncing between 1.7050 and 1.7150 with little to distinguish between the Loonie and Sterling in terms economic growth and central bank policy prospects.

But the latter may have changed slightly early in the new week after Downing Street announced a currently four-week delay to the final stage of its economic reopening process, citing rising infection numbers stemming from a derivative of the coronavirus.

“The delay will lower activity via two channels. First, settings considered the highest risk in terms of transmission, such as nightclubs and larger events, will remain closed. Second, social distancing will remain in place, meaning many venues must continue to operate at reduced capacity,” says Andrew Goodwin, chief UK economist at Oxford Economics.

“We think the impact on GDP will be modest,” Goodwin adds, after estimating a -0.30% impact on the economic recovery that has reduced his 2021 GDP forecast from +8% to +7.7%.

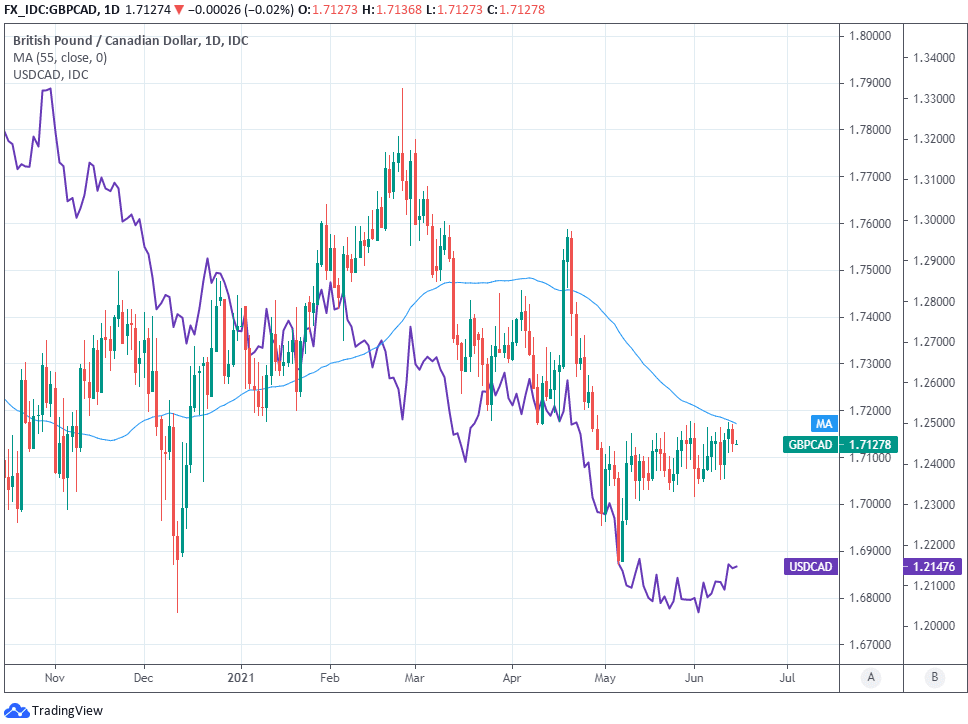

Above: Pound-to-Canadian Dollar rate shown at daily intervals with 55-day average and USD/CAD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The late Monday decision had been well telegraphed in advance and with little evident impact on Sterling although it’s formalisation could yet lead to questions about the economic outlook beyond this summer, potentially posing a risk to GBP/CAD.

More so given the Canadian Dollar’s 2021 strength and resilience, which endured through last week even after the Bank of Canada (BoC) noted that its economy hasn’t quite lived up to forecasts of late and appeared to take care in order to avoid inciting strength in Canadian exchange rates.

“We think an unchanged policy tone leaves the door open for another C$1bn per-week worth of tapering in July – which is our base case - and should allow USD/CAD to trade consistently below 1.20 in 2H21. More reasons for investors to believe the BoC will keep a good pace in reducing asset purchases may come from May’s inflation report in Canada,” says Francesco Pesole, a strategist at ING.

“We expect headline CPI to have risen to 3.8% from 3.4% YoY in May, which would be quite a strong read considering some restrictions were still in place in Canada in May. We expect this to positively impact CAD as markets consolidate their expectations around a July taper,” Pesole adds.

Wednesday sees May inflation numbers released in Canada at 13:30 London time and the Canadian Dollar could be sensitive to upside surprises, which would if anything weigh on USD/CAD in price action that would also be a headwind for GBP/CAD.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

However, and despite the short delay to the final phase of reopening, there’s plenty of UK economic data due out this week and no shortage of scope for it to support the Pound-to-Canadian Dollar rate.

Most importantly Tuesday’s job data points to rising wage growth of an order that has been almost unheard of in the UK during modern times, as well as a resilient labour market while Wednesday’s UK inflation figures are forecast by economists to show the consumer price index advancing toward the 2% target of the Bank of England (BoE).

This is before Friday’s retail sales data for the month of May, which consensus suggests should reveal that April’s barnstorming 9.2% gain in spending was followed by another albeit lesser increase of 1.5% that would go some way toward vindicating bullish forecasts for the UK economy this year.

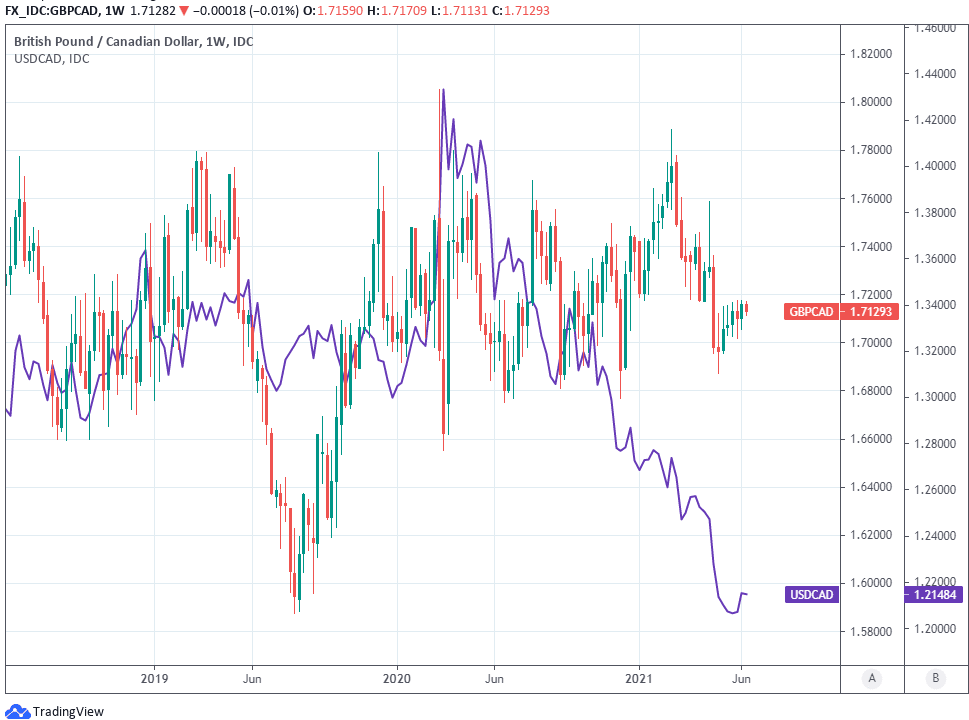

“GBPCAD is respecting the trading range established in May. The flat trend momentum indicated by the daily DMI oscillator signal and the fact that the GBP is bumping up against the 55-day MA suggest limited upside potential for the pound at the moment. We look for more, neutral range trading as a result,” says Juan Manuel Herrera, a strategist at Scotiabank.

“For choice, we favour a little more GBP strength emerging in the next few months but there is scant sign of this market moving decisively in the short run,” Herrera adds.

Above: Pound-to-Canadian Dollar rate shown at weekly intervals with USD/CAD.