Soft Jobs Report Knocks Canadian Dollar

- Written by: Gary Howes

Image © Adobe Stock

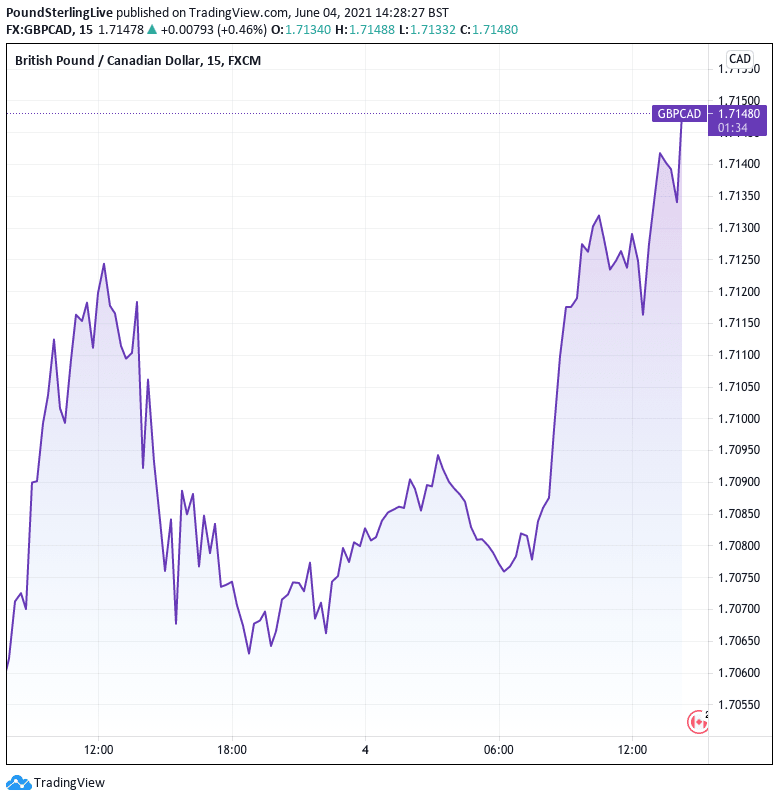

- GBP/CAD reference rates at publication:

- Spot: 1.7145

- Bank transfer rates (indicative guide): 1.6545-1.6665

- Money transfer specialist rates (indicative): 1.6990-1.7025

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Canadian Dollar fell against the majority of its peers after employment figures from the North American country disappointed against investor expectations.

The Canadian economy shed 68.0K jobs in May according to the StatCan Labour Force Survey, a figure that was certainly less severe than April's -207.1K but disappointed against market expectations for a reading of -20.0K.

The Canadian Dollar fell a third of a percent against the Pound in the wake of the miss and was seen lower against all its G10 rivals apart from the U.S. Dollar, which was also weaker courtesy of disappointing labour market data south of the border.

Digging deeper into the Canadian statistics reveals the unemployment rate rose to 8.2% with labour force participation falling a bit more than expected to 64.6% from 64.9% in April.

"It's not surprising that the economy shed jobs in May, as there was still further pain to be felt in provinces that shut down in April and new sources of pain from those that had a delayed onset of the third wave and tightened restrictions in May," says Royce Mendes, an economist with CIBC Capital Markets.

Following the data release the Pound-to-Canadian Dollar exchange rate (GBP/CAD) rose a third of a percent to 1.7143, the U.S. Dollar-Canadian Dollar exchange rate fell a quarter of a percent to 1.2080 and the Euro-Canadian Dollar rate rose 0.20% to 1.4700.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

"Markets absorbed weaker than expected jobs reports from both sides of the border," says Joe Manimbo, Senior Analyst at Western Union. "The disappointing jobs report introduced the risk of the Bank of Canada sounding less hawkish when it renders a decision on June 9."

Concerning the outlook, CIBC expect the economy to grow over coming weeks and months ensuring the worst is in the rear-view mirror for the Canadian labour market.

"After two tough months for the Canadian economy, in which it battled a harsh third wave of the virus, there appears to finally be some sunshine peaking through the clouds, with provinces embarking on reopening plans," says Mendes.

CIBC expect June data to show a modest recovery that will transition into more robust growth readings early in the second half of the year as additional segments of the economy are reopened.

A breakdown of the data showed employment weakness was understandably more noticeable in those industries that are facing the most stringent restrictions to the country's Covid-19 restrictions.

Employment in accommodation & food services, retail trade, and 'other' services all declining again in May.

"The massive 660k shortfall in employment relative to pre-shock levels in the 'high-contact' hospitality and retail sectors will likely begin to reverse in June with virus case counts slowing significantly and vaccine distribution continuing to ramp up," says Nathan Janzen, Senior Economist at RBC Economics.

"And with households sitting on an exceptionally large stockpile of savings built up during the pandemic, that recovery could accelerate relatively quickly over the summer," he adds.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}