Canadian Dollar Drops against Pound after Unemployment in Canada Jumps

Image © Bank of Canada

- GBP/CAD spot at publication: 1.7556

- Bank transfer rates (indicative guide): 1.6942-1.7064

- FX transfer specialist rates (indicative): 1.7160-1.7433

- More information on accessing specialist rates, here.

The Canadian Dollar fell against the Pound, Euro and other major currencies following the release of disappointing economic data out of Canada that showed the country shed 212.8K jobs in January.

The Canadian job losses were a great deal worse than the -47.5K markets were expecting and marked a sharp slump from the -68.2K reported in December.

However, the Canadian currency advanced against the U.S. Dollar owing to an equally disappointing jobs report across the border that suggested to investors the U.S. Federal Reserve would have to continue offering easy money to support the economy.

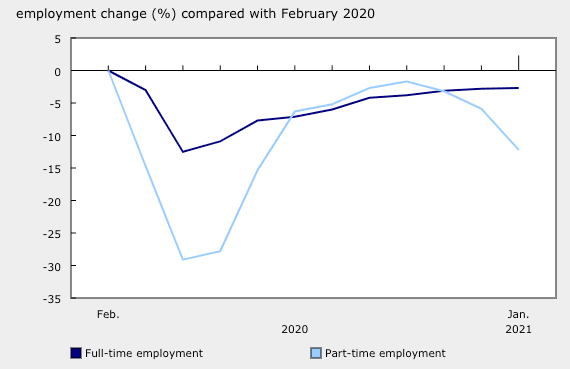

Above: Canadian employment dynamics since February 2020, image courtesy of StatCan.

Canada's unemployment rate rose to 9.4% according to StatCan, which was a more severe deterioration than the 8.9% markets were expecting.

"The job market was already headed in the wrong direction in December, and not only did it continue down that path in January, it hit the accelerator," says Royce Mendes, an economist with CIBC. "Employment declines were more than five times greater than what the consensus had penciled in."

Given the scale of the disappointment, it is unsurprising that the Canadian Dollar shed ground: the Pound-to-Canadian Dollar exchange rate rose to 1.7556, the Euro-to-Canadian Dollar exchange rate rose to 1.5372 having endured a poor week up until the release of the figures.

"The U.S. report, coupled with weak Canadian payroll data suggested that the North American COVID recovery has not yet transformed into the juggernaut that markets had imagined," says Paul Spirgel, a Reuters market analyst. "That presents an opening for Sterling as the rapid UK vaccine rollout has increased expectations that Britain can move closer to the head of the economic recovery class than the rear."

Above: GBP/CAD on Feb. 05.

Economists say the second wave of infections in Canada, and the resultant tightening of restrictions on movement and activity, have not had the same harsh impact on employment as was the case in the first wave.

"Pain has been both less severe and more narrowly focused. In fact, total hours worked actually gained ground in January as job losses were concentrated in part-time work," says Mendes. "As a result, the effect on GDP should be less pronounced than the headline employment decline would suggest."

Economists at CIBC say there’s scope for some labour market weakness to persist, but they note daily new Covid cases have already fallen to levels low enough that officials are in the process of carefully easing restrictions introduced in late December and early January.

"The combination of fewer daily new Covid cases and more lenient shutdown orders could see employment growth return in short order, much like it did following the first wave. The only difference being that hopefully there’s no looking back this time," says Mendes.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}