British Pound Finds No Love From UK Inflation Data

- Written by: Gary Howes

UK inflation data was broadly where analysts expected it to be and thus failed to boost GBP. But, analysts tell us that prices are going to gradually rise through 2016.

The pound sterling has moved higher on Tuesday after UK inflation data came in-line with economist forecasts.

The headline annual figure stands at 0.3%, up from 0.2% last month but monthly figures showed prices fell by 0.8%.

The ONS have pointed the finger of blame squarely on a rise in motor fuels as being the driver of the rise in inflation.

"With fuel prices continuing to fall, it may at first seem puzzling that they can be pushing the inflation rate up. The reason for this is that, although prices continued to fall in January, they fell by less than they did in January last year," say the ONS.

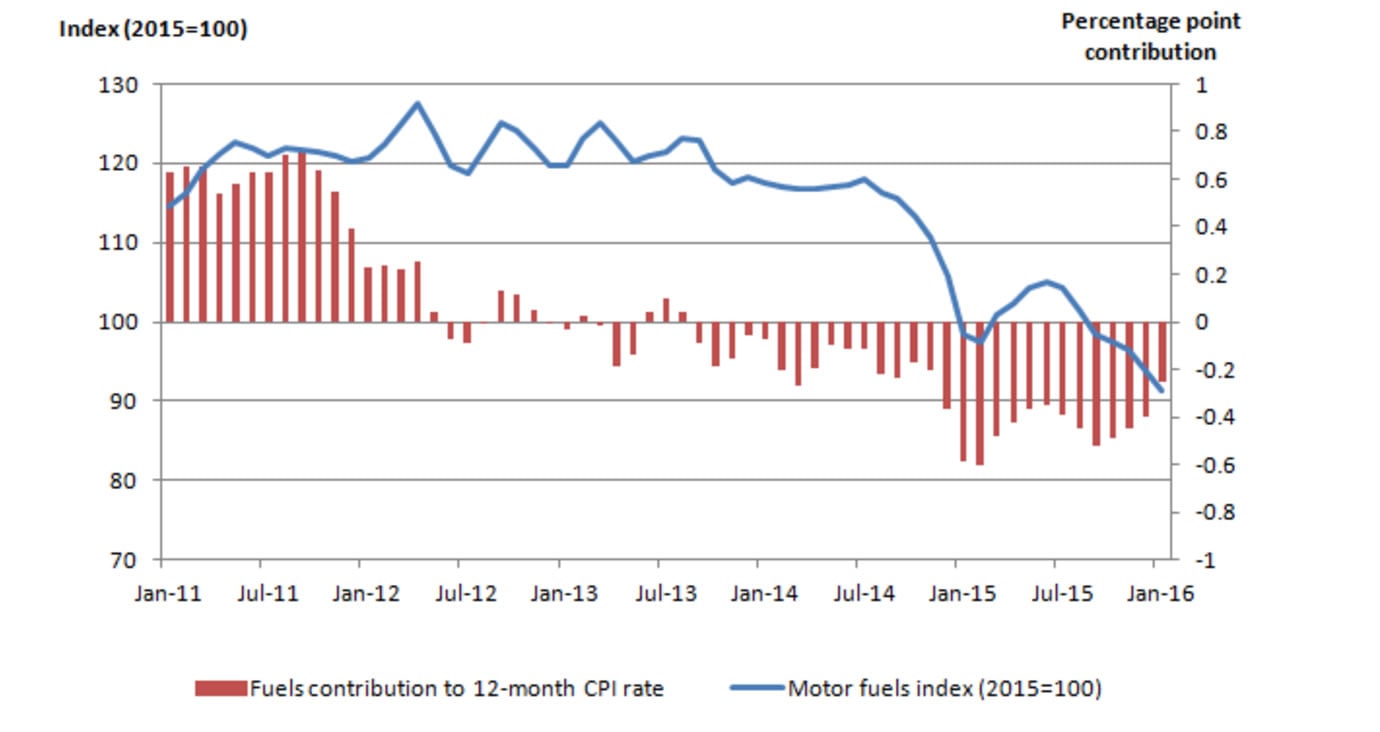

The chart shows price movements for motor fuels over the last 5 years. Last year, prices began to rise in March, following large falls that started towards the end of 2014.

Over the coming months in 2016, the impact of motor fuel prices on movements in the inflation rate will depend heavily on whether this pattern is repeated, or if prices continue to fall.

Anyone interested in finding out more about how this all works, please see here.

"Whilst the monthly CPI comparison showed a sharper fall than expected, the annual rate ticked up to 0.3% - its highest in a year. We think the market is likely to view the slight rise in inflation as a positive, but it’s unlikely to change the outlook for UK rates remaining on hold well into next year," says Andy Scott at HiFX.

The Pound's Response

The impact on sterling has been broadly positive as markets are so geared against sterling anything that is on-target, or better than expected, is more likely to translate into a positive for the currency. The GBP/USD has been the main recipient.

The pound to euro conversion is unchanged on the day at 1.2940.

The pound to dollar conversion is higher at 1.4467.

The pound to New Zealand dollar conversion is a good percent higher at 2.1914, this is more to do with the NZD though where inflation data undershot expectations.

The pound to Australian dollar conversion is unchanged at 2.0200.

Note that these quotes are from the spot markets, your bank will affix a spread at discretion. To get a rate this is close to the market get a quote from an independent provider. This can result in gains of up to 5%.

What Does the Data Mean for the Pound Going Forward?

The Bank of England is keenly following the UK's inflation profile and will only raise rates when they see inflation starting to climb at faster than expected levels.

We heard from MPC member Ian McCafferty most recently that he withdrew his vote for an interest rate rise on the observation that UK inflationary pressures have receded over recent months.

This dynamic put pressure on the pound. That said, the outlook is one of gradually rising prices.

The Institute of Directors has said low inflation and cheap oil are "as good as it gets."

“Despite the slight increase in the headline rate, we are still considerably off a level of inflation which could be considered ‘normal’. We should be in no doubt, this is as good as it gets as far as inflation is concerned. Further volatility on the financial markets could undermine consumer confidence and might encourage people to save, rather than spend, the low-inflation windfall,” says James Sproule, Chief Economist at the IoD

Lloyds say the marked recent weakening of the exchange rate, alongside the residual strength of underlying domestic costs should still provide some upward impetus to inflation trends further ahead. Analysts at the bank see inflation reaching 1% by the end of the year.