Reeves Will Borrow Additional £20BN per Year to Avoid the Austerity Tag

- Written by: Gary Howes

File image of Rachel Reeves. Picture by Kirsty O'Connor / Treasury.

The new Chancellor, Rachel Reeves, is already drawing comparisons with one of her Conservative predecessors, George Osborne, who is remembered for overseeing a period of fiscal austerity.

Having been in the office for a mere month, Reeves has already announced spending cuts. However, economists say she can avoid being tagged as an austerity chancellor if she deals with significant budgetary shortfalls in coming years by limiting tax rises and borrowing more than is currently projected.

This is the path she will choose, according to one economist.

"The government will probably borrow more in order to fund greater spending. All told, we expect fiscal loosening of £20B per year," says Robert Wood, UK Economist at Pantheon Macroeconomics.

Image courtesy of Pantheon Macroeconomics.

Economists tend to agree that fiscal loosening is, on balance, pro-growth.

The worry has been that she would succumb to the Treasury orthodoxy of cutting departmental budgets further while raising taxes. This contractionary fiscal stance can limit the UK's economic growth potential, with Osborne's programmes said to have cost the UK 2% in lost GDP.

Economists say Reeves is at a crossroads: does she slavishly adhere to the fiscal rules that require the government to bring debt down in a certain timeframe and risk economic growth, or does she fund expenditure via borrowing and potentially break fiscal rules?

Pantheon Economics thinks the new government will avoid wanting to put the squeeze on the economy, opting to boost borrowing alongside tax hikes. Wood and his team think the government will look to raise revenue with an additional £10B per year of tax hikes and double this amount in borrowing.

"The additional public spending is estimated to require extra borrowing of £20B per year, which would boost the Bank of England's inflation forecasts by 0.1-to-0.2pp at the two-year horizon, while public-sector pay increases could boost wage growth forecasts," says Wood

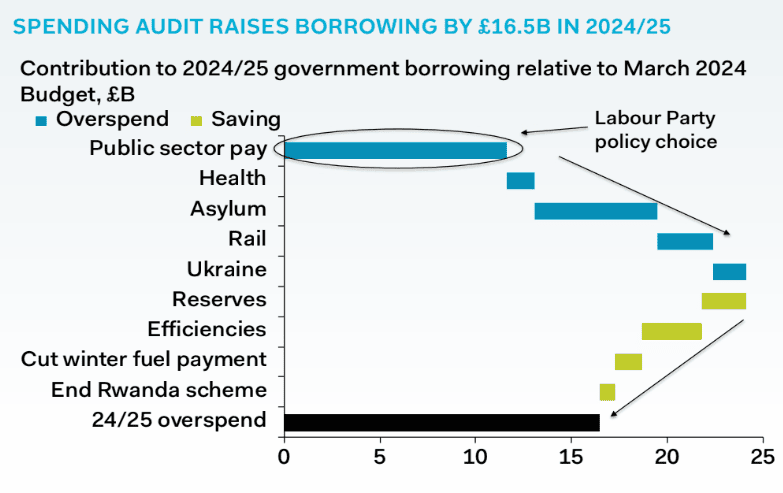

Reeves said on Monday the government is on track to borrow £16.5BN more than budgeted for in fiscal year 2024/25. This is after she said an audit found £21.9BN of unfunded spending commitments in the current fiscal year.

She responded by immediately announcing savings in a number of departments, raising concerns that she would pursue a policy of austerity. She has signalled a number of tax rises will be announced in October.

"The fiscal statement by Rachel Reeves was a shambles. We are no wiser about problems with public spending or long term remedies. Instead, we now have a blame game with Labour & Tories blaming each other. This is not the stability promised pre-Election - more Truss Mk 2!" says economist Andrew Sentance, a former member of the Bank of England's Monetary Policy Committee.

"Rachel Reeves appears to have been captured by old-fashioned and outdated Treasury orthodoxy," he adds.

A concern for economists is that Reeves is focussing savings on capital expenditure in projects that can help boost the economy's output potential.

"The government inherited very low capital spending plans. If it cuts them further, that would risk damaging the UK's already weak potential growth outlook," says Andrew Goodwin, Chief UK Economist at Oxford Economics.

He says one worrying aspect of Reeves' immediate policy measures was the cancellation of several transport projects. "The decision to cancel them jars with the government's pro-growth rhetoric," says Goodwin.

Dean Turner, an economist at UBS, says whichever way Reeves decides to go about repairing the hole in public finances, all roads lead to one inescapable conclusion: the UK is facing a sizeable fiscal squeeze through a combination of lower spending and higher taxes.

"This will ultimately weigh on growth in the near term," says Turner. "Fiscal prudence may be bad for the economy."

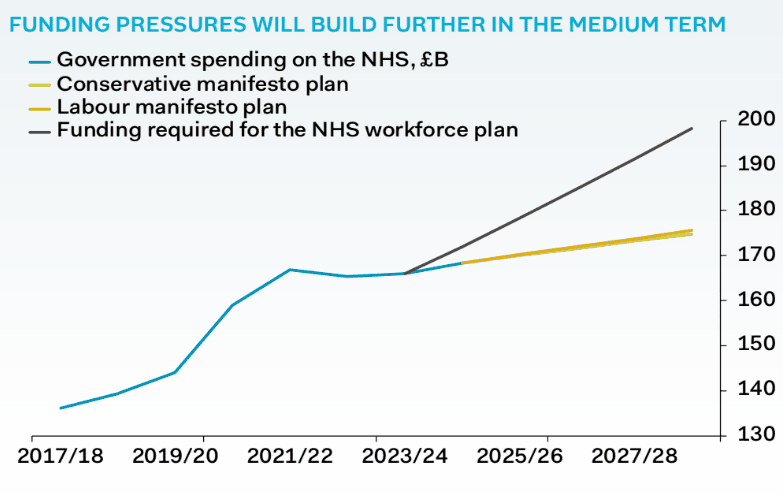

The Treasury's problem is the cost burden in the years before the next general election. The NHS, for example, will continue to guzzle cash at significant rates.

"Public spending pressures become more severe the further ahead we look. For example, funding

the NHS workforce plan requires £23.5BN per year more by 2028/29 than budgeted for," says Wood.

An unreformed health system, an ageing population, and costly immigration and asylum policies (this alone accounted for nearly half of the black hole Reeves uncovered) are proving to be structural problems that the government won't be able to solve.

Reeves has said increased productivity can mitigate the funding shortfalls, and the government has said it is relying heavily on increased economic output.

But the risk is Reeves focusses her cuts on the very projects aimed at boosting productivity.

It might, therefore, soon become apparent that the fiscal rules will be changed to allow for increased borrowing.