UK Business Confidence Rallies from Summer Slumber

- Written by: Gary Howes

UK businesses are more confident about their prospects now than they have been at any point in the past four years, according to a regular survey.

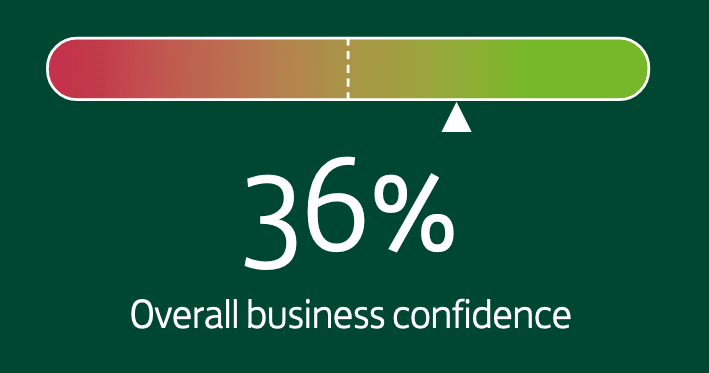

The Lloyds Bank Business Barometer for August reported a four-year high for business confidence, while wage growth and price inflation expectations picked up to the highest levels since the start of the pandemic.

The findings will help push back against concerns that the UK's economic rebound is at risk of stalling.

"Business confidence reaching its highest level in over four years tells an extremely positive story about the country’s economic recovery," says Hann-Ju Ho, Senior Economist at Lloyds Bank Commercial Banking. "This confidence is driven by the continued success of the vaccine rollout, the removal of lockdown restrictions and adjustments to self-isolation rules."

Overall confidence increased by 6 points to 36%, the highest level since April 2017.

Despite ongoing domestic and global supply constraints manufacturing businesses reported a pickup in prospects, but it was the transport services, hospitality and ‘other’ services including arts & leisure that saw the greatest pickup.

The net balance for trading prospects gained 6 points to a three-year high of 34%.

It also appears that a summer growth slowdown has passed as business optimism about the wider economy rose by 6 points to 38%, the first rise in three months and more than offsetting

last month’s fall.

Recent UK economic data has pointed to a slowdown in growth, with economists placing some of the blame on high Covid-19 cases which impact directly on consumer and business confidence. Also, the summer months saw high levels of self-isolation rates owing to staff coming in close proximity of someone who subsequently tested positive.

But these stringent self-isolation rules were axed in August, while daily Covid reports show infections in England are starting to fall.

We have reported today that some foreign exchange strategists have turned more cautious on the outlook for the British Pound based on evidence of a slowdown in activity.

However, these calls could prove premature if there is a strong uptick in growth through August and into Autumn, an outcome which could offer the Pound support.

Lloyds Bank says the results of their latest survey suggest that the recovery remains on track, even if the pace of growth moderates in the second half of the year after the strong outcome in the second quarter.

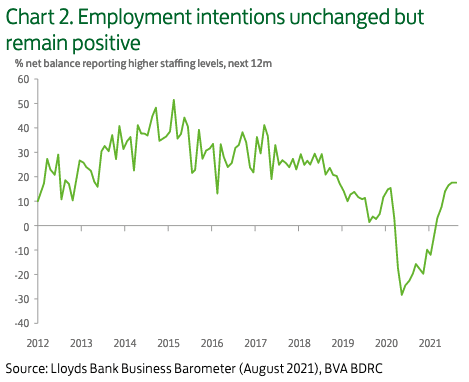

The strong confidence is meanwhile expected to translate into a firmer labour market as 18% of firms say they expect to increase their workforce in the coming twelve months.

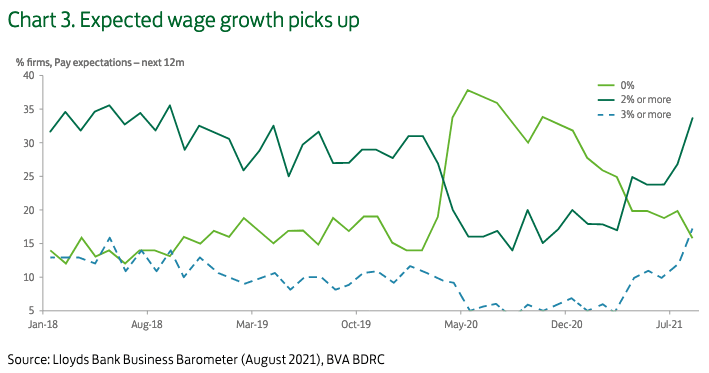

Expectations for pay growth were meanwhile the most elevated since the start of the pandemic, suggesting the recent improvements in official wage data are unlikely to abate soon.

The proportion of businesses expecting average pay growth of at least 2% in the next twelve months increased to 34% (from 27%).

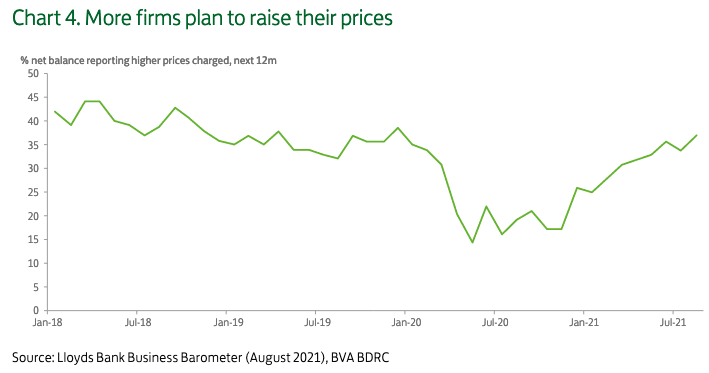

Inflationary pressures are meanwhile expected to tick higher with the net balance for prices for

goods and services charged by firms in the year ahead increasing by 3 points to 37%, the highest level since December 2019.

The Bank of England is expecting inflation to peak at 4.0% before turning lower again. The risk is that inflation remains stubbornly high over coming months.

If this were to be the case then the prospect of a series of interest rate hikes in 2022 and 2023 becomes more likely.