UK Economic Recovery Curtailed by New Restrictions Even Before November's Lockdown

- Written by: James Skinner

Image © Adobe Images

Britain's economic recovery all but petered out in October as a tiered system of localised restrictions came into force, Office for National Statistics (ONS) data showed on Thursday, although economist forecasts suggest an outright contraction looms for the final quarter due to November's national 'lockdown'.

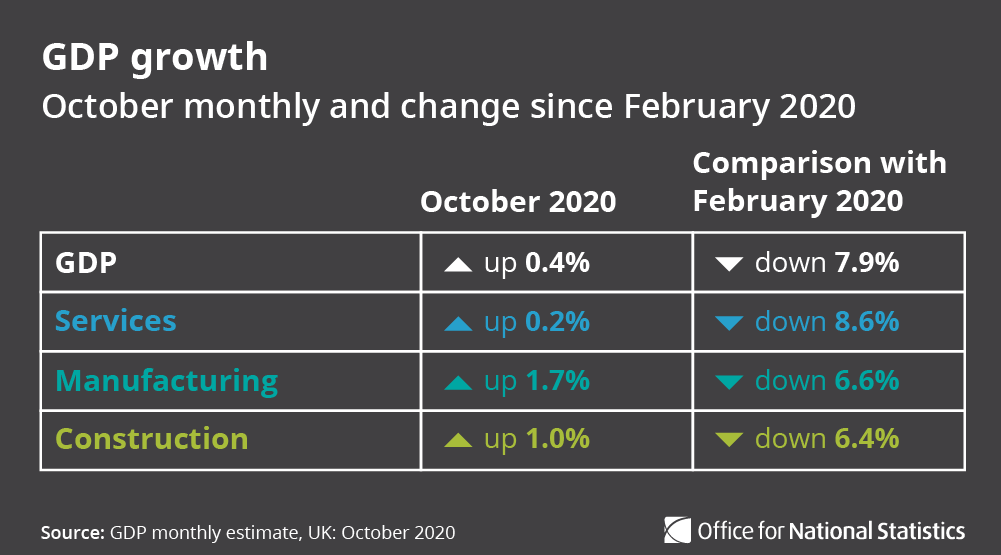

GDP rose by just 0.4% in October, in line with economist expectations, after having risen by 1.1% in September and 2.2% in August, with the slowdown coming as the initial rebound from the summer's reopening ebbed and new social distancing measures were gradually brought into force.

October's tepid increase in output was driven first and foremost by the manufacturing sector, which saw an increase in demand for transport equipment, although gains here and from within the construction industry were not matched by the all-important services sector.

Britain's largest sector grew by just 0.2% in October after the accomodation and food services subcomponent suffered a -14..4% contraction due to the introduction of a tiered system of coronavirus-related restrictions that saw restaurants, pubs and cafes forced to close in many Northern and some other areas.

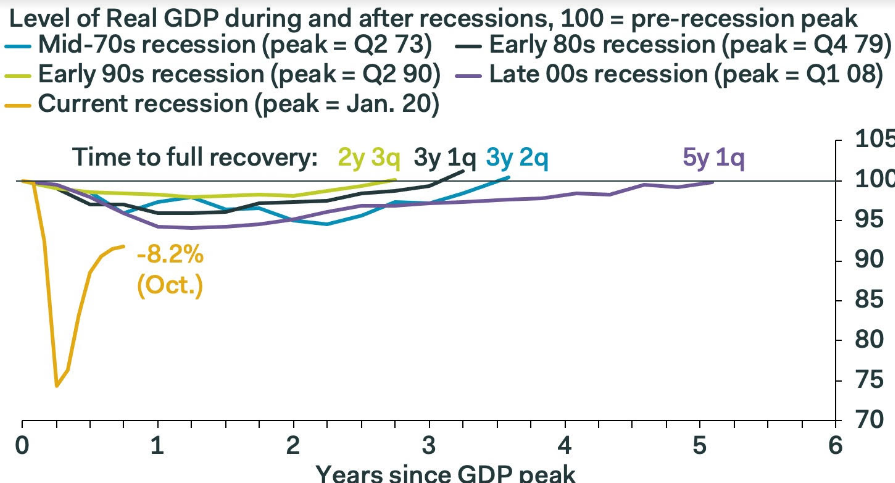

"The economy continued to grow in October, but at a snail’s pace," says Ruth Gregory, a senior economist at Capital Economics. "What’s more, the second lockdown probably caused the economy to contract sharply in November, perhaps by up to 8% m/m. And the economy still has an awful lot to contend with in the form of ongoing COVID-19 restrictions in the coming months, rising unemployment and a large overhang of corporate debt. This underlines the need for the Chancellor to resist the urge to raise taxes and focus instead on keeping the fiscal support in place to nurse the economy back to full health."

Above: Source: Office for National Statistics.

Momentum behind the UK's economic rebound has been ebbing ever since May, although the recovery slowed notably in August when GDP growth fell from 6.6% to 2.2% even as the restaurant, cafe and pub trades were boosted by Chancellor Rishi Sunak's Eat Out to Help Out scheme.

Since then the number of coronavirus infections detected by the government has increased markedly, leading to a second wave that grew larger the first by October and prompted the government to order localised forms of 'lockdown' in many mainly northern cities.

Renewed shutdowns disproportionately impacted the accomodation and food services sector in both October and November, while December's updated restrictions have ensured that many pubs and bars will remain closed until at least the New Year and despite a reopening of other sectors.

"We judge that GDP dropped by about 4.5% month-to-month in November," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics. "So far, near-real-time data suggest that activity since the ending of the lockdown on December 2 has not snapped back to October’s level. For instance, data from the Department for Transport show that motor vehicle journeys were still 5% below October’s average level between December 2 and 7, while rail passenger numbers were down 25%. In addition, Google Trends data show that the volume of online searches for phrases including "restaurant" so far in December has been 19% below October's level."

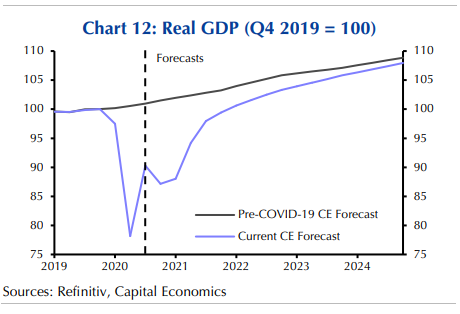

Source: Pantheon Macroeconomics.

Recent newsflow has not been all doom and economic gloom however, given the outlook for the year ahead was boosted this week when the ball began rolling on a global coronavirus vaccination programme, with Pfizer and BioNTech's vaccine administered for the first time outside of a research setting in the UK on Tuesday.

Nearly a million doses are expected to be made available in the UK before year-end, which is enough to vaccinate almost half a million people, although Health Secretary Matt Hancock also said this week that the government hopes to have "the bulk" of the vaccination rollout complete before next summer.

More vaccines are expected to follow in the coming months, potentially leading the government to relax its demands for social distancing and related curbs on activity that have come at a high price for businesses, people and the economy.

Vaccines, if effective, could reduce the threat of overloaded health services and enable normal life to resume, leading output from industries and spending among consumers and households to normalise.

That's unless HM Treasury and Chancellor Rishi Sunak are panicked, pushed or pulled into a calamitous course of policy action first.

"The noises coming out of the Treasury seem to suggest that the UK government is keener than most other countries to enter into a period of belt-tightening. This might be driven by a political desire to prove that the Conservative Party is better at managing the public finances than the Labour Party. Or it may reflect a desire to lengthen the time between unpopular tax rises and the next general election," Capital Economics' Gregory says in a Tuesday briefing to clients. "It doesn’t make sense to announce a fiscal consolidation, when the fundamental state of the economy is still so poor and the tax base has not fully recovered. Instead, the tapering and withdrawing of policy support should be calibrated to match the recovery in private sector demand."

Source: Capital Economics.