ZEW Survey Warns of Protracted German Economic Slump and Slow Recovery

- Written by: James Skinner

Image © Adobe Images

- EUR/USD spot at the time of writing: 1.0837

- Bank transfer rates (indicative): 1.0458-1.0534

- FX specialist rates (indicative): 1.0674-1.0739 >> More information

The influential Leibniz Centre for European Economic Research (ZEW) survey forewarned Tuesday of a protracted period of pain and only a slow recovery from the coronavirus crisis for the German, Eurozone and global economies.

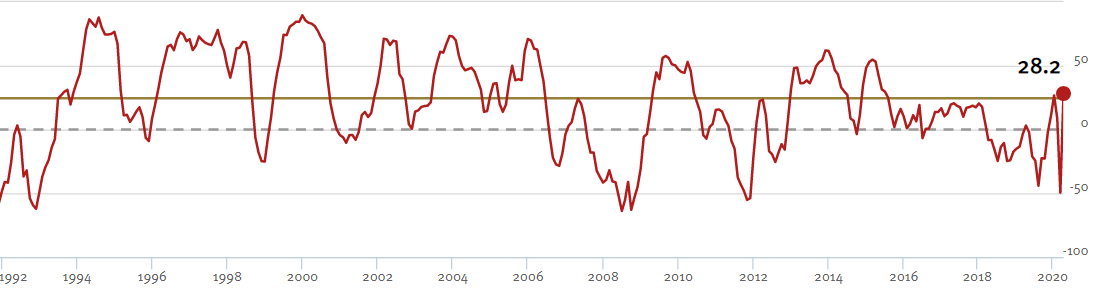

ZEW's closely watched index of analyst expectations for the German economy six months out rose by 77.7 points to 28.2 in April, a record increase from -49.5 previously and when the consensus had looked for a rebound to only -40. Although this follows a record slump from the prior month.

Current economic conditions deteriorated substantially with the index measuring them falling 48.4 points to -91.5, an all-time low. The picture for the Eurozone was no better, with the expectations index rising 74.7 points to 25.2 for April while the current situation index fell -45.4 points to a new low of -93.9.

“Special questions on the coronavirus crisis included in the survey show that the experts do not expect to see positive economic growth until the third quarter of 2020.Economic output is not expected to return to pre-corona levels before 2022,” says Professor Achim Wambach, president of the ZEW institute.

ZEW's survey asks 300 financial analysts for opinions on questions relating to the markets and economy. Both survey components had risen in recent months, indicating a less dour outlook in response to October's Brexit withdrawal agreement and the 'phase one deal' struck between the U.S. and China.

Above: ZEW index of expectations for the German economy.

ZEW expectations for Germany had been trending lower for years heading into the coronavirus crisis although Europe's largest economy now faces an even more protracted period of decline even though it appears poised to be the first major economy to exit a lockdown of people and companies.

Increasingly large parts of the Eurozone have ground to a standstill since late February when it became clear that Italy had a serious coronavirus problem on its hands, which has since made a global epicentre out of the old continent.

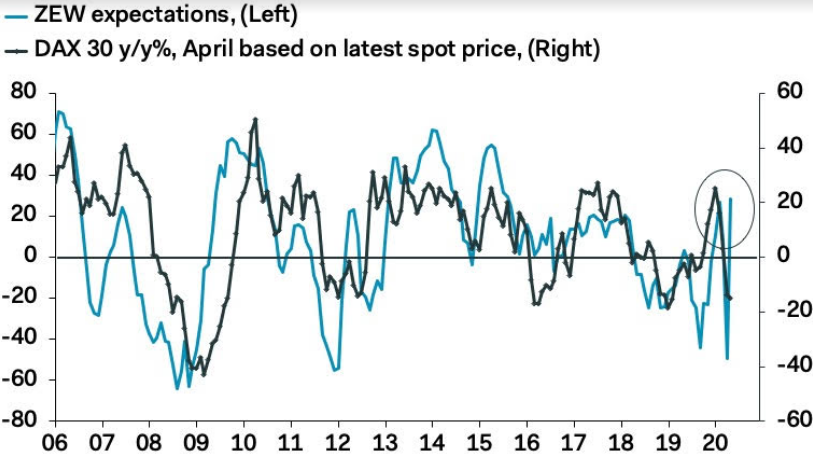

"We had expected a divergence between current assessment and expectations, but not to this extent. We have to take it with a pinch of salt. The survey was collected in the past few weeks, coinciding almost perfectly with the sharp rebound in equities, which now appears to be petering out. That said, we suspect the ZEW is a good metaphor for investors’ perceptions, or hope. Current conditions are terrible, but with lockdowns in full effect through April, conditions can’t get much worse," says Claus Vistesen, chief Eurozone economist at Pantheon Macroeconomics.

Above: Pantheon Macroceconomics graph showing ZEW Index of expectations alongside German DAX stock index.

Shutdowns of entire economies are expected to driven unprecedentedly huge double-digit falls in GDP for the first and second quarters of all countries, with similarly large increases in unemployment and government spending as a share of GDP now in progress or expected for the quarters ahead

But Germany's sixteen states were free on Monday to begin lifting restrictions on everyday life as they see fit, which has led the country's most populous state North Rhine-Westphalia to allow retail stores to reopen and could precede a slow but steady normalisation.

Spain, the seat of Europe's largest outbreak and world's second largest, said at the weekend that from April 27 children will be able to go outside subject to certain conditions but also that a third extension of a national lockdown would keep most people confined to homes for another three weeks.

Meanwhile smaller countries like Austria, Denmark and Finland set out plans the prior week for a steady return to normal too but many economists see the global economy remaining in a hole until all countries return to normal.

"Today’s increase is the largest monthly increase ever. In all honesty, this number is too good to be true. It probably reflects the stock market rally of the last few weeks, central bank and government action as well as a good portion of optimism that up to now all viruses eventually ended with a U- or V-shaped recovery," says Carsten Brzeski, chief Eurozone economist at ING.