UK Economy Stalled at Year-end but Worse Awaits in 2020, Economists Say

- Written by: James Skinner

Image © Adobe Images

- Spot GBP/EUR rate at time of writing: 1.1201

- Bank transfer rates (indicative): 1.0900-1.0980

- FX specialist rates (indicative): 1.1040-1.1100 >> More information- Spot GBP/USD rate at time of writing: 1.2337

- Bank transfer rates (indicative): 1.2000-1.2100

- FX specialist rates (indicative): 1.2200-1.2230 >> More information

The UK economy stalled in the final quarter, Office for National Statistics (ONS) data confirmed Tuesday, ensuring a weak handover to a likely testing year with the first quarter alone seen augering a historic slump in GDP.

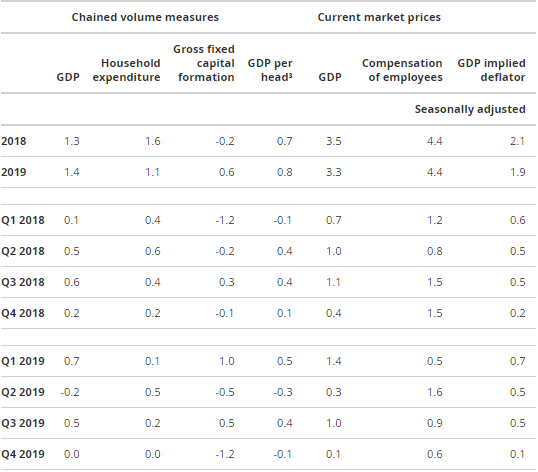

Economic growth was 0% in the final quarter, down from 0.4% previously, official figures have confirmed. The stall came after a contraction in household spending, business investment and manufacturing production more than offset increases in government spending, net trade and services output.

The annualised rate of expansion for the economy was 1.1% in the final quarter while overall annual growth was 1.4% for the full calendar year. Both are low levels of growth compared with those seen in other recent quarters and years, although they also pale into insignificance when compared with the likely performance of the economy this quarter.

"The confirmation that the economy stagnated in Q4 2019 shows that it was very weak even before the spread of the coronavirus in the UK," says Ruth Gregory, an economist at Capital Economics. "The only real “strength” came from government spending, which added 0.3ppts to GDP growth possibly due to planning ahead of Brexit (remember that?). Household consumption did not grow at all and business investment dropped by 0.5% q/q."

Above: ONS table of quarterly and annual growth estimates.

The UK economy was buffeted by domestic and geopolitical politics in the final quarter of 2019, with the U.S.-China trade war reaching a crescendo and inflection point just as the October 31 Brexit deadline was approaching and in a quarter that Britons spent most of engaged in rheotrical combat over a ballot box. Acrimony between the world's two largest economies and uncertainty over the UK's future trade relationship with Europe weighed heavily on business confidence and manufacturing activity late last year.

Growth headwinds were heavy enough last quarter but have worsened in an unprecedented way this quarter as vast parts of the global economy including the UK have ground to a halt as businesses have closed and citizens have hunkered down indoors in the hope of slowing the spread of coronavirus so as not to overload health systems. The economic stoppage that is unprecedented in peacetime is expected to drive historic falls in GDP this quarter and next.

"We think the coronavirus will deliver a hit to economic activity well in excess of the 6% fall in the financial crisis and the 8% drop in the Great Depression. And while we assume that GDP will recover fairly quickly in the second half of 2020, it may be a few years before the economy reaches the level it would have done had the coronavirus shock not happened," says Capital Economics' Gregory.

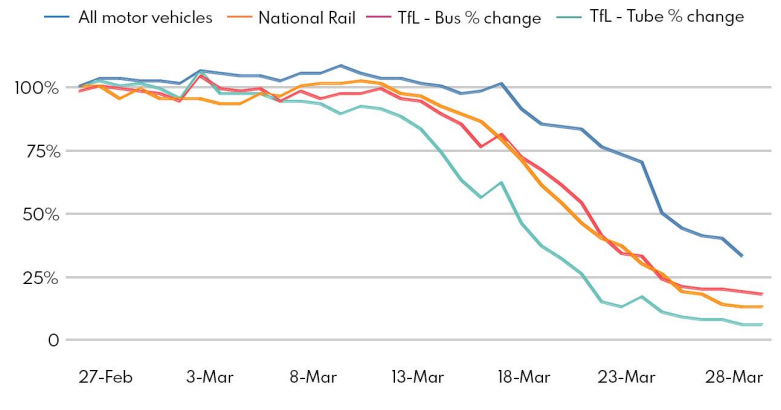

Above: UK government chart showing changes in rail, bus, tube and vehicle travel volumes.

The UK government has instructed that many businesses including pubs, cafes and restaurants close their doors and that citizens remain home except for in limited circumstances until late April in the hope of preventing the National Health Service from becoming overloaded. Many expect that the initial three week period of 'lockdown' will be extended as it has been in other countries like Italy and France, exacerbating the pain for the economy.

Government has taken action that is as unprecedented as the damage caused by the virus, in the hope of lessening the long-term impact on the economy, which includes the subsidy of up to 80% of wage payments to the private sector so that individuals can keep their jobs. But nonetheless, economists still expect a severe hit to growth this year and Capital Economics forecasts this hit could be as large as an annualised -15% in the second quarter.

"We look for a quarter-on-quarter drop in GDP of 1.5% in Q1, followed by a huge decline of about 13.0% in Q4, based on an assumption that output will be about 15% below normal during the current lockdown, which was have assumed will last for three months," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics. "Policymakers have acted decisively to soften the blow to incomes, but households likely will cut back sharply on discretionary spending, until they feel secure in their jobs again."