Ethereum Selloff "Typical" Response to Good News

- Written by: Sam Coventry

-

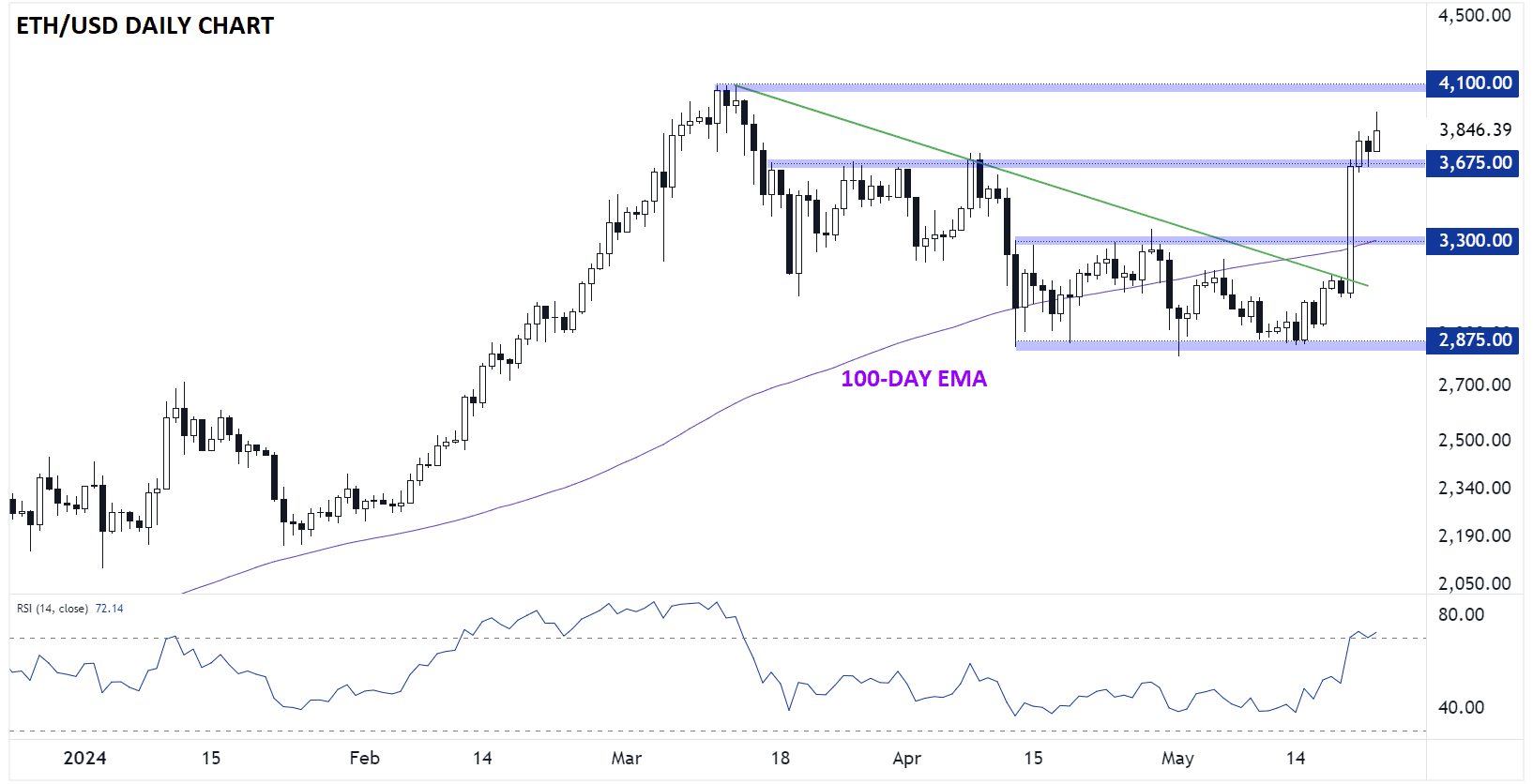

Above: ETH/USD at daily intervals.

An analyst we follow says news of the approval of spot ETFs on Ethereum has added to the pressure in the cryptocurrency space.

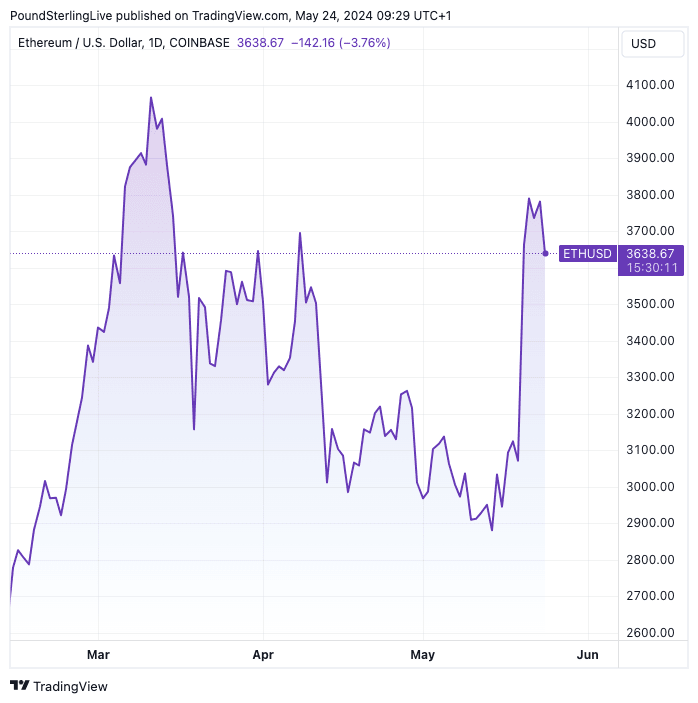

Cryptocurrencies lost value over the past 24 hours despite news that the U.S. Securities and Exchange Commission has approved rule changes to support exchange-traded funds (ETFs) that invest in Ether, the native cryptocurrency of the Ethereum blockchain.

This paves the way for the potential launch of eight ETFs tied to the world's second-largest digital coin.

"Ethereum's sell-off on positive news is a typical 'buy the rumours, sell the facts' reaction of speculators. We saw the same in January after the approval of the Bitcoin ETF, which took 19% off its price in the following two weeks before there was a spectacular reversal," says Alex Kuptsikevich, senior market analyst at FxPro.

"This is still a big moment for crypto, as just a few weeks many had written off the chances of Ethereum ETFs being approved," says Michael Graw, an analyst at Valuewalk.

Kuptsikevich says the market may let off steam regarding Ethereum: "We shouldn't be surprised if the price pulls back to the $3000 area again, returning to an important consolidation area. From these levels, large institutional investors can start building a position in ETFs."

Matthew Weller, Global Head of Research, FOREX.com, says the Biden Administration has seemingly shifted in favour of crypto assets this week. This after the House of Representatives approved the Financial Innovation and Technology for the 21st Century (FIT21) Act in a bipartisan vote.

He says the bill could setup a new regulatory framework for digital assets with greater involvement from the (relatively) more crypto-friendly Commodity Futures Trading Commission’s (CFTC).

Looking ahead, Weller is constructive on Ethereum's prospects. "The approval of a spot Ether ETF would open ETH/USD to a vast pool of regulated capital that has so far been prevented from investing in the world’s second-largest cryptoasset."

Image courtesy of Matthew Weller @ Forex.com.

Weller says traders look to be booking profits in a short-term "buy the rumour, sell the news" reaction, but we could be seeing the market reaching a potential inflexion point.

"In terms of key levels to watch, short-term support may emerge at previous resistance levels from March and April, including $3675 and $3300. Overhead, the multi-year high at $4100 is the key level to watch for a potential bullish breakout or near-term bullish target," says Weller.