Bitcoin's Post-halving Bull Run Could Take Months to Play Out

- Written by: Sam Coventry

-

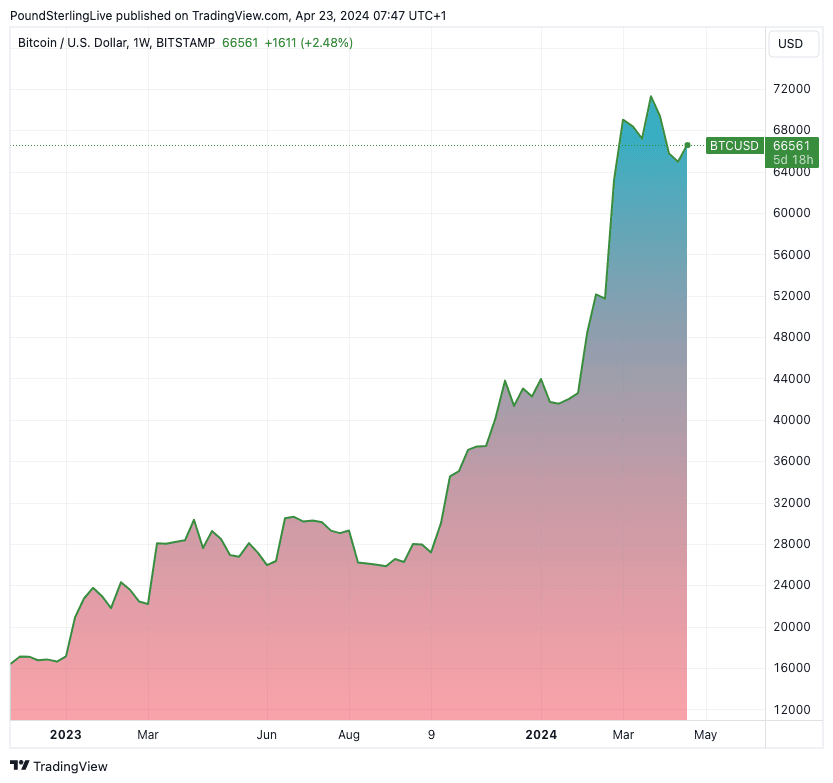

Further gains in the value of Bitcoin are expected in the wake of the recent halving event, but this could occur over a number of months.

BTC reached a high at $73794 in early March, paring the advance to $66531 at the time of writing. Some market participants had expected higher values in light of Friday's halving event which will squeeze supply further.

"Despite some volatile price action in the days leading up to Friday's Bitcoin halving event, the price of the world’s most popular cryptocurrency has remained relatively stable since. While previous halvings have historically been followed by major bull runs, it’s worth recalling that these played out over a matter of months rather than days or weeks," says Neil Roarty, analyst at investment platform Stocklytics.

Halving events lower the reward for mining Bitcoin transactions by half. Following the April event, the number of Bitcoin entering circulation every 10 minutes – known as block rewards – will drop by half, from 6.25 to 3.125 BTC. Halving happens after the creation of 210,000 blocks.

Economics 101 says restricting the supply of an asset in a market witnessing steady or growing demand pushes up the price of that asset.

"Halvings underscore the blockchain’s supply schedule and its disinflationary nature. Everything took place as expected, and as soon as the halving’s block height was reached, network demand spiked considerably. Miners’ dynamics will be altered in the short run, and most will endure strong increases in production costs," explains Manuel Villegas Franceschi, Next Generation Research analyst at Julius Baer.

Franceschi reminds us that global factors also play a role in determining the price of Bitcoin, and dynamics here have been unsupportive of late.

"Prices have remained sideways, as global markets are waiting for further clarity on the ongoing geopolitical tensions. Looking forward, top-down factors, including geopolitical tensions and US macroeconomic expectations, will likely have the strongest influence on digital asset markets," he says.

A particular concern for crypto markets and other 'risk on' markets is the reduction in expectations for Federal Reserve rate cuts to be delivered during 2024.

"Several analysts are predicting a downturn in BTC’s price in the short-to-medium term, citing central bankers' reluctance to reduce interest rates and the hesitancy of venture capital to fully embrace the space as factors that might put the brakes on what has been a remarkable 2024 thus far," says Roarty

“Remember, Bitcoin’s investment landscape is far more sophisticated than it was even four years ago. Those eyeing gains from Friday’s halving may well need to prepare themselves for a marathon, rather than a sprint," he adds.