Bitcoin Selloff: No Signs of Reversal Yet

- Written by: Gary Howes

-

Image © Adobe Images

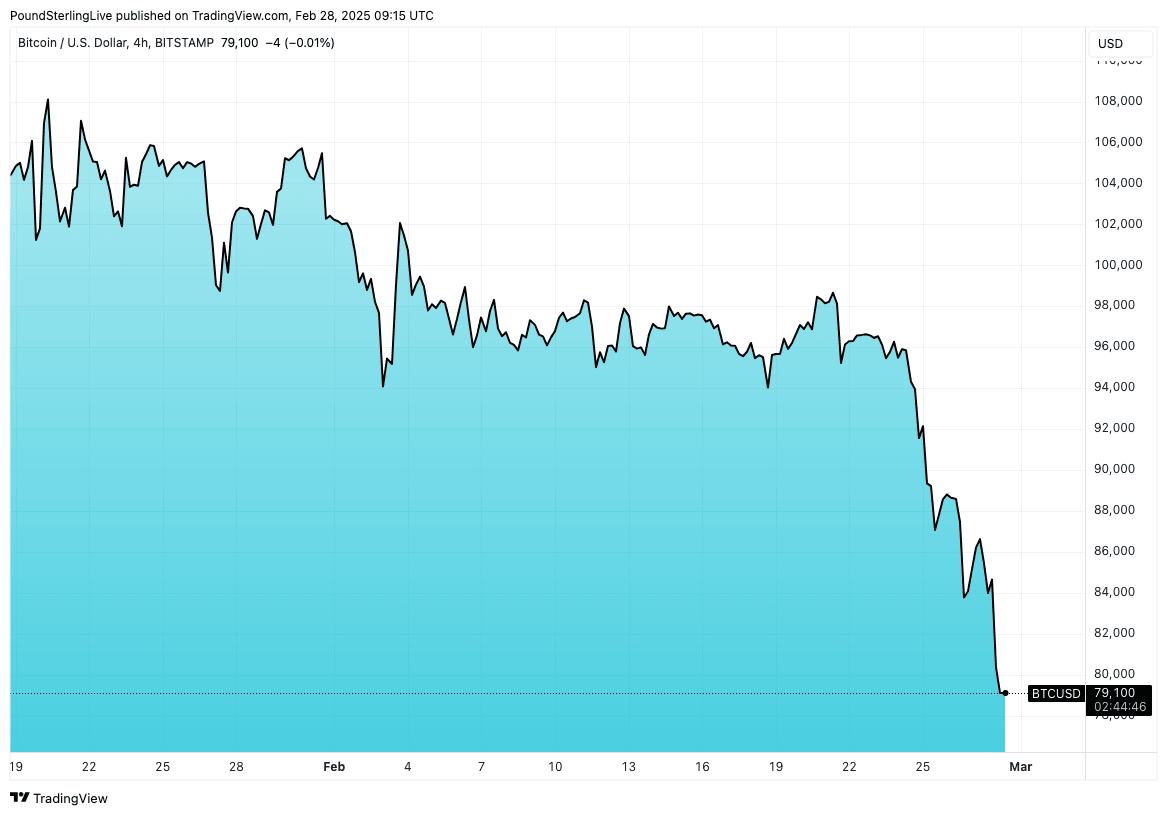

Bitcoin tumbled below the $79,000 mark, extending its recent losses as market sentiment deteriorated. This was driven by geopolitical concerns and a major cryptocurrency theft.

The world’s largest cryptocurrency has plunged 24% in a month, down from its record high of $104,000 at the end of January.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said Bitcoin's drop is "a spectacular descent sparked by risk-off sentiment wracking financial markets."

She noted that the cryptocurrency had "plummeted past the psychologically important $80,000 mark, with little in sight to prompt a significant reversal."

She attributed the downturn to renewed tariff threats from U.S. President Donald Trump, which have "cast an ominous shadow over the global economy." Streeter emphasised that "crypto euphoria is so highly intertwined with broad investor enthusiasm that when it’s dented, there is nowhere to hide, with coins and tokens falling in tandem."

Bitcoin has often been viewed as a hedge against inflation, but Streeter pointed out that "once again, it’s performing in the opposite fashion," falling despite rising inflation expectations in the United States.

She linked this to the threat of higher duties on imports, which could drive up consumer prices and add to economic uncertainty.

Adding to the turmoil, Streeter highlighted a massive $1.19 billion crypto theft from the Dubai-based Bybit exchange, which has "shaken the industry and reinforced concerns about security vulnerabilities in the digital asset space."

Bitcoin had surged past $100,000 following Trump’s election victory as investors anticipated that the U.S. would become a global crypto hub.

However, Streeter noted that optimism has faded as the administration’s initial executive order supporting blockchain technology "lacked the detail needed to provide specific support for the industry."

Instead, she said, focus has shifted to "the controversial launch of personal tokens linked to Trump and the First Lady, which rose in value before falling back down in ‘pump and dump’ fashion, alienating rafts of crypto enthusiasts."

"The flight from crypto has intensified as global sentiment has turned sour," Streeter warned. "At this point, only an intervention of support from the U.S. administration is likely to do the trick of stopping Bitcoin rolling further away from the heady heights reached post-election."

Despite its history of extreme volatility, Streeter stressed that "this latest downturn serves as a stark reminder of the risks inherent in crypto speculation, particularly for those who were lured in by the FOMO effect after Bitcoin hit $100,000."