A Third of Consumers See Bitcoin Below $20K This Year

- Written by: Sam Coventry

-

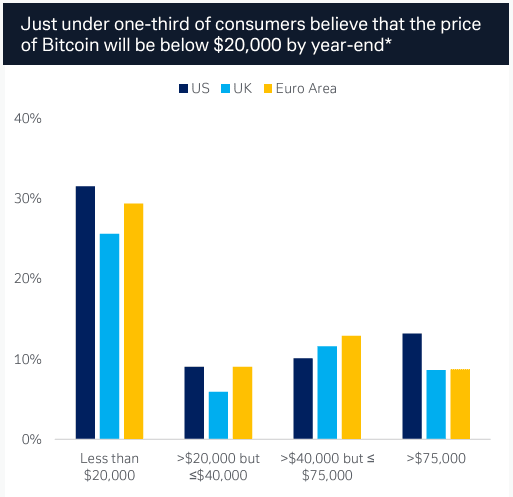

Half of the respondents to a new survey are worried the cryptocurrency market will crash within the next two years, with a third expecting the price of Bitcoin to dip below $20K by the end of 2024.

A third of respondents to a Deutsche Bank survey on the cryptocurrency market believe Bitcoin prices will dip below $20,000 by year-end.

"Despite the recent rally, consumers are not optimistic that Bitcoin will exceed $75,000 by year-end. Only 10% of respondents see it above this level," says Marion Laboure, a Macro Strategist at Deutsche Bank.

Source: Deutsche Bank dbDIG.. * Question asked was “At the end of 2024, where do you think the price of bitcoin will be? It will be…” **Question asked was “What level of understanding, if any, do you currently have about cryptocurrencies? I have…” Note: The survey was conducted in March 2024.

Nevertheless, the most recent edition of the bank's Future of Money survey finds 78% of U.S. consumers have become more positive on crypto in Q1 2024, with less than 1% thinking they are a 'fad'.

"Cryptocurrencies have been around for over a decade and continue to gain mainstream acceptance and utility. They are not just a fad but a new asset class being integrated into the global financial system," says Jennifer Alanis at LetsExchange, a xmr to btc converter.

Bitcoin and other cryptocurrencies rallied in value through the first quarter of 2024 in tandem with widespread investor optimism that the Federal Reserve was on course to cut interest rates on multiple occasions in 2024.

However, the robust U.S. economy and signs that inflation is accelerating once more have seen the market slash expectations for the number of rate cuts. At present, just one cut is fully priced for 2024.

"With signs of stickiness in inflation, a mid-year Fed rate cut is looking increasingly unlikely, with markets fully discounting only 1 US rate reduction this year," says Hann-Ju Ho, an economist at Lloyds Bank.

The rerating in Fed expectations has prompted a decline in investor confidence that has weighed on cryptocurrencies, giving rise to fears that the rally might have completed.

Indeed, the Deutsche Bank survey found that over 50% of respondents are worried about cryptocurrency collapsing in the next two years.

Displaying a significant degree of uncertainty among survey respondents, 40% of respondents believe that Bitcoin will be thriving in the next few years, whilst 38% expect it to be disappearing altogether.

But Deutsche Bank's own analysts are in the optimist camp, with Labourne saying:

"Looking ahead, we expect Bitcoin prices to remain high due to: (i) the expectations of the forthcoming Ethereum spot ETF approvals; (ii) the impending halving event; (iii) future central bank rate cuts; and (iv) regulatory changes.