Wave of Profit-Taking Hits Bitcoin

- Written by: Sam Coventry

-

Bitcoin has fallen sharply at the start of the new week, but industry experts attribute this to profit-taking and say the fundamental case for further gains over the medium term remains intact.

"A wave of profit-taking hit the cryptocurrency market," says Alex Kuptsikevich, senior market analyst at FxPro. "It seems that the failure of cryptocurrencies to rise over the weekend caused players to pull stop orders very close to market prices."

The FxPro analyst says there was a massive exit from long positions in low liquidity before the regular session in Asia.

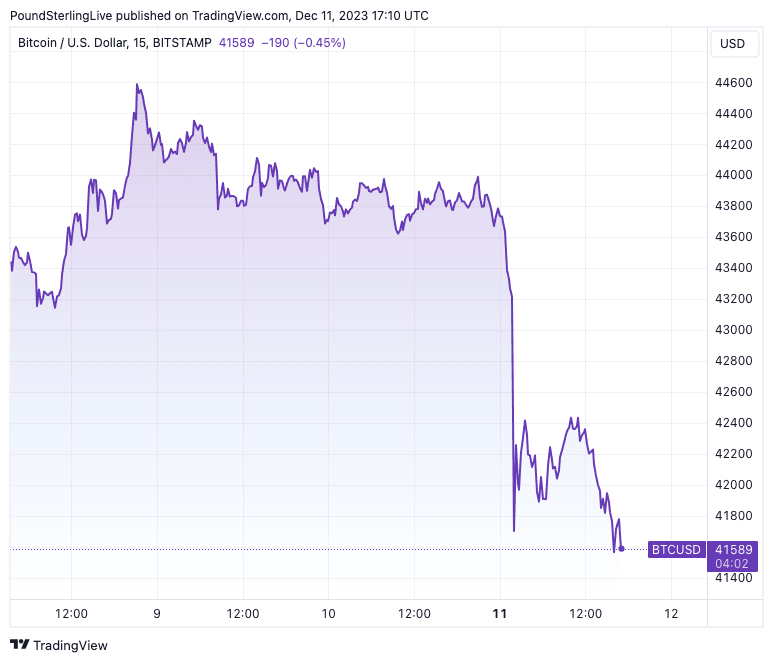

Above: BTC at 15-minute intervals.

BTC fell 5.0% on Monday, having touched 44K just last week, which amounts to its worst day since August.

"Digital assets are experiencing a significant decline, with Bitcoin itself dropping from nearly $44,000 to test the $40,000 level, and this sell-off is extending to the altcoin market," says Walid Koudmani, Chief Market Analyst at XTB.

The pullback in BTC is still relatively limited in the context of the 173% rally in value seen in 2023, which has largely been driven by fresh institutional interest and returning confidence amongst smaller market participants.

A new report from Glassnode notes significant fund flows on cryptocurrency exchanges, which could suggest institutional investors are preparing for spot ETFs.

Concerning the outlook, FxPro notes that the recent selloff was more severe in the smaller cryptocurrencies, but there is an element of dip buying now evident, suggesting ongoing support.

"The sell-off attracted buyers who were waiting for lower prices to enter the market, and the market gave them that chance," says Kuptsikevich.

Spot bitcoin ETFs could raise more than $2.4BN as early as the first quarter of 2024, according to asset management firm VanEck, with Bitcoin expected to take away a significant market share from gold.

According to the report, the inflow of funds may reach $40.4BN in two years.

Regarding price action, Bitcoin will hit a new all-time high in the fourth quarter of 2024, potentially driven by "political events and regulatory changes following the U.S. presidential election," VanEck predicts.