Macau Pataca: Gaming Revenues Back to 70% of Pre-Covid Levels, says OCBC

- Written by: Sam Coventry

-

Image © Adobe Images

Macau's gross gaming revenues have returned to 70% of 2019 levels in a development that will support monetary authorities in maintaining the Macau Pataca peg.

According to Oversea-Chinese Banking Corporation (OCBC), gaming revenue in Macau reached 70.1% of pre-Covid levels in 2019.

Although the Pataca is pegged to Hong Kong's Dollar, rising revenues will ease pressures on the peg going forward.

Image courtesy of OCBC Bank.

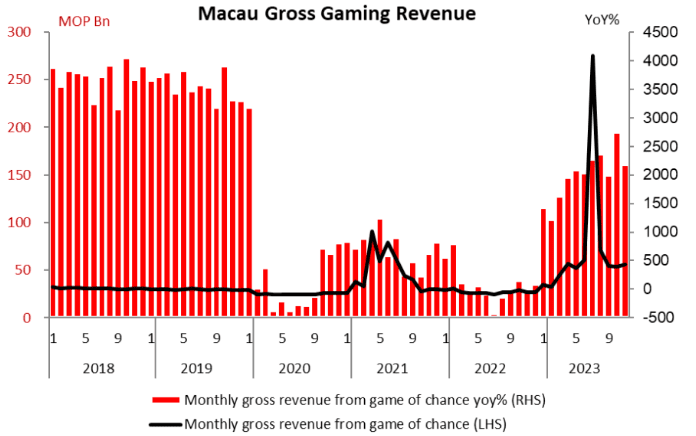

Authorities said casino gross gaming revenues were down by 17.7% month on month in November, but this was mainly because activity fell back from the high base set by the eight-day Golden Week holiday.

Indeed, the sector continues to recover as activity was still up by 435.0% year on year, at 16.04BN Macanese Pataca.

In November alone, the gaming revenue reached 70.1% of pre-Covid levels of 2019, according to OCBC.

"As for the first 11 months of 2023, the figure returned to 61% of 2019-levels, largely in line with our estimates," says OCBC.

Macau is the only region of China where gambling is allowed, and gambling tourism makes up approximately 50% of the economy.

"The ongoing recovery in Macau's most important sector is supportive of the wider global gaming industry," says a note from Gamblizard, an echeck payments specialist.

Image courtesy of OCBC.

The Macanese pataca or Macau pataca is the currency of the Macao Special Administrative Region of the People's Republic of China. It is pegged to the Hong Kong Dollar and is administered by the Monetary Authority of Macau (AMCM) at a fixed exchange rate of HK$1 = MOP 1.03.

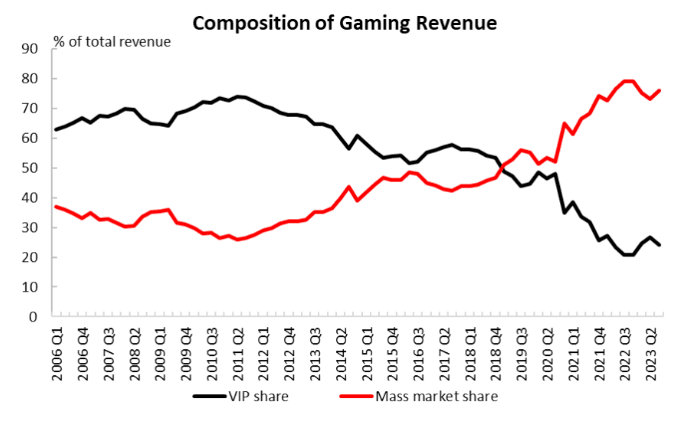

"The recovery story continued for the mass and premium mass segments, with gross gaming revenue generated in the third quarter from these segments returning to 82.2% of the pre-COVID level (vs. 31.6% YoY in VIP segment)," says OCBC.

As a result, the share of the mass market grew to above 75% again in the 3Q23.

"Going forward, casino concessionaires’ investment in non-gaming amenities should continue to have a positive spillover on their gaming revenue for mass segments, while the same may not be true for the VIP segment under the stringent regulatory setting," says OCBC.