Bitcoin Rally Can Extend into 2024: de Vere Group

- Written by: Sam Coventry

-

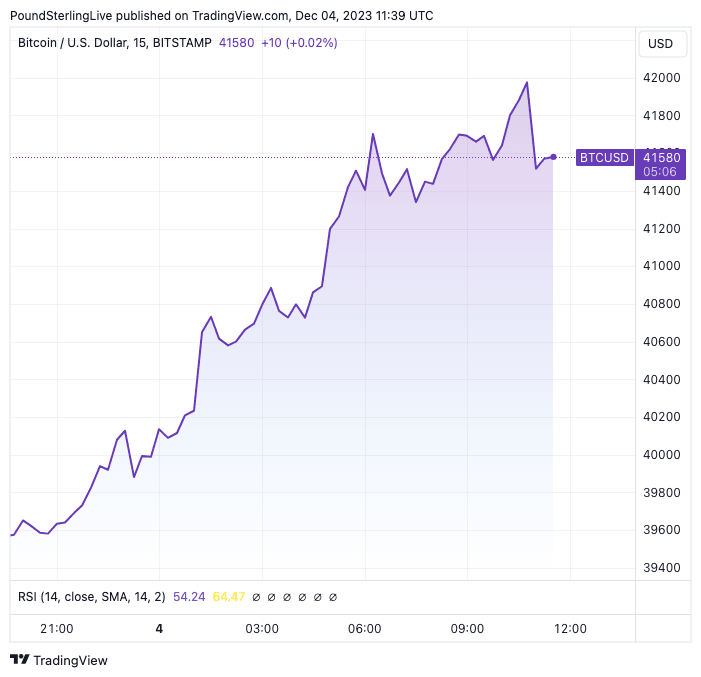

Above: Bitcoin at 15-minute intervals showing price action on December 04.

A financial markets specialist says that scandal-triggered crackdowns, expectations for interest rate cuts, and next year's halving event are fuelling Bitcoin prices, and the trend will continue for the rest of this year and into 2024.

Bitcoin went as high as $41,700 on Monday, its highest since April 2022.

deVere Group's CEO, Nigel Green, says the rally is because - not despite - recent scandals have cleared out the bad actors from the market.

Last month, Changpeng Zhao, better known as CZ, the founder of Binance, the largest cryptocurrency exchange in the world, pleaded guilty to money laundering violations and agreed to pay a $50 million fine and step down from his role as the company’s chief executive.

According to federal authorities, The company also pleaded guilty and agreed to pay $4.3 billion in fines and restitution to the government.

"The CZ/Binance scandal and the FTX collapse, which resulted in a month-long trial which convicted the FTX founder Sam Bankman-Fried of seven counts of fraud and conspiracy, triggered some short-term volatility, but the crypto market has continued to remain bullish," says Green.

Bitcoin is up by over 150% so far this year.

"It appears that law enforcement and regulatory authorities worldwide are cracking down on executives and companies of digital currencies. This greater regulatory scrutiny is seemingly appealing to investors who are piling into the likes of Bitcoin," says Green.

"It would also be attractive to institutional investors who bring with them huge amounts of capital," he adds.

Microstrategy, the software developer and the largest corporate holder of Bitcoin, boosted its holdings recently, buying some 16,130 BTC, worth around $610 million at current prices.

BlackRock, the $9trillion asset manager, alongside WisdomTree, Invesco Galaxy, Wise Origin, VanEck, Bitwise and Valkyrie Digital Assets, have published Bitcoin ETF applications waiting to be approved by the US Securities and Exchange Commission, the SEC.

“We believe that Bitcoin ETFs are an imminent inevitability, and this would help drive crypto prices and mass adoption,” says Green. "Should SEC approval happen, it would be a landmark moment for Bitcoin. The approval by the financial regulator of the world’s largest economy of this spot ETF would show that Bitcoin is, without any question, part of the global mainstream financial system."

Spot ETFs invest directly in underlying assets, typically stocks or bonds, at the current market price (spot price).

They aim to replicate the performance of a specific index or asset class by holding a portfolio of the actual securities that make up the index.

“In addition, expectations the Federal Reserve and other major central banks are done hiking interest rates are fuelling Bitcoin prices,” says Green.

Also in the mind of investors is next year’s Bitcoin halving event. One of the key features of Bitcoin’s monetary policy is its limited supply. The total number of Bitcoins that can ever exist is capped at 21 million coins.

Its issuance is also predictable. Through a process called mining, new Bitcoins are created and added to the circulating supply.

However, the rate of issuance is programmed to decrease over time. Initially, miners were rewarded with 50 Bitcoins for each block they successfully mined. This reward is halved approximately every four years in an event known as the 'halving.'

"The next halving is expected in April 2024. The lead-up has typically been the most profitable time for crypto investors," says Green.