BTC Price Looking Set for "Bullish Trend": XS.com

- Written by: Sam Coventry

-

Despite Bitcoin's sideways path between $31,800-28,400 levels, we are beginning to see the return of sentiment to the market says Samer Hasn, Market Analyst at XS.com.

The call comes after the number of open interest positions rose to the highest level since October of 2022 with more than 10.4 billion positions on August 8, according to CryptoQuant.

A high number of open interest, which includes long and short positions, usually indicates an upcoming rise in momentum and volatility over the coming periods, explains Hasn.

Expectations for further spot Bitcoin ETFs coming to market are also on the up, with Galaxy Digital CEO Mike Novogratz citing sources at both major asset managers BlackRock and Invesco.

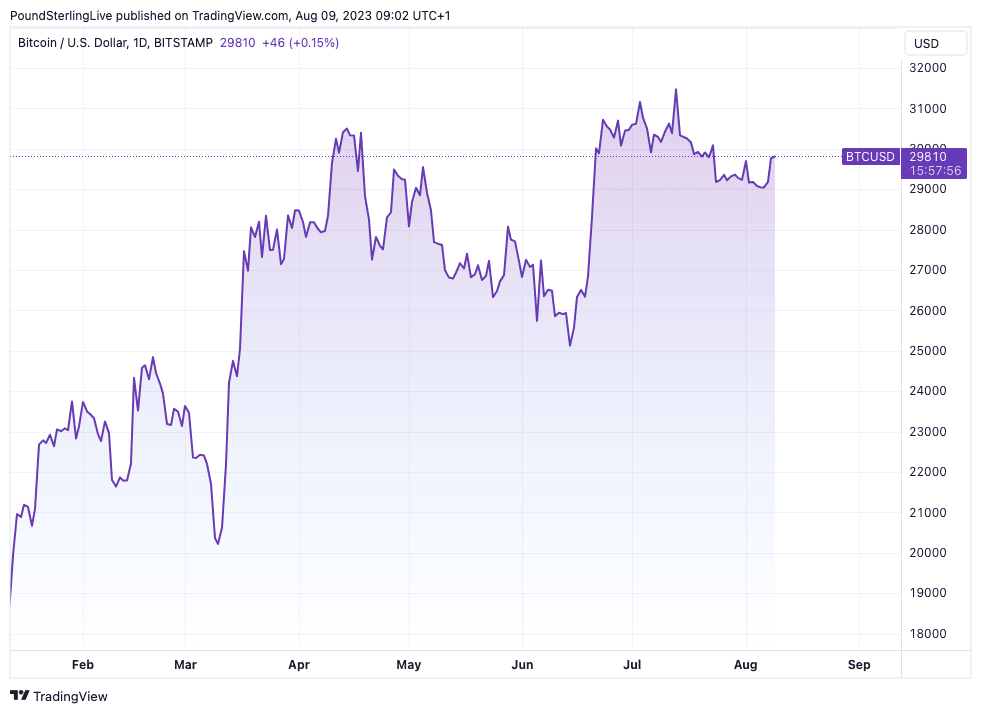

Above: The BTC price at daily intervals.

He suggests the SEC approval for the Bitcoin spot fund offering would be within four to six months.

"The increase in the number of open positions reflects more positive sentiment among investors with more recognition, whether of the importance of cryptocurrencies as a means of settling payments or their importance as an investment, with the introduction of the new currency from PayPal, in addition to the upcoming launch of instant bitcoin funds," says Hasn.

Cathie Wood, CEO and founder of Ark Invest, which manages a number of growth ETFs and which also applied to launch a spot Bitcoin ETF, said SEC may approve the offering of a number of spot bitcoin ETFs simultaneously.

"Offering Bitcoin ETFs may provide more access by individual investors, institutional investors, and large companies that may not be able to invest in cryptocurrencies directly," says Hasn.

Current Bitcoin ETFs are limited to holdings of futures contracts issued by regulated exchanges such as CME, as is the case with the Valkyrie Bitcoin Strategy ETF (BTF).

PayPal meanwhile said this week its own stablecoin, PYUSD, was ready for launch. "As the new offering of the PYUSD currency may provide more access for cryptocurrency networks to the one of the largest payments companies in the world," says Hasn.

"However, the move, while important, has met with some scepticism from the markets, with some concerns that assets in digital wallets could be frozen in some cases as is the case with the stablecoin Tether (USDT)," he adds.

Headwinds to the industry meanwhile persist with current or upcoming regulatory restrictions and lawsuits being the most prominent negative factors that may put pressure on the digital currency markets in general, explains the XS.com analyst.