Can the Crypto Rally Last? FXPro's Kuptsikevich Thinks So

- Written by: Sam Coventry

-

Image from Jernej Furman, sourced: Flickr, licensing: CC 2.0.

In a significant upswing, the cryptocurrency market saw a 5.5% surge in its market capitalization, reaching $1.25 trillion within the last 24 hours.

This level, briefly observed in April, holds substantial implications for the market's trajectory.

Market analysis indicates that the market gained considerable support from June 2021 to June 2022, but since then, this support has transformed into resistance, attracting sellers back into the playing field.

Alex Kuptsikevich, senior market analyst at FX Pro, highlights the critical question at hand: "Will the market manage to cross this line to the upside? More likely, yes than no."

This sentiment echoes the recent performance of Bitcoin, which reached its highest level since early June 2022, hovering near $31,800.

Ripple's favourable outcome in its legal battle against the U.S. Securities and Exchange Commission (SEC) served as a catalyst for this upward movement.

Kuptsikevich elaborates on Bitcoin's recent performance, stating, "The first cryptocurrency has moved above the top of its trading range for the past four weeks, but it still needs to be comfortable in thin-air territory."

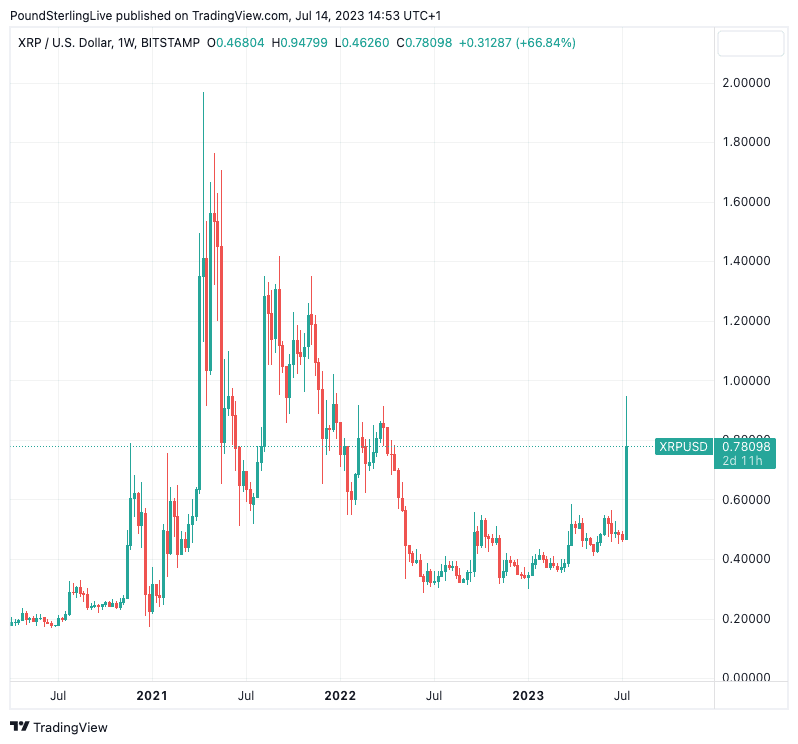

Notably, the XRP token experienced a momentous surge, doubling in value to $0.93 before settling at $0.77, "representing a remarkable 65% increase within the last 24 hours," says Kuptsikevich.

Above: XRP at weekly intervals.

This surge propelled XRP back to fourth place in terms of market capitalisation, while also creating a "ripple effect" that resonates across altcoins, signalling a significant precedent for the broader market says Kuptsikevich.

A Southern District of New York court made a noteworthy ruling, stating that XRP sold to retail investors should not be classified as securities.

However, the court's decision upheld that institutional sales of XRP could potentially be deemed as sales of unregistered securities. The finality of this ruling remains subject to potential appeals from the SEC.

The SEC meanwhile made further headlines with a lawsuit against the bankrupt cryptocurrency lender Celsius. As part of the investigation into the company's collapse, former CEO Alex Mashinsky has been arrested on charges of fraud and market manipulation.

The recognition of Celsius' token as a security adds complexity to the ongoing legal proceedings, emphasizing the importance of regulatory oversight within the industry.

Elsewhere, Brian Armstrong, CEO of Coinbase, drew attention to alleged account blocking by Bank of America, affecting customers' ability to transact with the exchange.

A Twitter poll conducted by Armstrong revealed that approximately 9% of respondents confirmed suspicions regarding account restrictions. This incident underscores the challenges faced by cryptocurrency exchanges in maintaining seamless operations amid potential disruptions from traditional banking systems.

Coinbase also faced a downgrade by Barclays, one of the UK's largest banks. The downgrade was attributed to insufficient near-term catalysts for the company's stock growth, prompting a reassessment of its potential performance in the market.

In contrast, hedge funds are showing increased confidence in the sustainability of cryptocurrencies, according to PwC. The survey revealed that 93% of respondents anticipate growth in the market capitalization of digital assets by year-end. However, the proportion of hedge funds investing in cryptocurrencies has slightly decreased from 37% to 29% by 2023, indicating a nuanced outlook and evolving investment strategies within the hedge fund industry.

U.S. authorities have meanwhile initiated the transfer of the first cryptocurrency seized from the Silk Road darknet marketplace. In March 2023, the government successfully sold 9,861 BTC for $215 million, signalling efforts to address illicit activities and establish regulatory control within the digital asset landscape.