Bitcoin Rally: A Lot of Good News "In the Price" Says Julius Baer Analyst

- Written by: Sam Coventry

-

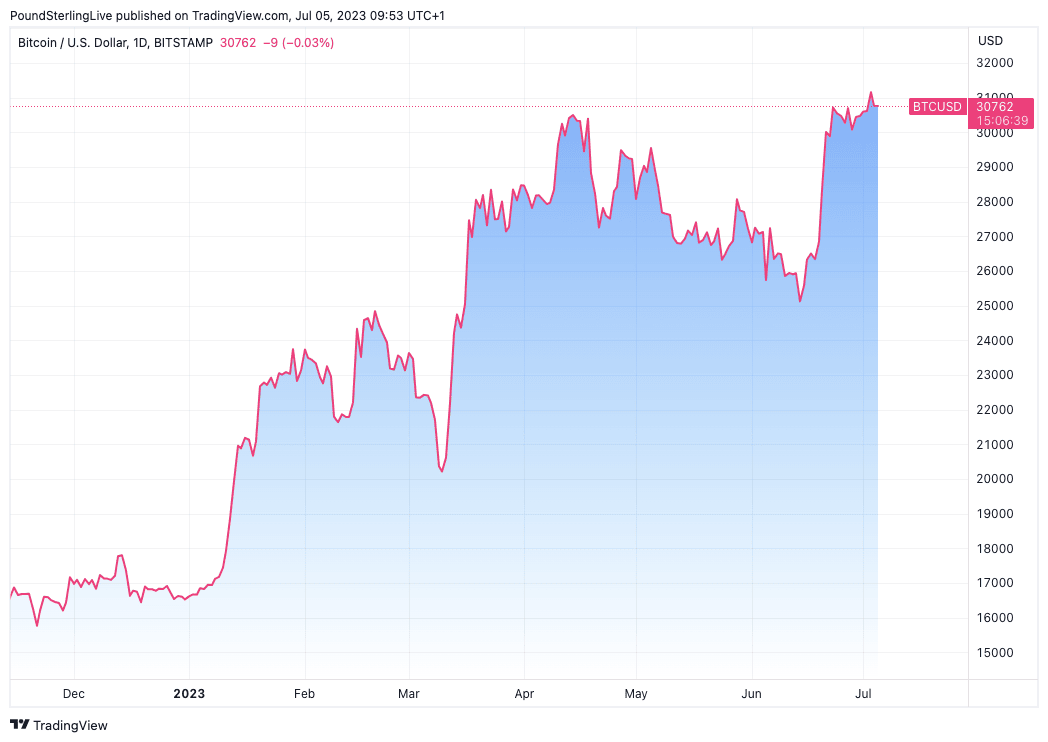

Bitcoin's year-to-date rally to 85% is looking increasingly stretched as the market has likely fully absorbed a great deal of the good news related to the ETF filings underway in the United States.

This is according to Julius Baer, a Swiss private bank, which finds expectations are high that the filings will ultimately succeed, thereby negating a source of regulatory-linked risks to the leading crypto asset.

"Based on the price performance since the speculation started, we believe that quite a bit of good news is already in the price, while the overall regulatory backdrop in the US remains uncertain," says Manuel Villegas Franceschi, Next Generation Research analyst at Julius Baer.

Above: Bitcoin at daily price intervals.

Franceschi acknowledges the rally is yet to stop amidst ongoing hopes for further regulatory progress in the crypto sector at a time of low exchange liquidity, meaning larger orders can continue to have a high impact on the order books.

"Last week’s series of 'physically-backed' Bitcoin spot exchange-traded fund (ETF) filings in the United States revamped crypto-wide optimism, as institutional players finally made the long-awaited move, potentially lowering the entry barriers for the average no-coiner and institutional investor to get into crypto," notes Franceschi.

Nonetheless, the Securities Exchange Commission (SEC) deemed the filings inadequate; allegedly these were insufficiently clear, incomprehensive, and lacked investor protection.

Writing in a research update, Franceschi says the Nasdaq and Chicago Board Options Exchange Global Markets, which filed the applications on behalf of the asset managers, were quick to react, with some applications being resubmitted shortly after the SEC’s response.

The SEC has 15 days to put the filing out for public commentary and, after a week, they can return the filing to the exchange that filed for the application.

After this timeframe, the SEC has 240 days to either approve or reject the filing, suggesting that the approval process is unlikely to be quick and there remains a risk of rejection.

"Bitcoin nevertheless trades above the USD 31,000 mark, and market sentiment remains positive despite the complicated regulatory and macroeconomic backdrop," says Franceschi.

Other notable developments to consider include the SEC's recent approval of a 2x leveraged Bitcoin Futures ETF, a naturally riskier asset than a spot ETF, fuelling the optimism for the latter.

Franceschi says one potential reason for the approval is that futures are established in the realm of US financial regulation while Bitcoin spot exchanges are not, allegedly making the latter more prone to price manipulation.

"All in all, the products have sparked optimism for the asset class, and quite a bit of good news is already in the price in our view. At the same time, the US regulatory backdrop is still uncertain, exchange liquidity is low, and larger orders will have high impact on the order books," he says.