Bitcoin Needs to Cool Off, Says FxPro Analyst

- Written by: Sam Coventry

-

According to Alex Kuptsikevich, senior market analyst at FxPro, Bitcoin's recent surge necessitates a cooling-off period after showcasing its growth potential. The overall capitalization of the cryptocurrency market reached $1.184 trillion, marking a 10.8% increase over the week, as reported by CoinMarketCap.

Bitcoin experienced a 15% rise, closing at $30.4K, while Ethereum recorded a gain of 9.5% to reach $1890.

However, Kuptsikevich suggests that the recent momentum was dissipated over the weekend, bringing Bitcoin's price down to $30.3K in early Monday trading.

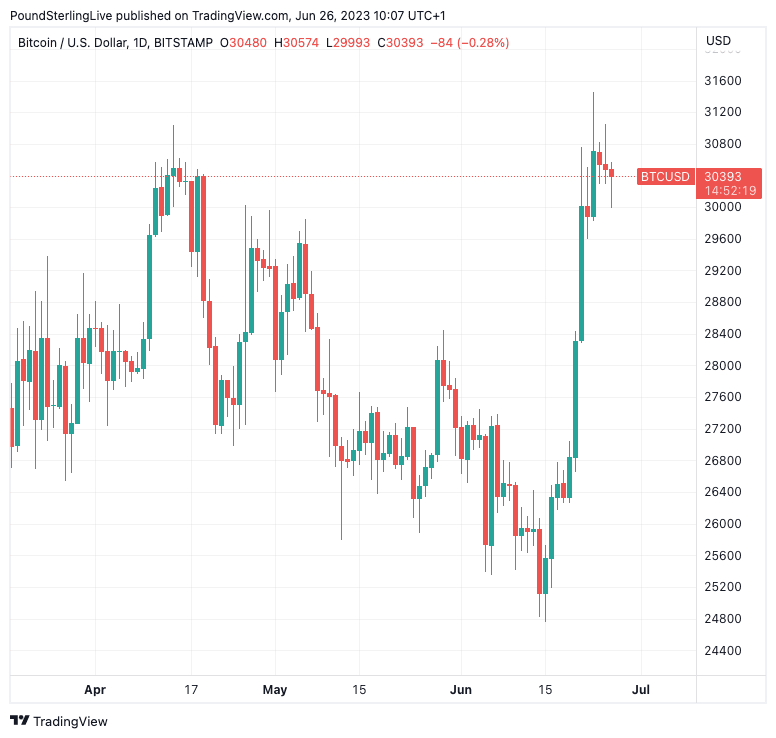

Above: Bitcoin at daily intervals.

Kuptsikevich explains, "Bitcoin renewed its early June highs near $31.4K on Friday, but the rally was not sustained, and over the weekend, the recent momentum was dissipated, bringing the price back down to $30.3K in early Monday trading."

The rally was largely attributed to hopes of launching spot bitcoin ETFs, which would facilitate institutional capital's access to the flagship cryptocurrency. Additionally, the analyst notes technical factors played a role in Bitcoin's upward movement, such as breaking through the 50-day moving average resistance and consolidating above the upper boundary of the descending channel.

Despite the positive indicators, Kuptsikevich suggests that Bitcoin will need a cooling-off period in the short term.

He states, "In the short term, bitcoin will need to cool off after the march, but overall, it has a much better chance of touching the upper boundary at $34.5K within a month than the lower boundary at $26.1K." While Bitcoin's long-term outlook remains bullish, Kuptsikevich believes the market should calm down in the coming days.

The recent rise in Bitcoin and other cryptocurrencies is seen by Mark Yusko, founder of Morgan Creek Capital, as the beginning of a new bullish cycle that will continue until the next spring's halving. Yusko believes that Bitcoin will eventually replace gold as a store of value.

Bitwise CEO Matt Haugan suggests that the cryptocurrency market is entering a multi-year bull cycle, as institutional investors increasingly invest in digital assets.

Hugh Hendry, founder of hedge fund Eclectica Asset Management, argues that rising interest rates in major economies will lead to a deterioration in macroeconomic conditions, which is favorable for Bitcoin. He envisions the BTC exchange rate tripling in such a scenario.

In other news, major German software developer SAP has initiated a pilot project for international payments using the Circle USDC and EUROC stablecoins on the Ethereum blockchain.

Bitcoin Cash, one of the oldest altcoins, experienced an 80% surge last week, supported by the endorsement of crypto exchange EDX Markets.

As Bitcoin takes a breather, the cryptocurrency market awaits the next phase of its journey, considering both the technical factors and the broader macroeconomic landscape.