"Duopolistic Dominance" of ETH and BTC Only Growing Says Swiss Investment Bank

- Written by: Gary Howes

-

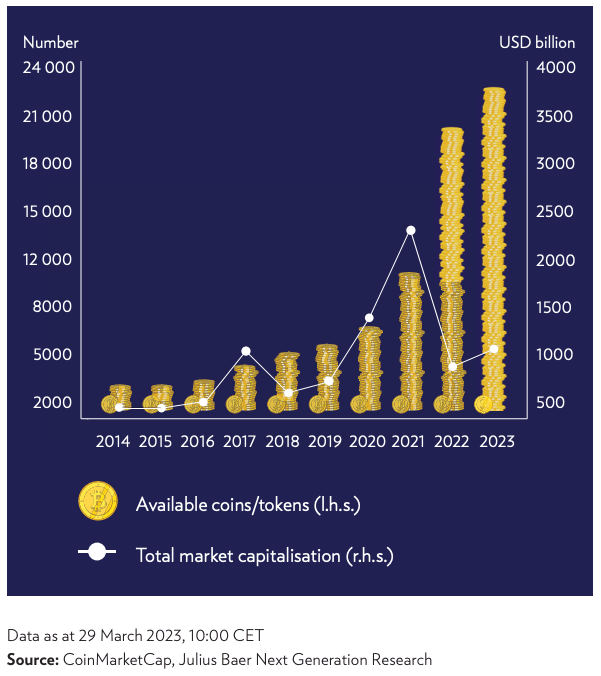

Just two crypto coins - Bitcoin and Ethereum - accounted for over 80% of the total increase in crypto market capitalization in 2023, prompting analysts from one Swiss investment bank to say the lead of these two coins is nearly unsurpassable.

"While it is too early to declare that 'the winners take it all', we struggle to see other blockchains that can compete with Bitcoin and Ethereum," says Carsten Menke, Head of Next Generation Research at Julius Baer, a brief that includes the bank's cryptocurrency research.

Menke says digital assets have experienced a period of consolidation in recent weeks, with the total market capitalization hovering around $1.2 trillion.

Within this market, Menke notes the emergence of a duopolistic dominance by Bitcoin and Ethereum as the preferred crypto to invest in by retail and institutional investors.

Menke highlights the outperformance of Bitcoin and Ethereum since the beginning of the year, accounting for over 80% of the total increase in market capitalization, equivalent to more than $280 billion.

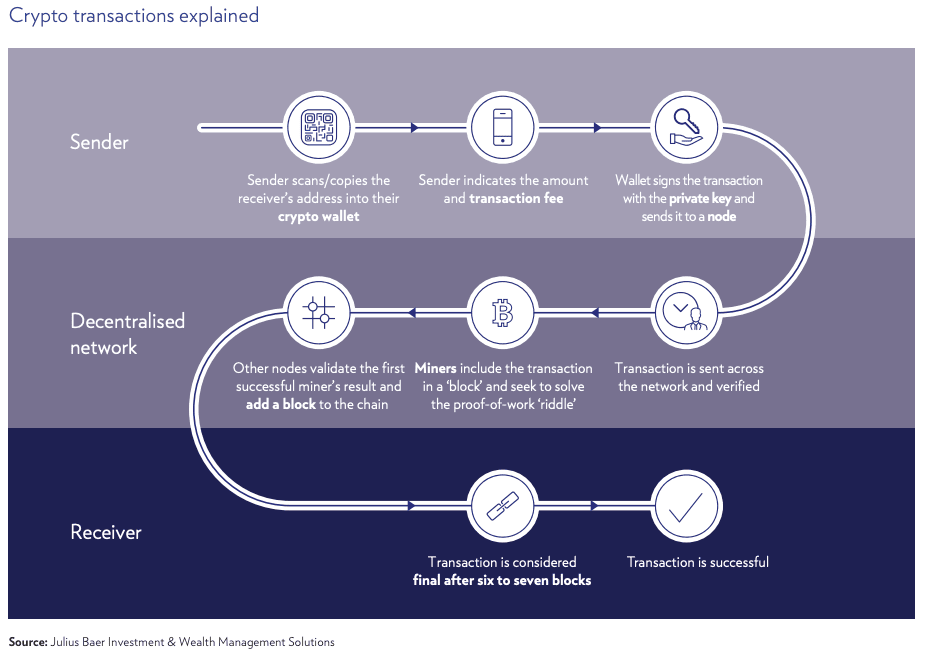

He attributes this trend to strong fundamental reasons. Bitcoin, positioning itself as a go-to payment token, benefits from lower volatility and the growth of the lightning network, which enables faster transactions and addresses scalability limitations. The Bitcoin network's security is reinforced by the increasing difficulty of mining new blocks, evidenced by record-high hash rates and estimated energy consumption.

While Bitcoin is on track to establish itself as "digital gold," it still needs to prove its status as a safe haven during times of financial market risk aversion, says the analyst.

On the other hand, Ethereum solidifies its value proposition as a leading smart contract solution. Recent successful upgrades, including "The Merge" and "Shapella," demonstrate Ethereum's development potential and its ability to address network shortcomings.

Ethereum, already boasting the highest number of developers, aims to tackle its scalability issues with next year's anticipated "Sharding" upgrade, which is expected to further enhance its value proposition.

Menke emphasises that Ethereum challengers have failed to meet their ambitions thus far. For example, Solana has faced network outages, raising concerns about its reliability. While it is premature to declare "the winners take it all," Menke struggles to identify a layer-1 blockchain capable of competing with Bitcoin and Ethereum over the medium to long term.

The dominance of Bitcoin and Ethereum in the digital asset market reinforces their positions as leading players in the evolving landscape.

As regulatory uncertainties gradually subside, investors and market participants will closely monitor the continued development and expansion of their respective value propositions.