Bitcoin and Ethereum Prices Steady Following a Week of Woes

- Written by: Gary Howes

-

Image © Adobe Images

The two major cryptocurrencies remain on fragile footings at the start of the new week with both Bitcoin and Ethereum suffering idiosyncratic woes over recent days, although some analysts look for some discount buying to help steady valuations near-term.

Ethereum fell back 3.82% on Friday to deliver a weekly loss of 10.16% with Jim Reid, analyst at Deutsche Bank, saying the decline was thanks to issues related to the network's major Shapella update.

Specifically, two Beacon Chain finality issues were encountered that required stalled activity and required immediate fixes.

"The Ethereum core network experienced two massive outages that prevented transactions from being completed for some time. Blocks were created, and transactions were completed but could be altered. The developers of the Ethereum client Prysm released an emergency update," says Alex Kuptsikevich, senior market analyst at FxPro.

Prysmatic Labs currently builds technical infrastructure for the Ethereum blockchain with an aim to boost ethereum's role in web3 development, through better tooling for users and developers of the Ethereum ecosystem through our expertise.

It was reported Sunday that developers had successfully rolled out patches to address two Beacon Chain finality issues suffered in just 24 hours. The Beacon Chain serves as the consensus layer for the Ethereum network.

Despite recent declines in ETH, Coin Data Flow's ethereum price prediction tool finds the trend remains higher with the three-, six- and 12-month timeframes expected to deliver gains.

Robin Wikin, an analyst at Macro Hive says the ETH price is now moving into "the ideal region between 1720 and 1650 to look for a higher low develop."

"If so, we should then move into a broader range before new highs, or just straight to new highs, targeting 24,500," he explains.

Bitcoin meanwhile fell in value 6.9% last week to close at $26,900 after Bitcoin network congestion pushed Binance to halt bitcoin withdrawals.

"Some users panicked as they were assuming an attack on the bitcoin network, thus sending withdraw requests on exchanges," says Nikolaos Panigirtzoglou at JP Morgan.

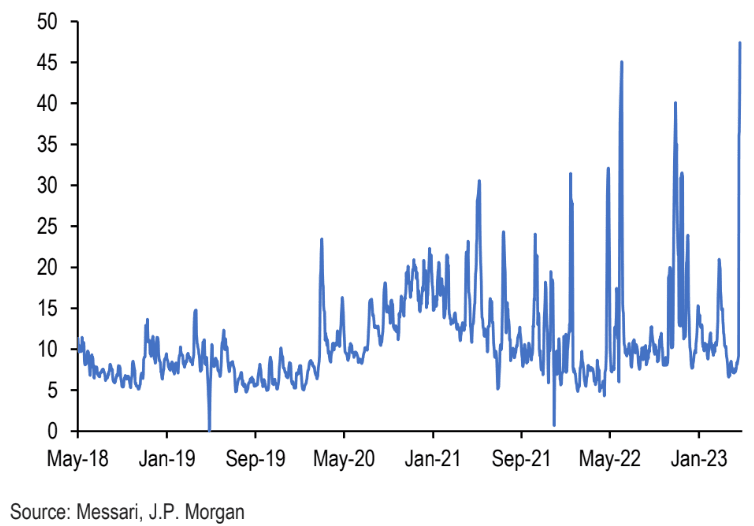

Above: BTC withdrawals from the Binance exchange. Image courtesy of JP Morgan.

JP Morgan's analysis of on-chain activity (above) showed around 150 thousand BTC leaving Binance wallet address, "this led to more panic in the market and resulted in more withdrawal requests over Binance," says Panigirtzoglou.

Concerning BTC's outlook, FX Pro's Kuptsikevich says the coin now attracts buyers on the dip to 200-week Moving Average.

"Bitcoin proved interesting for sellers as it touched the 200-week average, passing close to $26,000 last Friday. By defending this key average, the bulls have convinced the market of the sustainability of the long-term bullish trend. On Saturday and Sunday, the Bulls defended the $26.8K level. On Monday, investors switched to active buying and pushed the price to $27.5K," he says.

Kuptsikevich, however, says buyers will likely want to see a $28-28.5K takedown as confirmation of the break of last month's downtrend.