Bitcoin and Ethereum Carving Out Distinct Identities says a Swiss Private Bank

- Written by: Gary Howes

-

Image © Adobe Stock

Research from Swiss private bank Julius Baer finds Bitcoin and Ethereum are beginning to carve out distinct use-case identities in the crypto-scape, that can underpin value going forward.

However, the recent rise in the value of cryptocurrencies is starting to look extended in the near term and some pullback risks can therefore be anticipated says Manuel Villegas, an economist who oversees Next Generation Research at Julius Baer.

The findings come as crypto assets experience a purple patch of gains, with Bitcoin rising 23% last month and a further 6.25% in April as "all stars appear to be aligned for digital assets at the moment," says Villegas.

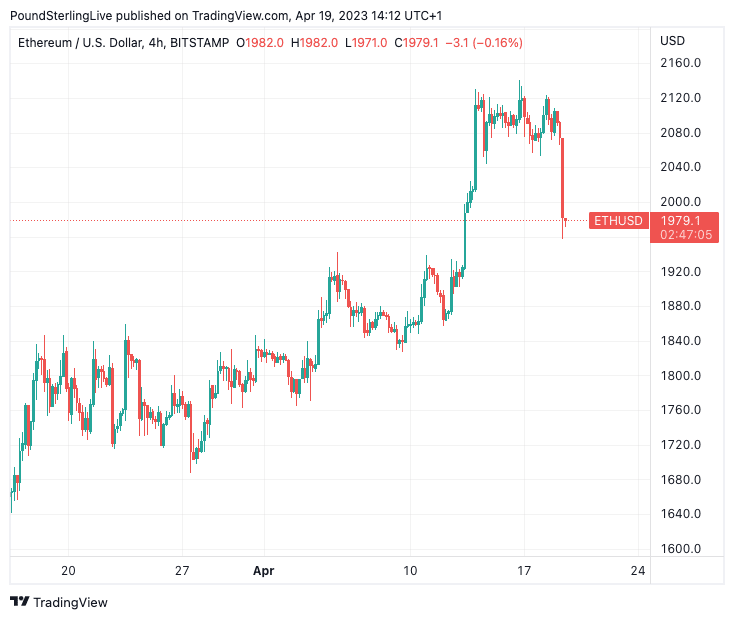

Outperformance also extends to Ethereum where March's 13.50% advance is joined by a gain of 15.21% in April.

Above: BTC in USD at four-hour intervals.

April's advance comes after Ethereum completed its transition to a proof-of-stake model last week with the Shapella upgrade.

"The success of the upgrade should pave the way for Ethereum to cement itself as the go-to layer-1 blockchain for smart contracts," says Villegas.

"Meanwhile, Bitcoin is cementing itself as the go-to solution among crypto payments, suggesting an increasing convergence in the crypto space towards either of the two," he adds.

[Contextual advertisement: Learn how some crypto casinos now accept payment in six different cryptocurrencies].

ETH Rides High on Shapella Upgrade

Ethereum successfully completed the Shapella network upgrade on April 12, 2023, which sees the finalisation of the network's move to a proof-of-stake model.

The development allows those who have staked ETH as part of the network validation process to withdraw their assets.

Villegas says the success of the upgrade should pave the way for Ethereum to cement its position as the premier blockchain for smart contract development.

"The inflation-adjusted staking rewards for the Ethereum blockchain are above 5.5%, and only around 16% of the total Ether supply has been staked," says Villegas.

By way of comparison, the inflation-adjusted rewards for Solana and Cardano are near - 1% and 0.14%, respectively, mainly due to the high emissions of new tokens on the blockchains.

Above: ETH in USD at four-hour intervals.

"Potentially, Ethereum’s liquidity-risk lowering upgrade can bring forward a much higher share of staked Ether out of the total supply," says Villegas. "This will likely be a major signal for accumulation by reducing the active supply."

Julius Baer's analysis finds that the success of the upgrade, paired with the soundness and the vast ecosystem of the Ethereum blockchain, should pave the way for Ethereum to increase its market share in the crypto space.

The developments also mean it is becoming increasingly clear that divergence in the crypto space is underway with Bitcoin on the one side and Ethereum on the other.

"Bitcoin has been underpinning its value proposition as a potential form of future gold more recently, while the increasing capacity of the Lightning Network should cement Bitcoin as the go-to-solution among crypto payment tokens," says Villegas.

Ethereum is meanwhile on track to cement itself as the go-to layer-1 blockchain for smart contracts, enabling applications such as decentralised finance or non-fungible tokens.

But can the value of the two leading coins continue to rise from here?

The gains of the past few weeks suggest the 'crypto winter' might finally be over, but a pause in the rally could be expected.

"We believe the mood in the crypto markets has become too bullish as of late," says Villegas.

"Regulation remains a threat especially in the United States and the expectations of a rapid reversal in US monetary policy seems somewhat overdone," he adds.