"Flight to Bitcoin": Demand for Secure Crypto Assets Sees BTC End Month With a 22% Gain

- Written by: Gary Howes

-

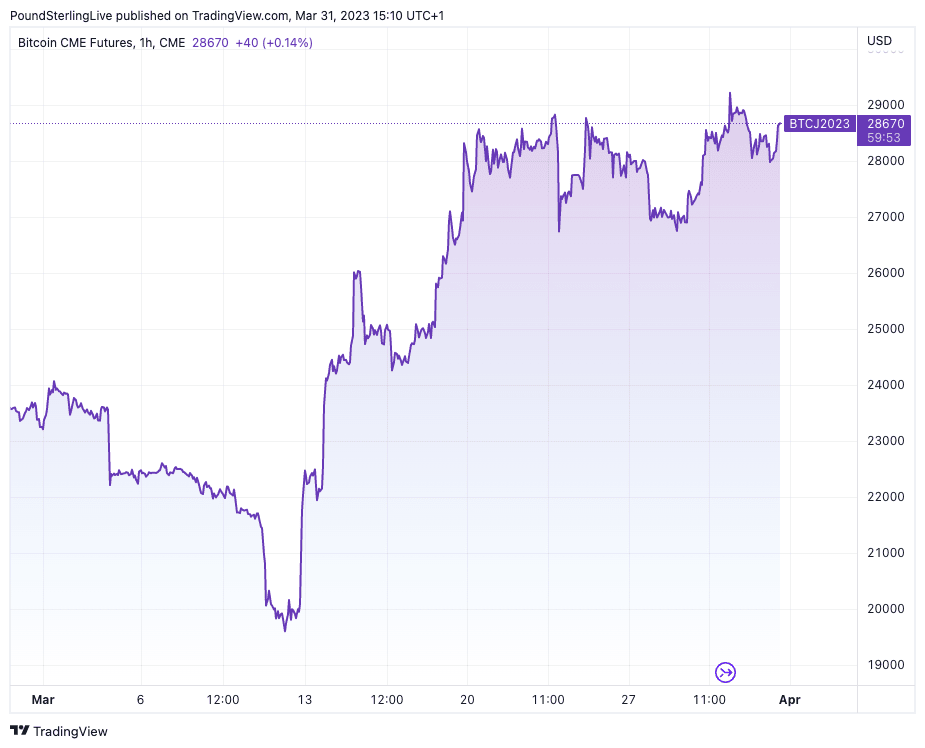

Above: BTC price dynamics through March. Image © Pound Sterling Live, TradingView.

The Bitcoin price is set to end March with a gain in excess of 20%, courtesy of crypto investor demand for quality assets in the space.

The rally came amidst ongoing pressures in the crypto space related to increased regulatory pressures in the U.S. and other developed market economies.

However, Bitcoin's gains came despite financial market fears associated with the collapse of banks in the U.S. and Switzerland, suggesting the asset embodies 'some safe' haven features.

"During the last 9 months, we have seen major crashes with Terra-LUNA and FTX. In both instances, there has been a ‘flight to secure’ assets safely," says Dušan Stojanović, Founding Partner of True Global Ventures. "Now with 3 U.S. and 1 European bank being closed and saved either by regulators or competitors, there has been a flight to Bitcoin".

Bitcoin opened the month at $23275 and peaked at 29415, before paring the advance to $28580 on the final day of March.

(Learn more about the crypto market with our advertising partners at the Tesler app).

Bilal Hafeez, the chief analyst at Macro Hive says "big investors flood back to Bitcoin" and he likes to be bullish on the asset.

Macro Hive's preferred metric to track institutional demand is flows into bitcoin ETFs.

"ETF inflows have jumped again recently. The past five days saw around $154mn of inflows into the bitcoin ETFs we track – some of the largest since July 2022," says Hafeez.

In addition, Macro Hive finds 'whales' are also accumulating again and its on-chain/flow signals are currently "very bullish" on Bitcoin.

The findings come a day after it was revealed that Microstrategy, one of the largest bitcoin investors, purchased an additional 6,455 BTC for $150mn at an average price of around $23,238 per BTC.