Crypto Market "Temporarily more attractive than Stocks" - FXPro

- Written by: Sam Coventry

-

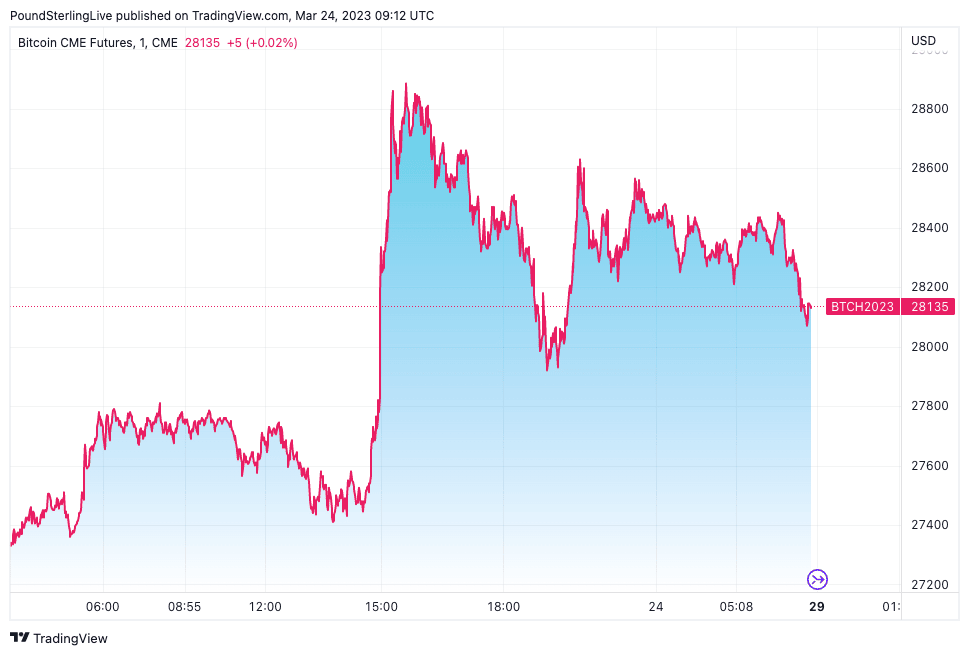

Above: Bitcoin price at one-minute intervals.

The crypto market is proving "temporarily more attractive than stocks," says Alex Kuptsikevich, Senior Market Analyst at FXPro.

The call comes as the cryptocurrency market's capitalisation rose 2.2% over the past 24 hours to $1.183 trillion, returning to Wednesday's highs.

"Despite entering the oversold territory on the daily chart's RSI, Bitcoin still has a good chance of testing the $30K level before a medium-term correction to $25K," says Kuptsikevich.

Ethereum has meanwhile built up some upside momentum and posted local highs at $1800.

"A promising bounce from the 200-week average and a consolidation above the 50-week average has been formed on the weekly timeframe. This week's momentum confirms the return of active bulls and sets up a test of $2000 in the coming weeks," says Kuptsikevich.

The price action sees crypto industry executives interviewed by CNBC remain bullish on the first cryptocurrency.

(Explore the latest price action with our partners at the Bitsoft 360 app, click here for more).

Tether CTO Paolo Ardoino believes bitcoin could retest its previous record high of $69K.

Gemini cryptocurrencies exchange strategic director Marshall Beard believes BTC could hit $100K this year

The recent robust trade in the crypto space comes amidst ongoing regulatory headwinds, with the U.S. Securities and Exchange Commission (SEC) suing Tron project founder Justin Sun and three of his companies for "unregistered sales of securities in the form of cryptocurrencies" Tron (TRX) and BitTorrent (BTT).

The regulator also believes that Sun manipulated the secondary market for TRX through "laundered trading".

Elsewhere, U.S. cryptocurrency exchange Coinbase has received a notice of investigation from the SEC regarding the listing process on the platform and its products - Coinbase Prime, Coinbase Wallet and the Coinbase Earn stacking service.

The exchange has time to respond.