SVB, Silvergate Failures Heap Pressure on Crypto Valuations

- Written by: Gary Howes

-

Image copyright: Pound Sterling Live, SVB.

Cryptocurrencies have come under fresh selling pressure as financial markets react to the news that a technology-focused lender is at risk of failing.

Silicon Valley Bank (SVB) has put itself up for sale after it failed to raise enough capital on the open market to cover losses incurred by its main investment portfolio.

SVB's focus on new technology businesses and ventures underscores the pressures the sector has come under since the Federal Reserve and global central banks started raising interest rates.

Growth stocks relied on excessive liquidity to command sky-high valuations and stock prices, which were in turn underpinned by ultra-low borrowing costs.

The crypto market is also prone to these liquidity dynamics and is therefore highly responsive to the SVB news which comes just days after the collapse of Silvergate Capital.

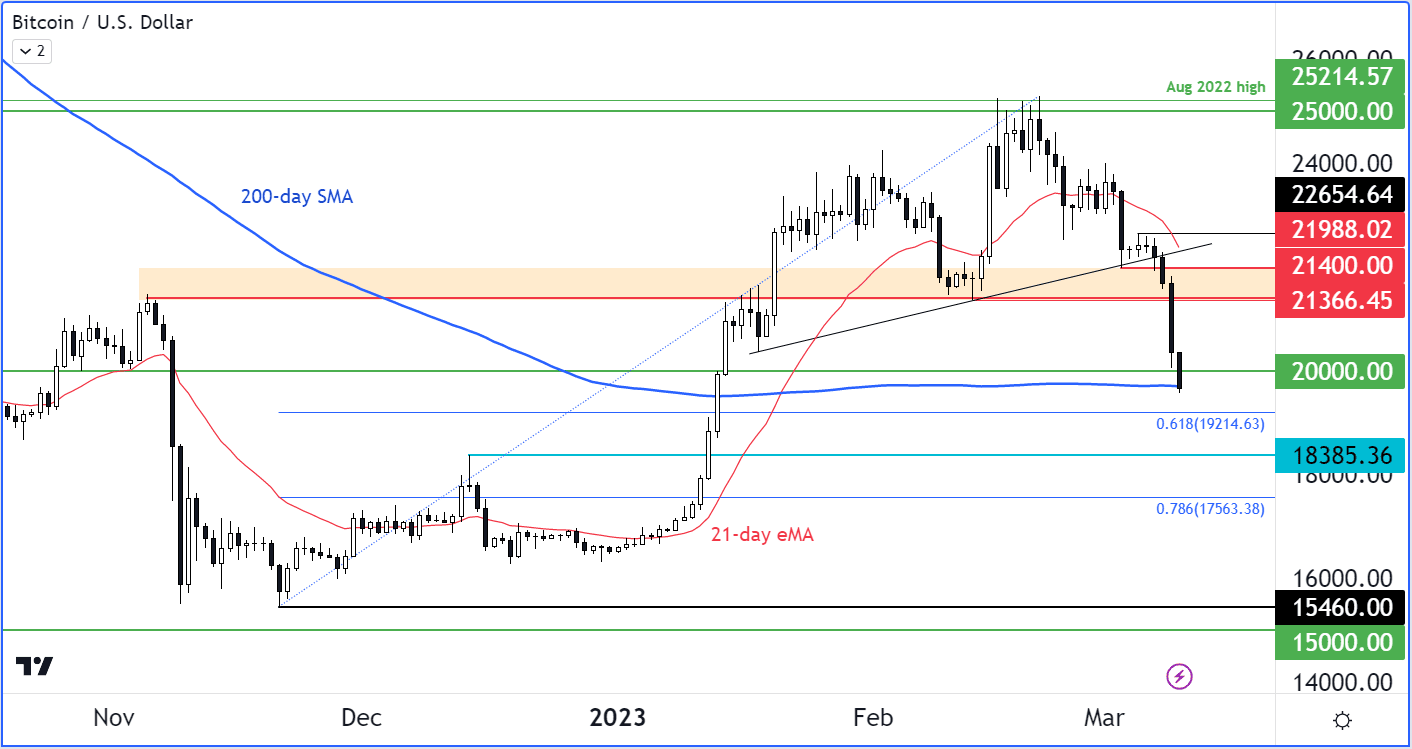

"Bitcoin was down for the fourth day and third week at the time of writing, after breaking $21.4K support, which led to following up selling to $20K as we had expected," says Fawad Razaqzada, Market Analyst at City Index.

Above: BTC in USD. Image: City Index.

The analyst says sentiment towards crypto assets has been particularly negative after Powell ramped up the Federal Reserve's hawkish rhetoric on interest rates earlier this week, "weighing on all non-interest-bearing assets, including cryptos and gold."

Powell said in an appearance before Congress on Tuesday that interest rates might have to go higher than previously expected owing to a recent run of strong economic data.

"But crypto assets have been hurt further after Silvergate, a bank that has been at the centre of the industry’s growth, decided to shut down. With BTC/USD breaking lower, we expect any bounces to be short-lived until price starts to form higher highs again," says Razaqzada.

"We are seeing the market come under fresh pressure following the Silvergate and SVB news," says Anton Kovačić, the founder of Bitcoin Loophole, a Crypto trading software provider.

The cryptocurrency-focused U.S. lender Silvergate said on March 09 it was to wind down its operations after it was hit by customer withdrawals following the collapse of crypto exchange FTX.

The California-based bank had warned last week it was "less than well capitalised" after depositors demanded their money back.

It said it was evaluating its ability to operate as a going concern.

Silvergate said a voluntary liquidation of the bank was "the best path forward" in light of "recent industry and regulatory developments".