Bitcoin: Technicals, Silvergate News "Does Not Bode Well for the Short-term Outlook"

- Written by: Sam Coventry

-

Image © Adobe Stock

The outlook for Bitcoin has been challenged by news shares in U.S. holding company Silvergate Capital Corporation, which owns crypto bank Silvergate, plunged almost 49% on news of a delay in publishing its annual report to the SEC.

The company said it needed "additional time" to complete its audit.

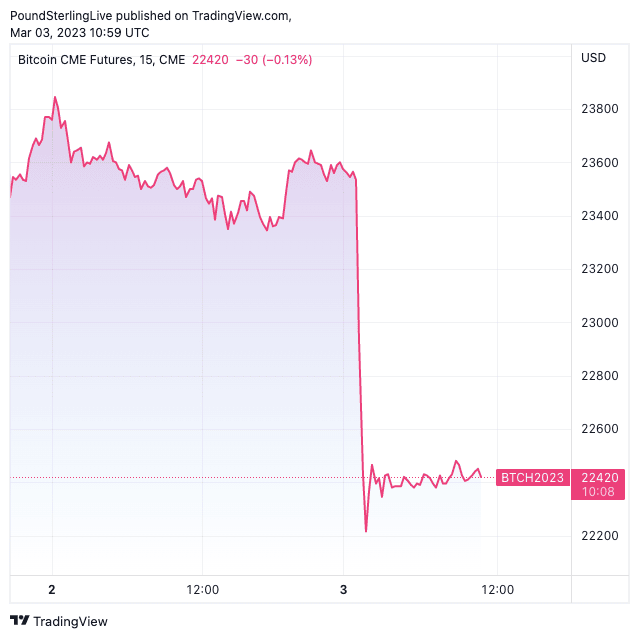

"Bitcoin plunged more than 6% to $22.0K early this morning. The plunge into this area came as a market reaction to the potential bankruptcy of Silvergate," says Alex Kuptsikevich, FxPro senior market analyst.

Kuptsikevich explains the news triggered a wave of stop orders on fears that the situation could cause a domino effect in the industry, as with FTX earlier in the day.

Silvergate Bank warned it might file for bankruptcy due to the massive sell-off and an inability to repay its debts.

Coinbase, the largest US cryptocurrency exchange, has in turn it would sever its financial relationship with Silvergate.

Concerning the outlook for Bitcoin, Kuptsikevich says from a technical perspective the dip has pushed the price below its 50-day moving average, which does not bode well for the short-term outlook, although this signal will only be reliable at the close of the day.

"The intraday picture is one of tidy buying after a brief dip. The overall moderately positive sentiment in the global markets supports the buy-the-dip mood," he explains.

However, a return above $22.8 an ounce before today's close could spark further buying.

"Closing near the lows would be an essential signal to spread fear throughout the crypto market, suggesting a further drawdown to $19.7K in the coming weeks," says Kuptsikevich.