Canadian Dollar's Rally Could be a Case of Fool's Gold

- Written by: James Skinner

CAD is riding high now that traders are betting on another rate hike from the Bank of Canada in January, but some strategists are warning this could be a case of fool's gold.

The Canadian Dollar has been lifted by a series of economic numbers that appear to have put paid to earlier concerns that the economy could be headed toward the rocks after the two interest rate hikes announced by the Bank of Canada in 2017.

Two showstopping jobs reports have driven the Canadian unemployment rate down to 5.7%, a level not seen since the 1970’s, lending the Loonie its new lease of life this January.

The Canadian Dollar has risen 1.03% against the greenback since the start of the month and 0.58% against Sterling, which had pushed the Pound-to-Canadian-Dollar rate down to 1.6839 at the time of writing.

These moves have helped lift Canada’s Loonie close to the top of the G10 currency league table, leaving it ranked just beneath the first placed unit, the New Zealand Dollar.

“In our judgement, that should be enough to see the Bank of Canada hike rates later this month, with the employment figures more than enough to offset recent disappointments on GDP,” wrote Nick Exarhos, an economist at CIBC Capital Markets, in response to the numbers.

Such was the magnitude of the gains in Canadian jobs for last month, markets have entirely overlooked the December 22 GDP report, which showed economic growth stalling at 0% back in October.

“The gains in December were partly skewed toward part-time work, but full-time positions still added 24K. Statistics Canada notes that the unemployment rate is now the lowest "since comparable data became available in January 1976". Over to you Governor Poloz indeed,” Exarhos added.

These data came after November’s inflation report, released on December 21, which gave hope that price pressures may finally be picking up in Canada.

Headline consumer price growth increased 70 basis points to 2.1%, taking the CPI index above its 2% target, while the more important measure of “core inflation” rose 40 basis points to 1.3%.

“That's a seven tick acceleration from the prior month, with most of the gains being concentrated in energy. Still, underlying inflation looks to be finally dragged higher by narrower economic slack, with ex-food and energy prices clocking another 0.2% seasonally adjusted gain, and are now tracking an annual advance of 1.8%,” Exarhos wrote in response to those numbers.

Core inflation removes volatile commodity items from the goods basket and so is seen as more representative of true underlying inflation.

Inflation is a crucial economic number for currency markets because it is price pressures that central banks are attempting to manipulate when they make changes to interest rates and it’s the interest rates themselves that are the biggest draw for investors and currency speculators.

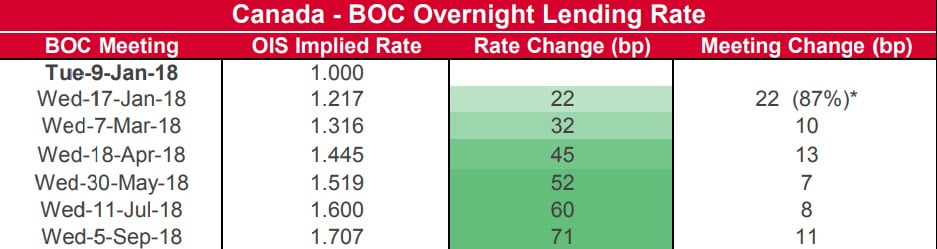

Above: Overnight Index Swaps pricing of Canadian cash rate. Source: Westpac Institutional Bank.

Advertisement:

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

These developments have seen traders in interest rate derivatives markets placing bets that have brought forward the date at which another Bank of Canada rate hike is likely.

Overnight Index Swaps prices now imply there is an 87% chance of another rate hike at the BoC's January, 17 meeting. As recently as December, that same market had put the next rate hike all the way out in April.

"The BoC will release its MPR and announce its policy decision on 17th January and following higher than expected CPI data for November, stronger than expected retail sales for October and much stronger than expected jobs data for November, the justification for a January rate hike is evident," says Derek Halpenny, European head of global markets research at MUFG.

Perhaps the most noteworthy impact of the recent jobs numbers is that not only are derivatives markets implying a very heavy chance of a rate hike in January, interest rate traders are also betting heavily (68% chance) on another rate hike coming in April.

Admittedly, the Bank of Canada stunned markets in 2017 when it followed up its July rate hike, which took the cash rate up 25 basis points to 0.75%, with another hike in September that left the Canadian interest rate at 1%.

“While we understand the enthusiasm for a rate hike in Q1 (we’re leaning towards March/April while our Economics team has now shifted their call to January), two rate hikes by April is likely a bridge too far for the BoC to cross,” writes Bipan Rai, a macro strategist at CIBC Capital Markets.

"Taken with the current level of positioning and sentiment for the CAD, and we’d veer towards tactical CAD shorts (on the crosses) once the January BoC meeting is out of the way."

Clearly, not everybody is convinced that the latest economic numbers will merit another rate hike so soon, much less another two back-to-back moves by the BoC.

On this note, the central bank has recently expressed concern over low inflation and a desire to observe the economic impact of its earlier policy changes.

“Even though the unemployment rate has reached the lowest level seen since the 1970’s, at 5.7%, to some extent the labour market is likely to have benefitted from the Christmas business, something that is likely to be corrected in January and affected further by the blizzard on the East coast,” says Antje Praefcke, an analyst at Commerzbank.

Praefcke also flags that the decline of the unemployment rate, which is down more than 100 basis points from the 6.9% recorded in December 2016, has not led to higher wage growth in Canada and so there are questions to be asked about whether the recent uptick in inflation can be sustained. It needs to be sustainable to merit another move from the BoC.

“Yes, the BoC will further hike its key rate this year. And yes, it may adjust some of its projections in the new monetary policy report in January, but it will look through December’s labour market report and will want to wait for the future development of inflation. In my view January is too early for a rate hike and as a result the current CAD strength is excessive,” Praefcke writes, in a note Tuesday.

Advertisement:

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.