Here's Why The Pound Vs Canadian Dollar Rate May Struggle To Make Further Headway

- Written by: James Skinner

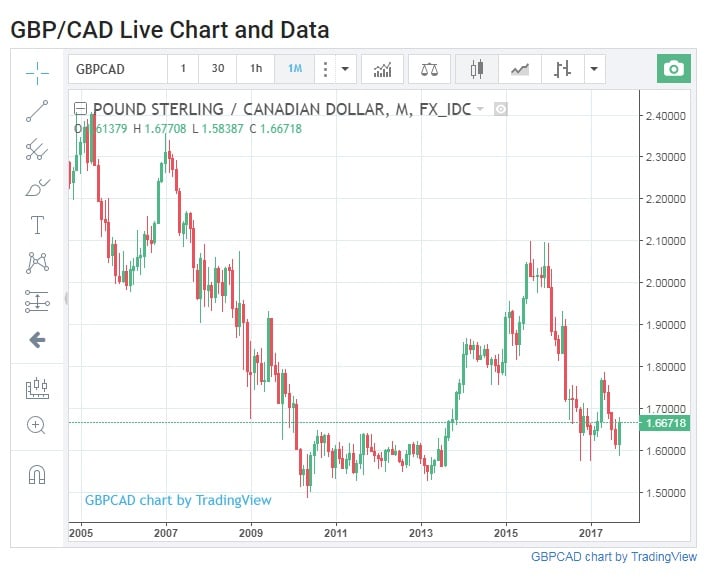

Strategists see GBP/CAD stumbling over the coming months while forecasts for year-end suggest the Pound could finish up as low as 1.6200, or as high as 1.7000.

The Pound may struggle to make further headway against the Canadian Dollar toward year-end, according to strategists, and could also experience downward pressure during much of the 2018 year if some of the latest forecasts are to be believed.

Two of Canada’s largest financial firms have made their predictions against a backdrop of a strengthening Pound-to-Canadian-Dollar-Rate.

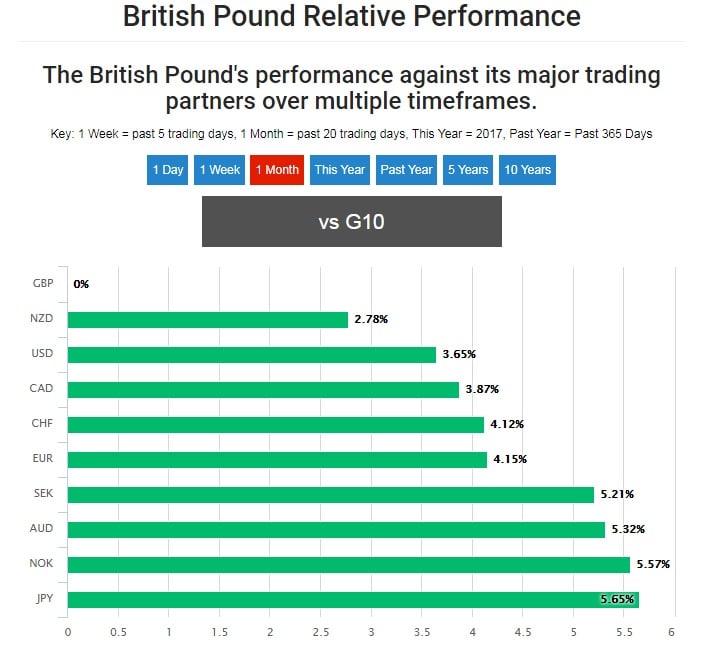

“Tighter monetary policy now looks like a given in the UK, but that might not lead to further currency strength,” says the fx strategy team at CIBC Capital Markets.

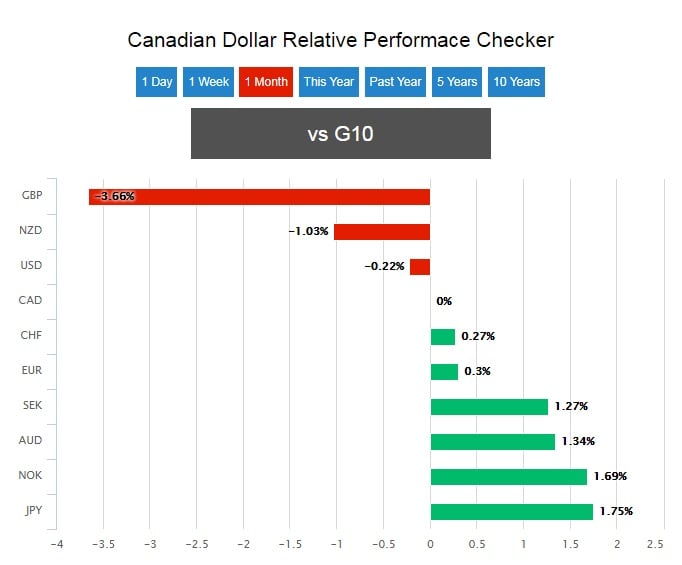

Sterling gained some 650 points on the Canadian Dollar during September, rising to trade around the 1.6750 level toward the end of the month, as a result of evolving expectations around Bank of England policy and modest signs of progress in Brexit negotiations between the UK and the EU.

Expectations Gone Too Far, Bank of England to Pause?

CIBC flags that the Bank of England could take a pause after hiking in November as concerns over the economy take precedence over concerns around near term inflation.

“While headline inflation will look hotter in the months ahead, we see that as only the temporary result of currency swings,” CIBC wrote in its latest FX Outlook. “Indeed, services inflation, a better guide to domestic-born price pressures, hasn’t seen the same reaction.”

The BoE took markets by surprise when it said in its September interest rate statement that the bank could soon begin to withdraw some of its stimulus for the economy. September’s comments came in response to inflation having risen to threaten the 3% level.

This is most likely to mean a reversal of the interest rate cut that was announced in August 2016 although markets have recently begun to price two rate increases from the bank over the next six months, with the second implied in February 2018.

“While it now appears that the data would have to turn decidedly softer ahead of the November 2nd decision for the Bank to hold off raising rates at that meeting, we think central bankers will be more cautious than markets currently expect regarding subsequent decisions,” CIBC says.

The strategy team at CIBC forecast the Pound will rise close to 350 points, to around 1.7000, against the Canadian Dollar before year-end and that the pair could trade as high as 1.7300 before the end of the first quarter 2018.

But these are dependent on the economy holding firm, the BoE pushing ahead and calamity being averted in the ongoing Brexit negotiations between the UK and the EU.

A Shot Across The Bow?

At a conference celebrating two decades of independence for the Bank of England Thursday, governor Mark Carney told an audience monetary policy cannot prevent weaker real income growth resulting from Brexit, but the bank can influence how the hit to income is distributed between job losses and inflation.

Neither comment is new but governor Carney’s choice to make those his sole remarks on current monetary policy probably underlines that any rate hikes will be “limited and gradual”, and could also be interpreted as a veiled warning to markets over current expectations.

Not Everybody Is Quite As Optimistic

“While we question the sustainability of sterling's recent gains, we are willing to go with momentum for now,” say Jacqui Douglas and James Rossiter at TD Securities.

But Douglas and Rossiter also warn that UK economic growth has slowed and inflation has probably peaked, while concerns over Britain’s exit from the European Union will persist in the background for some time to come.

“Long GBP positions are a trade, not an investment a s the market's conversation may turn to a BoE policy mistake,” they add.

TD Securities forecasts the Pound will fall by around 450 points to 1.6200 against the Canadian Dollar by year end while further losses may also be in store for the British currency in the first quarter of 2018.

The strategists project the Pound-to-Loonie rate will fall to a near five-year low, in the 1.5600 region, by the end of March 2018.

The Other Side of The Equation

The Canadian Dollar enjoyed a strong run throughout the summer months but has faltered in the latter half of September as policymakers began muttering about currency strength and a need to be vigilant about the effect of two recent rate hikes on the economy.

Canada’s benchmark interest rate now sits at 1% after the Bank of Canada raised rates in June and then followed through with a surprise hike in September.

“Deputy Governor Lane's comment that officials are "paying close attention" to the economic impact of higher short-term rates and a stronger CAD supports our view of a pause in the BoC's hiking cycle for the remainder of this year,” says Viraj Patel, a foreign exchange strategist at ING Group.

Wednesday saw BoC governor Stephen Poloz echo the recent sentiments of his deputy, Timothy Lane, when he used a speech on monetary policy and data dependence to warn that he and other policy makers are still watching the Loonie closely.

“The brilliance of first-half GDP growth not only brought on a well justified tightening, but it’s blinded investors to factors that are likely to materially delay a further round of rate hikes,” says Avery Shenfeld, chief economist at CIBC.

Shenfeld forecasts the BoC will now pause in its hike toward higher rates, which could be a source of downside for the Dollar, while one economist has forecast that the BoC may even reverse course next year.

“After a strong growth performance so far this year, Canada's economy looks on the verge of a downturn as the housing boom turns to bust,” wrote Paul Ashworth, chief North American economist at Capital Economics, in a September note. “We expect GDP growth to slow sharply next year, prompting the Bank of Canada to reverse its tightening cycle.”