Canadian Dollar Outlook: Next Targets vs Pound and Dollar

The rally in the Canadian Dollar is gathering apace after the Bank of Canada (BOC) surprised markets by increasing interest rates by 0.25% at its rate meeting on Wednesday.

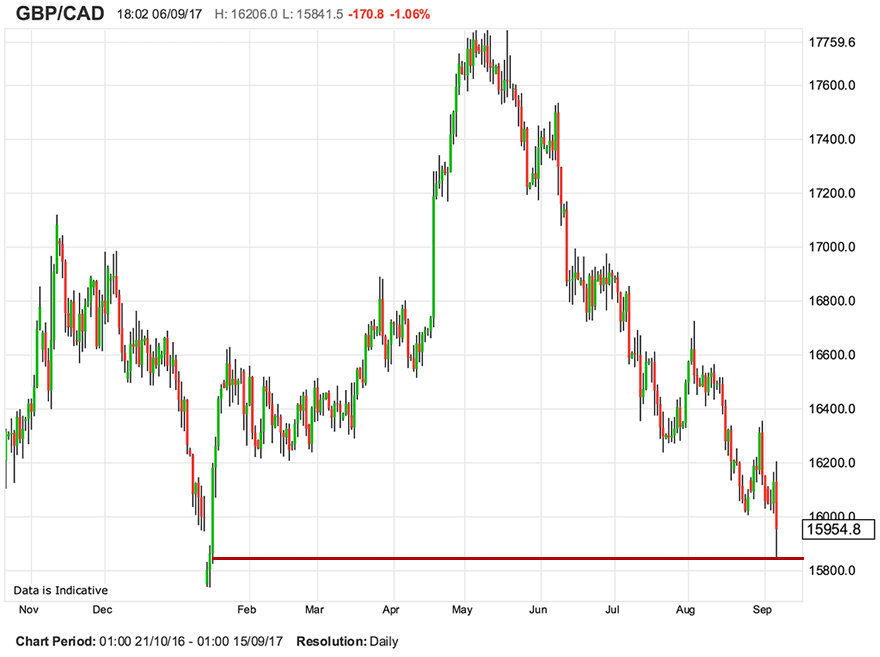

The move triggered a nine-month high in the Pound-to-Canadian Dollar exchange rate.

Over subsequent hours, a strong follow-through for the Canadian Dollar has consolidated the trend triggered by the BOC rate move.

Scotiabank's FX Strategist, Sean Osbourne, notes how the downtrend in the USD/CAD is "picking up speed" after a modest consolidation overnight, which merely presented sellers with an opportunity to re-enter at improved levels.

Technical momentum indicators are bearishly aligned:

"Intraday, daily, weekly and monthly oscillators all supportive of additional declines in the USD. "

Osborne's remarks concerning the USD reveal an exceptional lack of confidence in the currency's upside potential.

"The situation implies only limited, in terms of scale and duration, scope for counter trend USD corrections from here," says Osborne.

He adds that he seems long-term support at 1.2050 (50% retracement of the 0.94/1.17 rally between 2011/2017) and 1.1915 (low from May 2015) as, "quite reachable in relatively quick order."

And adds, "Longer-term chart signals are deteriorating. Minor USD gains remain a sell."

Osborne is equally bearish GBP/CAD, saying, "the absence of any real bounce in the GBP keeps the short-term outlook negative."

Above: Sterling falls to nine-month lows against the Canadian Dollar in the wake of the Bank of Canada decision.

There is the possibility the pair could be forming a very bearish chart pattern, called a bear flag, which would probably signal more downside once it breaks lower.

Despite a lack of volatility in either direction and price-action characterised by an aimless random walk, the outlook is still overall biased towards more downside than upside.

"The broader pattern of trade is weak and even with the daily chart suggesting a stall, we still rather think the upside risk in the GBP is quite limited at this point. The cross remains in a well-defined downtrend, the GBP has cracked support at 1.60 and trend signals suggest the underlying move lower remains intense," concludes Osborne, who now targets a level in the 1.50s.

"We continue to feel that the loss of support at 1.60 means the GBP risks sliding back to the early 2017 low at 1.5720/25. We remain bearish and favour selling into modest GBP gains," he said.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

BOC Unconcerned About CAD's Rise

If the Bank of Canada's (BOC) lack of concern at the runaway appreciation of its currency seems strange, it is probably because it is confined to one counterpart: the US Dollar, according to analysis from CIBC's Bipan Rai.

The Canadian Dollar (Loonie) has risen by over 10% against the US Dollar this year - more if you count it's fall from peak to trough since it stood at 1.3795 in May before falling to yesterday's post-BOC low of 1.2153.

Normally this would cause concern because an overly strong currency can hurt exports.

But although the BOC increased interest rates by 0.25% to 1.00%, at its last meeting, in a move which was only ever going to strengthen the CAD (weaken USD/CAD), Rai notes the absence of any moderating language in the BOC's statement, which might have been expected to try to curb excessive valuations.

"For one, the Bank didn’t push back against the appreciation in the CAD. In fact, the Bank implied that the strength was merited given the strength in the Canadian economy. That doesn’t mean that the Bank will be comfortable with another 10%+ appreciation in the loonie going forward, but it does suggest that it isn’t quite as obsessed with the bilateral USD/CAD rate as many believe," said the analyst.

Interestingly, Rai notes how, although the Trade Weighted Index of the Loonie, which is the currency versus a basket of its most traded peers, has risen by over 5.0% in the last year, gains are unevenly split.

"Our gauge of the broad CAD effective exchange rate now shows that the CAD is stronger by 5% on trade-weighted basis versus 10% versus the USD alone. Versus other competitor currencies, the CAD is only up 1.1%. In the Bank’s eyes, the strength in the CAD is overestimated by simply looking at the USD/CAD rate," said Rai.

It is this uneven spread which is probably responsible for the lack of "jawboning down" of the currency.

The trend of unidirectional appreciation versus the Dollar is unlikely to cede.

Comparative yields suggest investors see the gap between US interest rates and Canadian rates closing, and Canada catching up.

Money flows to the highest interest bearing jurisdictions, all other things being equal, so the flow is likely to continue north over the Rocky's.

"Front-end US/Canada spreads are now firmly back into positive territory and the market has moved to price in increased odds of another rate hike before the end of the year. The pressure on USD/CAD will be towards CAD strength for now as incoming data continues to be positive," said Rai.

Outlook for GBP/CAD and USD/CAD

But more importantly where does this leave forecasts for the actual USD/CAD rate, and GBP/CAD?

The main feature on the long-term chart of USD/CAD is its recent break below a major multi-year trendline, which strongly suggests a continuation of the bear trend lower.

Rai sees support for the down-trending USD/CAD kicking in at 1.2130, followed by 1.2000 and finally 1.1945.

But overall he sees the psychologically important 1.2000 level as the main level to target.

Our own charts are slightly more bearish with evidence the pair could fall to as low as 1.1650 eventually if a large ABCD pattern plays out according to text-book proportions.

ABCD's are large three wave patterns, rather like measured moves, which tend to obey mysterious laws of symmetry and equality, especially in relation to the length of waves A-B and C-D which are normally equal or near equal in length.

The ABCD pattern on USD/CAD can most easily be seen on the weekly chart, and if we extrapolate the C-D leg lower the same length as A-B it ends at 1.1650.

In the interim, however, we note another key support level which could stall downside, at the 1.1950 May 2015 lows.

Pound to Canadian Dollar

GBP/CAD fell precipitously following the BOC meeting like USD/CAD, but it has now reached a major trendline which is likely to offer considerable support to the exchange rate and make it harder for bears to push it lower.

The trendline is drawn from the October 2016 lows.

The trend remains down so we would expect the exchange rate to test the trendline in the mid 1.58s.

A clean break below 1.5800, however, would provide stronger bearish confirmation that the exchange rate was going to go lower, with an initial rather conservative target at 1.5700.