Canadian Dollar Hits Nine Month High Against the Pound on Bank of Canada Rate Rise, More Strength to Come

The Canadian Dollar shot higher on Wednesday after the Bank of Canada (BOC) decided to increase interest rates from 0.75% to 1.00%.

The move suprised markets which had on balance expected the BOC to stay on hold.

The Canadian Dollar surged against the Pound and US counterparts after the news.

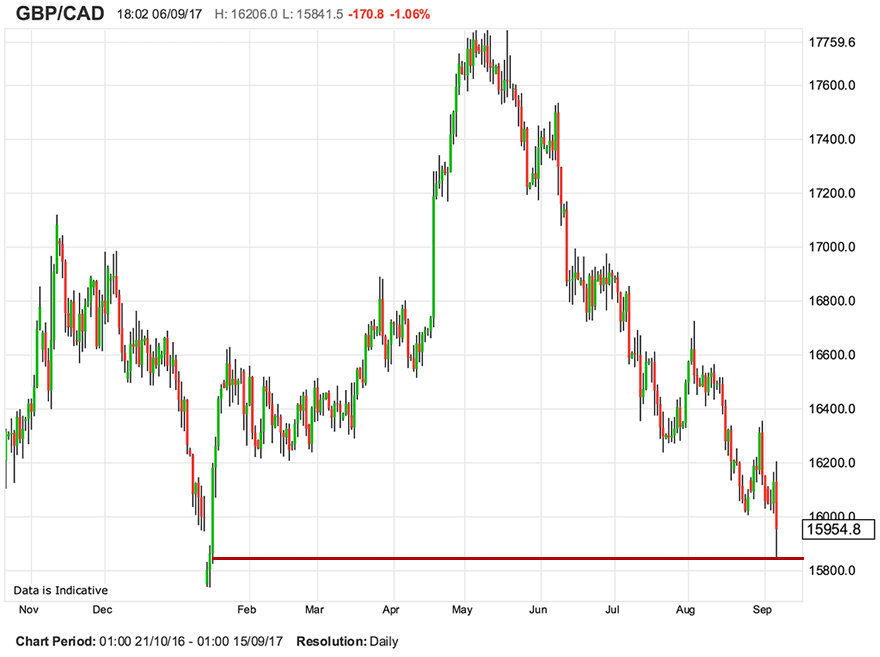

GBP/CAD dropped like a stone from a pre-meeting level in the 1.62s to a new nine month low of 1.5831 - a fall of over 1.15%.

Above: The Pound has fallen to its lowest level in nine months against the Canadian Dollar.

USD/CAD fell from pre-meeting 1.23s to a new low of 1.2153.

Although slightly off their lows these rates had not recouped much of their losses at the time of writing.

The strong growth shown in recent second quarter economic data was a major factor in the BOC's decision.

"Given the stronger-than-expected economic performance, Governing Council judges that today’s removal of some of the considerable monetary policy stimulus in place is warranted," said the BOC's policy statement.

However, they steered clear of signalling further hikes in the future, saying it would be dependent on incoming data.

"Future monetary policy decisions are not predetermined and will be guided by incoming economic data and financial market developments as they inform the outlook for inflation," added the statement.

Nevertheless, according to CIBC's Andrew Grantham, the forward guidance was not unequivocally data-dependent either, as the Bank did not hint that interest rates were yet at the 'right' level, and suggested even that they might still be 'stimulative'.

The statement said that removal of "some" of the "considerable" stimulus was warranted, which suggests that at these levels the Bank still views policy as very stimulative.

"The statement didn't go so far as to say the current level of stimulus is now appropriate, which has been a phrase used in the past. As such markets may now start pricing in further moves, meaning today's decision will be positive for the C$ and negative for fixed income," says Grantham.

Labour market conditions were highlighted as proividing a bellweather of economic health and determining the BOC's future decisions.

"Particular focus will be given to the evolution of the economy’s potential, and to labour market conditions. Furthermore, given elevated household indebtedness, close attention will be paid to the sensitivity of the economy to higher interest rates," said the BOC statement.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Bank Unconcerned by CAD's Strength

From a purely currency-orientated perspective, the Bank didn’t push back against the appreciation in the CAD.

In fact, the Bank implied that the strength was merited given the strength in the Canadian economy.

"That doesn’t mean that the Bank will be comfortable with another 10%+ appreciation in the loonie going forward, but it does suggest that it isn’t quite as obsessed with the bilateral USD/CAD rate as many believe," says Bipan Rai, an analyst with CIBC Capital Markets.

Rai is bullish on the Canadian Dollar's outlook and expects further gains.

In fact, CIBC have lowered their three-month target for the USD/CAD to 1.20 in anticipation of further Canadian Dollar Strength.

This will surely be felt in the GBP/CAD which will likely press fresh multi-year lows.

Hike Comes as Surprise

The Canadian Dollars rise can partly be attributed to the rate hike coming as such a surprise to markets.

A survey of economists had only 6 of 27 participants expecting a 25bp rate hike to 1.00% at this meeting.

According to Bloomberg’s WIRP function, the OIS curve had a little less than 11bps of rate hikes priced in.

"We argue that number may overstate the implied odds of a rate hike slightly, but we do think it is safe to say that a hike is 25-45% expected/priced by the money market," says Greg Anderson with the BMO Capital Markets in Montreal who has coined the decision as representing a "knife's edge moment" for the Canadian currency.

"After a stunning 2Q GDP print of 4.5% QoQ annualised, market chatter of a second successive Bank of Canada rate hike at this week's meeting has grown. The CAD OIS curve is now pricing in a 55% chance of this happening," said ING.

BMO Capital's economics team did not expect the BoC to hike at this meeting, predicting a hike to take place at the 25-October meeting instead, which will also have an accompanying MPR update and press conference.

The key projection of BMO's Canadian Rates & Macro Strategist Ben Reitzes was to “look for the tone of the statement to solidify an October hike while dampening expectations that the BoC will continue to push rates higher on a consistent basis”.

Risk of Disappointment for the Canadian Dollar Averted

"Speculative markets remain significantly long CAD going into the BoC meeting on Wednesday and with investors 50:50 over a rate hike this week," said ING's Viraj Patel in a note on the pair on the eve of the meeting.

Patel also thoguht it was more likely the BOC would keep rates unchanged:

"We think an on-hold Poloz could be the catalyst for some of the recent bullish CAD sentiment to unwind," said Patel, who thought that overall the bank would probably, " show its more cautious hand this week."

Outlook for Canadian Dollar vs the Pound and Dollar

Before the meeting the technical outlook was the only sign the BOC might suprise markets with a hike.

"Hawkish comments could see the Canadian dollar surge further higher," said Forex.com's Fawad Razaqzada in a tech-fund briefing.

The analyst was bearish USD/CAD, with next objectives at 1.2315 and 1.2192 "followed by the psychologically-important 1.2000 handle."

"With the USD/CAD breaking below key support at 1.2460 – which was also the 2016 low – the path of least resistance is clearly to the downside now," said Razaqzada.

"We will hold a bearish view on this pair unless price climbs above 1.2500 area, and the bearish idea would become completely invalid upon a rally above the last swing high at 1.2660," he continued.

The Pound to Canadian Dollar exchange rate (GBP/CAD) was also exhibiting a bearish bias before the meeting, although downside was expected to be curbed by the major trendline drawn from the October 2016 lows at 1.5900.

We at PSL were not convinced by the recovery at the start of this week, which lacked 'punch', and saw a break lower as more likely.

A move below the 1.6012 lows would be expecte to reach the 1.5900 target.

Clearly, the BOC meeting at 15.00 BST on Wednesday was expected to be the catalyst for such a move.