Canadian Dollar Charges Higher on Positive GDP Report

The Canadian Dollar vaulted higher on Thursday after the release of second quarter GDP data confirmed the economy's strong upward trajectory.

The Canadian economy grew by 4.5% in Q2 on a quarter-on-quarter annualized basis (that is compared to Q2 2016), outstripping the 3.7% expected level, and the same 3.7% level recorded in Q1.

Analysts who had expected monthly growth to fall to only 0.1% in June from 0.6% in May, were also surprised to see the official statistics record a higher 0.3% result.

The Canadian Dollar strengthened considerably following the release, gapping up against the Pound such that the GBP/CAD pair fell from 1.6260 to 1.6180 in a matter of minutes.

Against the US Dollar, the Loonie also strengthened substantially, falling from pre-release levels of 1.2650 to 1.2586.

The better-than-expected results were, to a certain extent, foreshadowed by strong growth data published by the National Bank of Canada (NBC's).

NBC recently produced a detailed report on province by province growth rates, which reported robust momentum in GDP in June of 0.5%.

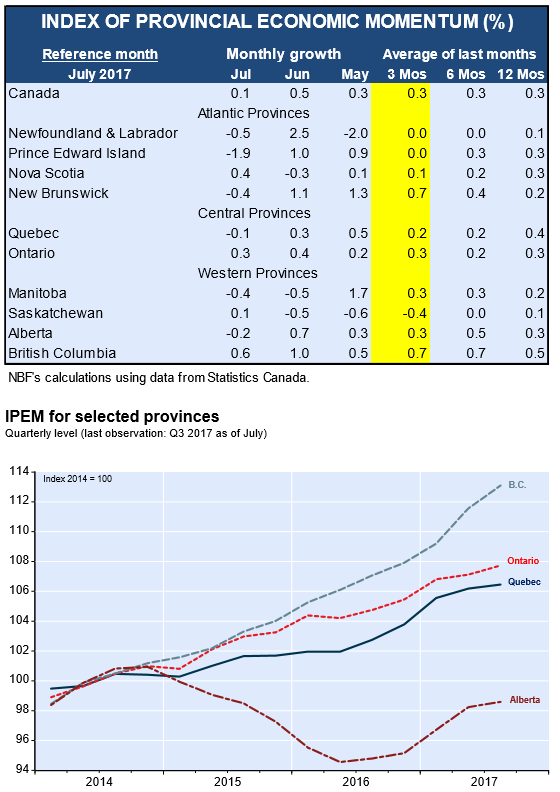

"For Canada as a whole, our proprietary Index of Provincial Economic Momentum (IPEM) increased 0.1% in July, on the heels of two strong increases in May and June," said NBC.

They also saw growth overall in 2017 as holding up robustly.

"IPEM suggests that the Canadian economy was shedding momentum early in Q3. This is consistent with our view that Canadian real GDP will decelerate to an annualized gain of about 2%, after above-3% gains in both Q1 and Q2. That being said, the economic momentum gained over the last three months overall in Canada remains strong," said NBC.

Not everyone expected a strong result.

BK Asset Management's Kathy Lien, for example, foresaw the possibility of a weak Q2 GDP print.

ING Bank's Chris Turner, however, thought the opposite, citing the Canadian economy's "broad-based" growth as a reason to expect a robust Q2 result.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.