Pound Forecast to Extend Decline Against Canadian Dollar but Near-Term Correction Higher Possible

The Pound to Canadian Dollar exchange rate (GBP/CAD) is in a strong short-term downtrend thanks largely to a change in the Bank of Canada’s policy stance which saw them increase interest rates at their policy meeting earlier this month.

Higher interest rates attract more capital inflows as they offer outside investors higher rates of return while at the same time the Bank of England keeps settings unchanged. This divergence in policy can be a powerful driver in global foreign exchange markets.

Pound Sterling is forecast to continue falling against the Canadian Dollar as our studies suggest there are no technical signs to suggest the trend is turning.

The pair has formed a descending channel during its recent decline.

The current market level is touching the lower border of this channel indicating the pair may be oversold and that there is a risk of a correction occurring.

Eventually, however, the downtrend is expected to continue, with confirmation coming from a break below 1.6232, and downside target at 1.6100.

MACD, which measures momentum, is falling in line with the exchange rate, reinforcing the bearish bias.

Get up to 5% more foreign exchange by using a specialist provider. Get closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Data for the Canadian Dollar

The main data release for the Canadian Dollar (loonie) in the week ahead is GDP out on Friday, July 28 at 13.30 BST.

Only the monthly rate is scheduled for release and expected to show a 0.2% rise – the same as previously,

Data for the Pound

GDP is expected to continue trundle along at sub-par levels around the 1.5-2.0% mark which we have grown accustomed to in 2017.

The first set of estimates for growth in the second quarter are released on Wednesday July 26 at 9.30 BST, and are likely to be the most significant release for the Pound in the week ahead.

They are currently expected to show a slightly slower 1.7% rise in GDP in Q2 compared to a 2.0% rise at the same time last year (in Q2 in 2016).

Such a result will pull growth down to the lower boundary of the current GDP growth rate range.

Quarter-on-quarter, growth in Q2 is likely to be 0.3% higher than it was in Q1, when it was only 0.2%.

The other release of note is Mortgage Approvals in June, from the British Banking Association (BBA).

These are also out at 9.30 on Wednesday July 23.

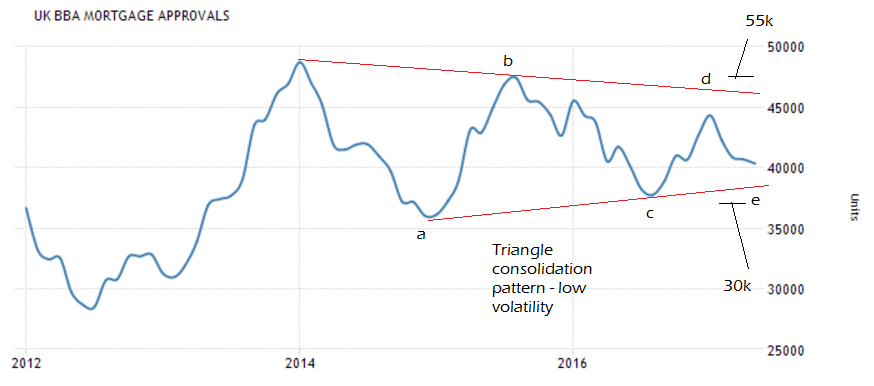

Mortgage Approvals have been oscillating in a subdued range for years since the great recession as illustrated in the graph below:

They have, however, formed an interesting triangle pattern over the last few years which provides clues of what might happen next.

Triangles almost always a precursor of periods of high volatility, and although we can’t tell which way the volatility will extend, it is highly probable there will be either a large swift spike higher or lower in the data.

The triangle has probably almost finished as it has formed 5 component waves - a,b,c,d,e - which is the minimum number to prove completion.

For confirmation, we would be looking for a move above 47,500 in an upside break; or below 37,000 in a downside break.

Using the height of the triangle at its widest as a guide we forecast a post-break volatile spike of about 8,000 -12,000 approvals higher or lower, so assuming the previously mentioned levels are breached, the upside target is 55k level and the downside 30k.

Given housing is such a key leading indicator for the economy this may be a key early warning for the general health of the economy going forward and thus the Pound.

A spike lower in approvals would probably drag down Sterling and vice versa for a spike higher.