The GBP/CAD Bearishly Consolidating into Weekend

The Pound to Canadian Dollar has declined steeply from highs of 1.78 in May to the current level in the 1.68s – a move down of 10 whole cents.

Now the pair appears to have temporarily bottomed and is consolidating, although more downside looks the next most natural development.

The steepness of the fall was due to a combination of UK political uncertainty following the inconclusive election result and positive commentary about the Canadian economy from one of its leading Central Bank officials.

The last part of the move down to 1.6800 is in line with Pound Sterling Live forecasts released last Sunday 11, which targeted the 1.6830 support level.

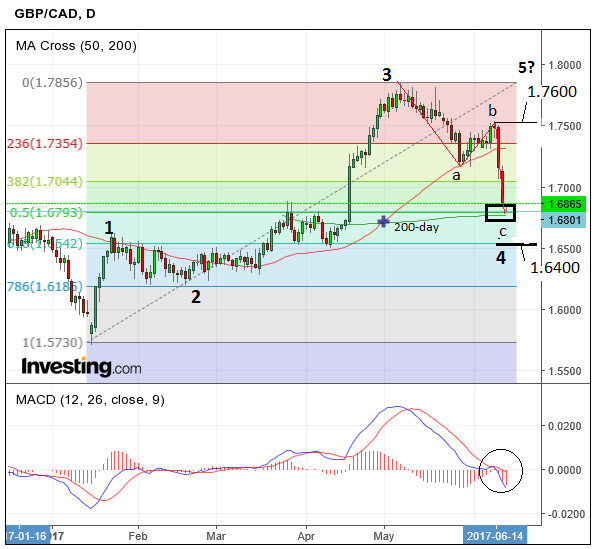

The chart below shows a clear, three-wave, a-b-c correction from the 1.78 May highs, which stretched 10 cents lower.

Only a few basis points below the 1.68 lows is the formidable 200-day MA which is likely to provide a difficult obstacle for bears to overcome.

Also at the lows, is the midpoint of the previous rally, also known as the 50% Fibonacci level, which is also likely to prove an obstacle to further downside as it will attract buyers.

Only a clear move below these levels would be necessary to signify a break below 1.6500, in order to confirm a continuation of the trend lower

Such a move would probably reach a target at 1.6400.

The move, though steep, down from the May highs is still only, technically, a correction, which means it could easily resume its ascent and return to the 1.78 peak again.

The pair has already stalled, forming a small hammer on Tuesday, but this not sufficient to suggest a resumption of the broader uptrend.

Here too a moving average stands in the way of further gains, except in this case the 50-day MA.

Ideally, we would want to see a clear break above the 50-day for confirmation of more upside.

Such a move would have to break above the interim peak of wave-b at 1.7500 for confirmation, with a target then at 1.7600.

Data for the Canadian Dollar

In the week ahead there is little of major importance on the data front, although on Thursday June 15 we get manufacturing sales at 13.30 BST, which are expected to show a 0.8% rise in April.

Foreign securities purchases, meanwhile, are out on Friday at 13.30 and are an important component of the current account which last month stood at 15.13bn.

Data for the Pound

The most significant release will be the minutes of the Bank of England (BOE) Rate meeting published just after the announcement has been made on Thursday at 12.00 BST.

These are likely to show a 7-1 voting split with Kirsten being the only dissenter again (it will be her last meeting).

Inflation rose more steeply than forecast in May, but this is unlikely to feed through into more hawkish rhetoric as, ““entirely” driven by the weaker currency. Demand indicators remain mixed, so there’s little evidence that this assessment will change,” according to analysts at TD Securities.

A more hawkish stance would propel the Pound higher, of course, but this unlikely to happen, especially given the lacklustre earnings data out this morning.

This showed that despite the unemployment sticking at a relatively low 4.6% UK average wages had slowed down more than expected in April to 1.7%, from 1.8% in the previous month. This was well below the 2.0% expected.