Canadian Dollar Outlook Hinges on Trump’s Border Tax: Points to Consider for Investors

A major contributing factor to the outlook for the Canadian Dollar is the realisation of Donald Trump’s plans for Border Adjusted Tax policy or BAT for short.

Briefly, the BAT is a charge which will be levied on imports and simultaneously a tax rebate paid to exporters; current estimates have the BAT being set at 20%.

If the BAT is imposed on Canadian imports it will reduce demand for them and lead to a depreciation in the Canadian Dollar.

As such, BAT is earmarked as a potential major risk event for the currency by Deutsche Bank’s Macro Strategist Sebastien Galy in a note to clients seen by Pound Sterling Live.

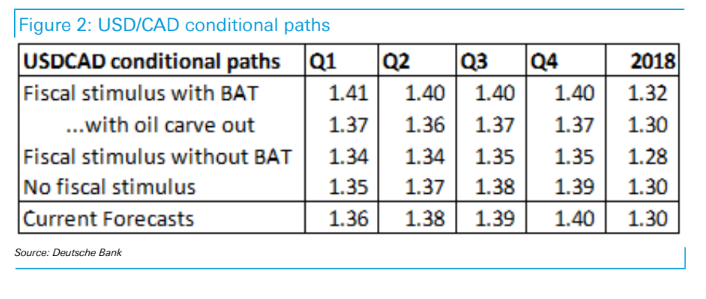

Galy's studies incorporates BAT and other major risk factors such as the price of oil, the impact of BAT on oil exports, US growth and produces a table of potential outcomes for USD/CAD.

Galy adjusts his forecasts for the pair based on several permutations of how Trump’s policy agenda evolves.

Fiscal Stimulus

One major risk factor is Trump’s promise to launch a comprehensive Fiscal stimulus programme, which has so far taken the form of what is called the Better Way Bill.

The Better Way Bill includes corporate tax reforms and a fiscal pending agenda through investment in infrastructure.

From the point of view of the Canadian Dollar, Better Way will probably be a strengthening factor as it will lead to an increase in US growth and Canada historically always does well when the US is booming.

Therefore one variable in the outlook for the Loonie is whether or not Better Way is prioritised.

The Border Tax

The Border Tax, as mentioned is a major factor impacting on the Canadian Dollar.

High import tariffs will be negative for Canadian exporters who rely on the US as a market for most of the trade.

There have been hints from the White House, however, that the Border Tax may include some ‘exemptions’ covering for example, Canadian Oil.

Such an exemption would lessen downside for CAD as Oil is Canada’s biggest export to the US, thus if it were exempt from BAT it would limit the damage to the Canadian economy substantially.

State of Union Address Key

It is expected that Trump will use his State of the Union Address on February 28 to law out his policy agenda.

One of the most pressing priorities is likely to be the repeal of the Affordable Care Act (Obamacare), however, there is much speculation as to what else he includes and how much emphasis he places on the panoply of other policies he has promised.

The speech is expected to be a key determinant of where the political energy will be directed in the first half of his presidency, therefore, analysts will be noting what he says closely.

The speech will likely to impact on CAD if any of the major valuation factors mentioned above are mentioned, highlighted or excluded.

Stimulus and BAT

BAT is likely to be incorporated into the Better Way Bill, which is a general fiscal stimulus programme, with BAT as one of the methods to help fund the programme.

Indeed, Galy mentions how Better Way will struggle to find support without a source of funding through comprehensive tax reforms, with BAT supplying the bulk through taxation of imports.

The Impact of Oil Prices on Forecasts

Beyond Trump’s policy agenda, the other main factor influencing USD/CAD is the price of Crude.

“USDCAD has a high sensitivity to oil prices. The market expects a continued slow positive drift in oil prices. A supply shock such as an Iranian crisis would lead oil to gap higher and then dampen demand. A more likely demand shock from the border adjusted tax would hit the CAD and heavy oil positioning particularly hard. However, in the case of an oil carve out the impact would be far less,” says Galy in an analysis of the implications of Oil on the Loonie.

If BAT were introduced with no carve out for Oil, it would cause a major shock to Oil prices which would fall rapidly due to a sudden fall in US demand – this would be especially true of Canada which exports most of its Oil solely to the US.

The introduction of BAT, however, would likely have two stages – one increased demand before its implementation as customers attempt to stock up prior to the BAT, and then a cliff edge fall following implementation.