Outlook for Canadian Dollar Gloomy in 2017: Morgan Stanley

Analysts at Morgan Stanley have confirmed they expect the Canadian Dollar to struggle over the course of 2017 because markets are not adequately pricing in risks associated with the country's trading position with the USA and the outlook for the economy.

Investors are labouring under misconceptions in their view of the currency argue Morgan Stanley.

These include the false hope that Canada will rise on the coattails of US growth, that Trump will go easy on Canada when it comes to the imposition of trade tariffs and the “too hawkish a path” taken by commercial interest rates following the recent Bank of Canada meeting.

Furthermore, the currency has lost its long-standing attachment to the oil price which is disappointing for CAD bulls in a year in which oil could continue to rise in value.

Canadian Interest Rates Still Too High

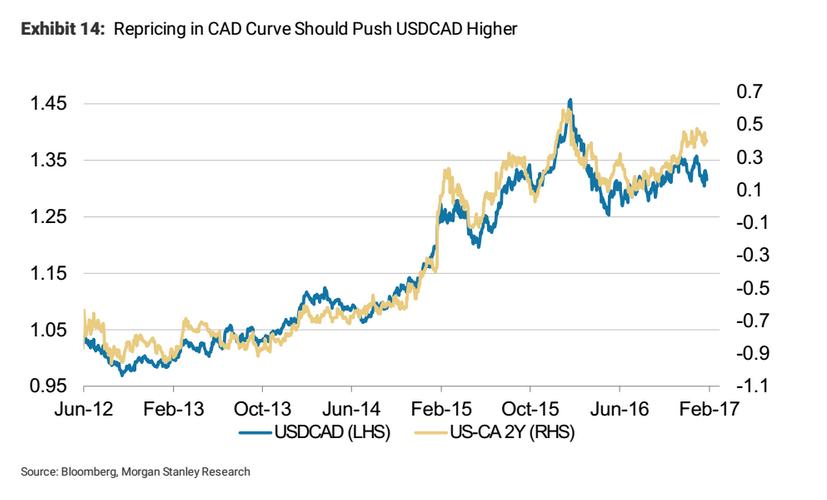

The rates market has not repriced adequately following the Bank of Canada (BOC) meeting, argues Redeker.

“The CAD rates market has adjusted following last week's BoC meeting, but it is still pricing too hawkish a path given the BoC outlook and rhetoric,” says the Morgan Stanley strategist.

At the meeting, governor Poloz argued that “fundamentally not much has changed” since the last MPR update in October.

The Bank’s growth forecasts remain unchanged, it still expected the output gap to close by the end of 2018 and the considerable downside risks to the outlook were undiminished if greater.

Poloz dismissed the argument that Canada would benefit from US stimulus, saying it would have very little effect on the country.

Significantly he said that the BOC had not modelled the impact of US trade protectionism despite the fact that it was “particularly concerned” about it.

The potential for Canadian interest rate expectations to fall bring into question the sustainability of the loonie current strength.

The strength is outsized compared to the US Dollar from a purely interest rate differential perspective.

The pull-back down to 1.31 in USD/CAD came despite the rate differential of US over CAD 2-year rates showing the advantage remaining very much on the US’s side.

If the repricing of CAD rates back down which is expected by Morgan Stanley occurs then this will push up the US 2-year over CAD 2-year higher and widen yet further, the already wide divergence with the exchange rate.

Assuming the tendency for the two to correlate, however, suggests the USD/CAD will rise as the USD strengthens and CAD weakens.

At Risk From US Trade Protectionism

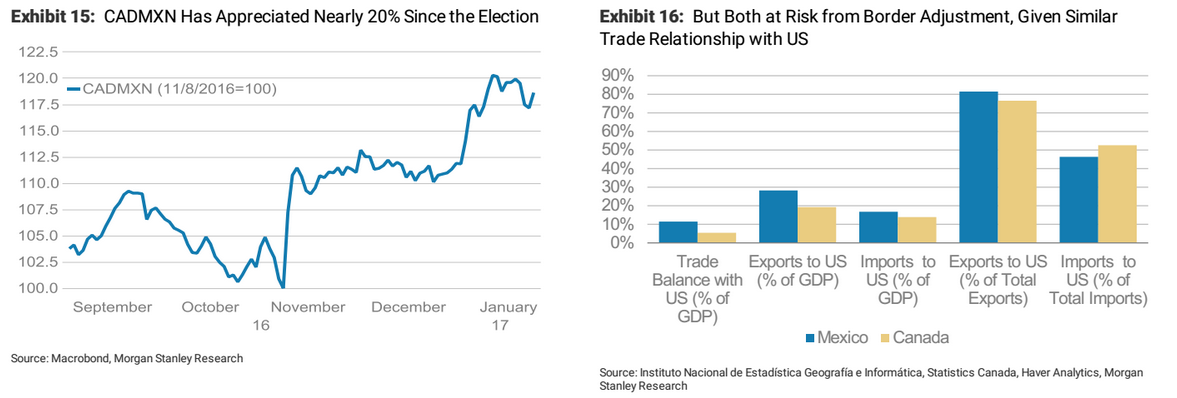

Donald Trump has tended to aim his trade rhetoric at enemies other than Canada – mostly Mexico and China – however, this does not diminish the potential threat to the Canadian economy of a NAFTA renegotiation.

“Canada is right to worry about unintentional consequences of NAFTA negotiation on its economy, particularly with its reliance on export growth to lead the non-oil sector,” remarks Redeker.

But this should not be the worst worry for Canada according to Morgan Stanley, rather the ‘Border Tax Adjustment’ should be of greater concern.

“Canada should worry also – and possibly more – about is border adjustment; given that the 20% proposed rate from House Republicans would impact all countries equally, Canada (as a major US trading partner) is likely to be heavily impacted,” says Redeker.

The 20% rise in the CAD/MXN exchange rate is an expression of the under-pricing of risk to the Canadian economy from a trade war.

“CAD/MXN shows how little the market is priced for such a scenario, up almost 20% since the election as the market has priced targeted protectionist measures against Mexico but not against Canada.

“People may forget that Canada is essentially as reliant on its trade relationship with the US as Mexico.

“Even though border adjustment isn't our base case, we still think CAD is not pricing in any probability of it happening,” said Redeker.

The Canadian Economy Has Not Been Following the US

The argument that the Canadian economy is likely to follow in the footsteps of the US economy if it grows, which analysts seem to think it will do, is a fallacy which is falsely elevating the value of the Canadian Dollar, according to Redeker and his team.

“We think trading CAD like a mini-USD doesn't make sense now because Canada's economy has not been improving in line with that of the US,” comments the Morgan Stanley strategist, who then goes on to give examples of why.

In the US the output gap has fallen as slack in the economy has been used up where as in Canada the output gap has widened.

Trade has not been bad as the balance has narrowed, however, this is more because of rising commodity prices than an increase in volume. Also, non-commodity exports have not gone up, to the disappointment of the authorities who like Australian are trying to re-orientate the economy away from a mainly resource-based economy, to a more diversified economy.

Most worrying and out of sync of all, however, is the Bank’s new measure of inflation called the CPI-Common, which has been falling in recent months and is now at levels last seen in the 1990s.

On the positive side, however, “Canada bulls can point to a number of solid data points; consumption growth has been improving, partly due to the impacts of the Canadian federal government stimulus package.

“Employment growth has remained strong, though mainly driven by part-time work.

“Lastly, the rebound in the 4Q Business Outlook Survey was an encouraging sign.

“However, as the BoC noted, the market took these data points as bullish for Canada really because it's been so used to the serial disappointment in the Canadian economy,” notes Redeker.

Crude Not as Influential

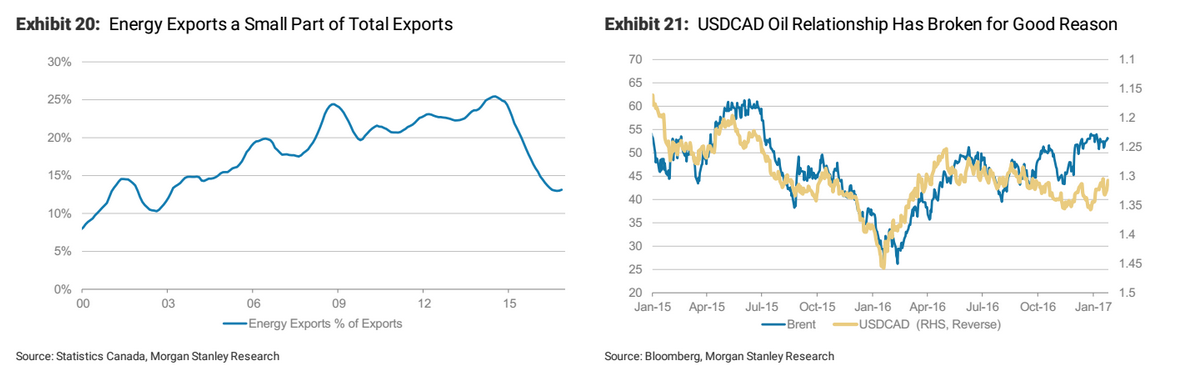

Another reason why analysts see the Loonie as overvalued is due to a major shift in the impact that Crude Oil prices have on the exchange rate.

Up until mid-2016 there was an extremely close correlation between the price of oil and CAD, especially USD/CAD.

The influence appears to have diminished since then, however, as the share of total exports contributed by oil has fallen.

“Above all, though, the energy economy just isn't that large anymore; energy exports have fallen to 13% of total exports and energy-GDP has a similar share of total GDP (~10%). We think the market has started to understand this dynamic, as evidenced by the loosening of the relationship between USDCAD and oil since mid-2016,” says Redeker.

Even the Keystone/Dakota pipeline news which elevated CAD last week, may have had a disproportionate effect to the benefit it is likely to impart, says the strategist, arguing, “The Keystone XL Pipeline is a long-term positive for Canadian oil production but marginally so and does nothing to impact the outlook in the near term,” suggesting those near-term gains for CAD may be given back.

Forecasts

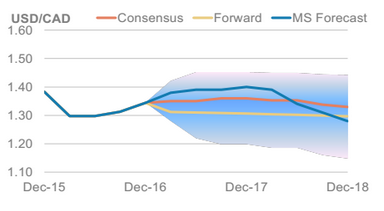

Their bearish outlook for CAD leads them to expect the USD/CAD exchange rate to rise steadily through 2017 to reach highs of 1.40 by the end of the year.

From there, the pair is likely to weaken to the 1.33s during the course of 2018.