Canadian Dollar's Outlook Positive as Investors Gorge Themselves on 'Maple' Bonds

A sudden surge in demand for Canadian financial assets, especially bonds, could be a positive factor in the currency’s continued resilience.

Negative bond yields are now so widespread that investors are actively hunting for yield in places they might not have considered before, such as Canada, according to a research note from NBF’s head of research Lovely Warren.

He suggests, “serial disappointments in global growth, deflationary concerns and, of late, heightened geopolitical uncertainty have seen global bond yields plumb new lows. Two-year sovereign bond yields today reside in negative territory from Germany to Japan, Italy to Ireland, Sweden to Spain.”

As a consequence, portfolio managers are searching further afield to get their fix of yield:

“Judging from recent flows, Canada is very much caught up in this hunt for yield. Year-to-date buying of Canadian portfolio assets is setting a record pace in 2016.”

They are particularly enamoured of Canadian bonds:

“Bond details show non-residents feasting on the sovereign, adding a net $9.8 billion of Canadas to their portfolios during the month—a big step up relative to the prior few months. Federal crowns were also a noted target, with non-residents active accumulators in both primary and secondary markets.”

Recent data released showing net flows for May 2016 shows a massive rise in purchases of Canadian assets, led by bonds:

“In Canada, international securities transactions data (for May) show foreign investors accumulating a veritable mountain of Canadian portfolio assets.

Non-residents snatched up a net $14.7 billion of Canadian securities in May, a fourth straight month of robust foreign buying.”

Foreign demand for Canadian assets far outstripped Canadian demand for foreign assets, leading to a surplus in ‘net portfolio capital inflow’ for the month, of $10bn.

This is above the pace required to finance Canada’s Current Account (CA).

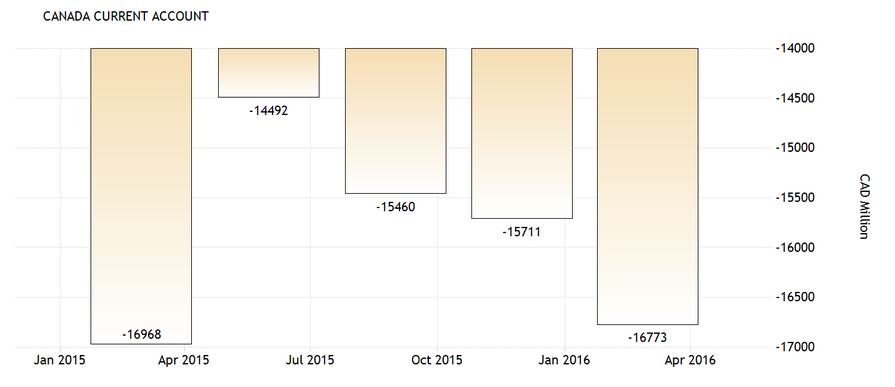

Given the CA deficit is currently -16.77bn for the first quarter, there is a possibility, that if the trend set in May, with its $10bn surplus in net portfolio capital income, were to continue month after month, then over a quarter, that would add up to 30bn surplus, which would more than cover the circa -16.77bn quarterly CA deficit set in Q1.

Such a CA surplus would be expected to provide support for the Canadian dollar going forward.

This data is for May, but if anything, the trend is likely to have strengthened in June and July following the UK referendum which sank international bonds even deeper into negative yield territory.

As Warren Lovely notes:

“As recent data for May confirmed, non-residents were aggressively adding to their positions in Canadian portfolio securities before ‘Brexit’ turmoil and the latest bout of yield compression.”

This could lead to a sudden lift in the CA numbers for Q2 and Q3.

Investor’s preference for ‘corporate’

Lovely says that foreign investors have a preference for corporate debt over muni, and that they liked sovereign too and equities but in smaller tranches.

The profile of buyers has changed markedly, for while most are still American May also saw an increase in non-OECD buyers.

One things which will not have been particularly supportive of the Canadian dollar is the large share - 50% of total foreign sales - issued in foreign currency markets, mainly dollar and euro markets.

“Meanwhile, international investors increased their holdings of Canadian private corporation bonds by $2.6 billion in May. Once again, that reflected corporate issuance in foreign currency markets—a now well-established theme. Indeed, during the past 12 months, foreign investors have added $32 billion of Canadian corporate bonds—accounting for fully half of total amount of Canadian bonds gobbled up over that timeframe—driven overwhelmingly by a diversion of bond supply into the US dollar and euro markets by Canadian financial and non-financial issuers.”

Nevertheless, despite the selling of bonds in foreign exchange the flows would eventually be expected to come back to Canada leading to increasing demand in the form of repatriated funds, although what share would be repatriated and when is unknown.

In conclusion the greater interest in CAD assets should help provide a supportive backdrop to the currency for as long as yields internationally remain low.

Pound to Canadian dollar forms perfect triangle chart pattern

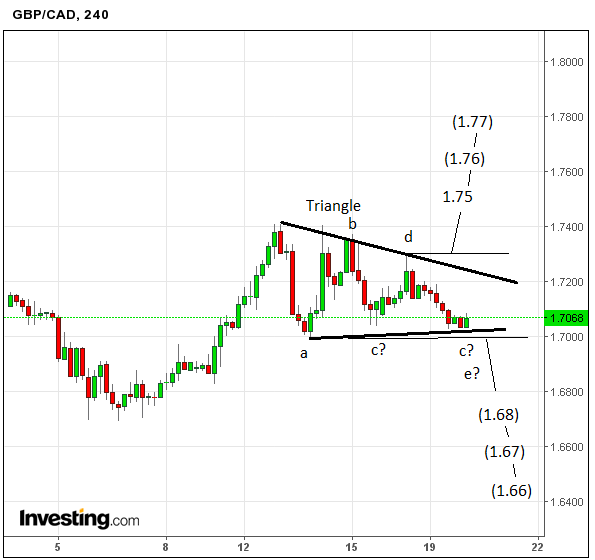

he pound to Canadian dollar exchange rate continues to move sideways in a range, visible on the four-hour chart below.

The range looks like a triangle pattern since the component waves are narrowing with each turn.

The triangle will probably breakout to the upside, with a move above the 1July 18 highs at 1.7300, would probably signal a move to a maximum target at 1.7700 - although 1.75 or 1.76 provide safer targets for the more risk averse; breakouts from triangles normally extend between 61.8% and 100% of the height of the tirnagle at its tallest.

It is not clear whether we are in component wave C or E of the triangle - either interpretation is possible.

Triangles have a minimum of five waves A,B,C,D and E, so there is a possibility that if E has just completed then the triangle is also complete.

Not all analysts are buillish, for example, Scotiabank's FX Strategist, Shaun Osborne is bearish the pair, citing the tough layer of resistance at 1.7300 as reason:

"Despite intermittent signs of strength last week, the GBP attracted steady selling interest above 1.73 and closed poorly on the week overall (“shooting star” signal). We remain bearish overall and continue to think that near - term risks favour 1.65 trading before 1.75." Says Osborne.

Indeed the triangle is a symetrical type which can break in eithe direction so a move below the July 13 lows at 1.6995 would confirm more downside to a minimum target at 1.68, then 1.67 and a maximum of 1.66.