Canadian Dollar Forecasts to Strengthen Against GBP and USD, Oil's Grip Loosen

The Canadian dollar has found strength of late - we consider what the outlook holds for the currency against the pound and US dollar.

The CAD's early-February rally came undone at the close of the previous week after data showed the Canadian unemployment rate edge up to 7.2% from 7.1% while overall employment fall by -5.7k in January.

The participation rate remained unchanged and the one bright spot was the 5.6 rise in full-time employed, versus the 11.6 fall in part-timers.

In the wake of the data CAD retreated against both the pound and US dollar. However, on Monday the Canadian unit is firmer against the pound - this despite another fall in oil prices.

Indeed, the price of oil is arguably still the main driver of the Canadian dollar and so much this week depends on how oil’s rebound develops.

While news coverage concerning the relationship between oil and the Canadian dollar is in abundant supply it is worth noting that the strong correlation could wane, so be wary.

“The Canadian dollar has been negatively affected by the tumble in crude oil prices in recent quarters. Though a commodity currency, Canada is not tightly linked to the Chinese economy, and should benefit from the continuation of the US economic recovery,” say Societe Generale in a special note on the commodity currency complex.

And, the prospect for higher oil prices is increasing according to Societe Generale:

“Both global and OECD crude/product stockbuilds should get smaller in H2 16 vs H1 16, with OECD crude/product stocks roughly balanced in H2 16. When this happens, the oil markets should finally see evidence of light at the end of the tunnel, which in turn should enable them to begin rebalancing in 2017.”

Yield Spreads Advocating for a Stronger CAD

Another increasingly important influence according to CIBC Capital Market’s Jeremy Stretch are U.S Treasury yields, and more importantly their spread to Canadian sovereign yields:

“While we continue to fixate on oil correlations we should not ignore the fact that 2-year spreads continue to move back in favour of the CAD and have moved by around 30bps in just three weeks.”

On Friday U.S 2 year yields rose by 28 basis points – nine times the three basis point rise in Canadian 2-year bonds, despite both country’s releasing their employment data.

As far as the week ahead goes there are only two significant releases for the loonie – December Building Permits on Monday (-11.6% prev), and the New House Price Index on Thursday, which showed a 1.6% rise previously in November (both data sets are for December).

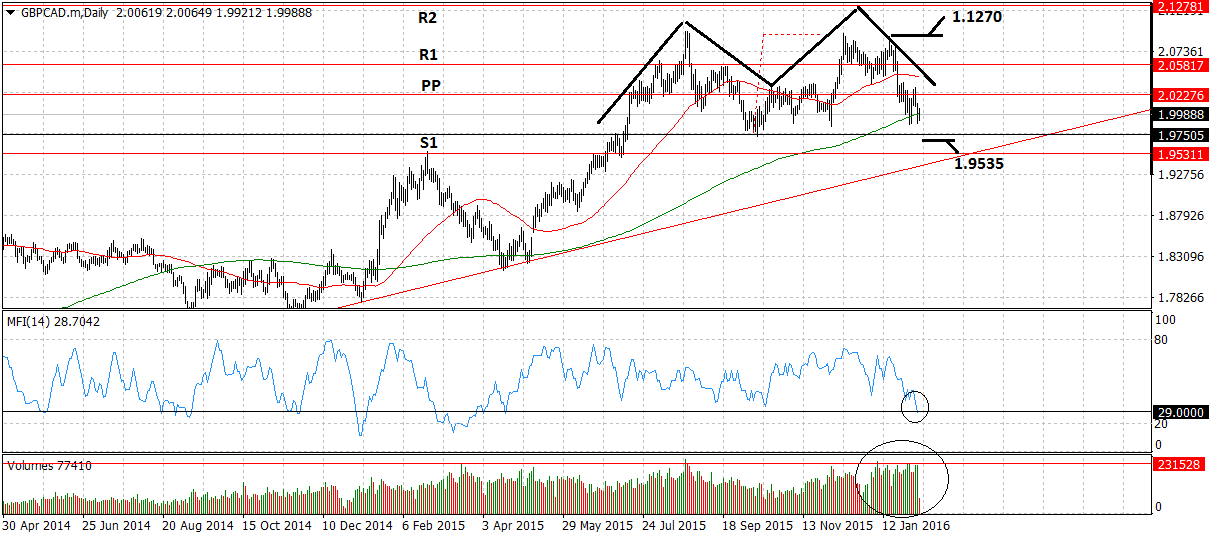

GBP to CAD Forecast

Technically speaking, GBPCAD has made a second consecutive daily test of 2.00, the sequence of candles (and their extended lower shadows) underscoring considerable support below this crucial level.

"Recent GBPCAD lows have emerged at sequentially higher levels, suggesting a potential waning in downside pressure. However the ADX appears poised to break above 25 with DMI’s that are suggestive of greater down-side risk," says analyst Shaun Osborne at TD Securities.

Osborne suggests we await a clear resolution of the recent range with a focus on 1.9880 support and 2.0380 resistance.

I note that the pair is at the floor of a long sideways consolidation, box pattern, or possible double top.

Untypically for a reversal pattern, however, there is a lot of buying volume on the right shoulder, allowing for the possibility of a continuation higher eventually.

Money Flow is the lowest since April 2015 – a very bearish sign in a sideways market.

The mixed signals, however, make it difficult to predict in which direction it will break.

However, a clean breach of the neckline at 1.9732 - confirmed by a move below 1.9690 - would probably confirm a move down to support from the S1 Monthly Pivot and the trend-line at 1.9535.

Alternatively, a break above the pattern highs at 2.0949 would probably lead to a move up to resistance from the R2 Monthly Pivot at 2.1279 initially.

Canadian Dollar Oversold Against the US Dollar

USDCAD has risen sharply over the course of 2016 and has surpassed the forecast levels held at Scotiabank for 2016 by a substantial margin, rising to a peak near 1.47 earlier in January.

"However, we are keeping our forecast for the Canadian dollar (CAD) unchanged over the balance of the year as we think the USD has overshot and the CAD, which has lost nearly 7% against the USD in the past three months, is starting to look oversold and fundamentally cheap," says a note from Scotiabank.

Analysts expect oil prices to stabilize near $30-35/bbl in the medium term and we also expect the next move in Bank of Canada (BoC) rates to be up – though not until 2017.

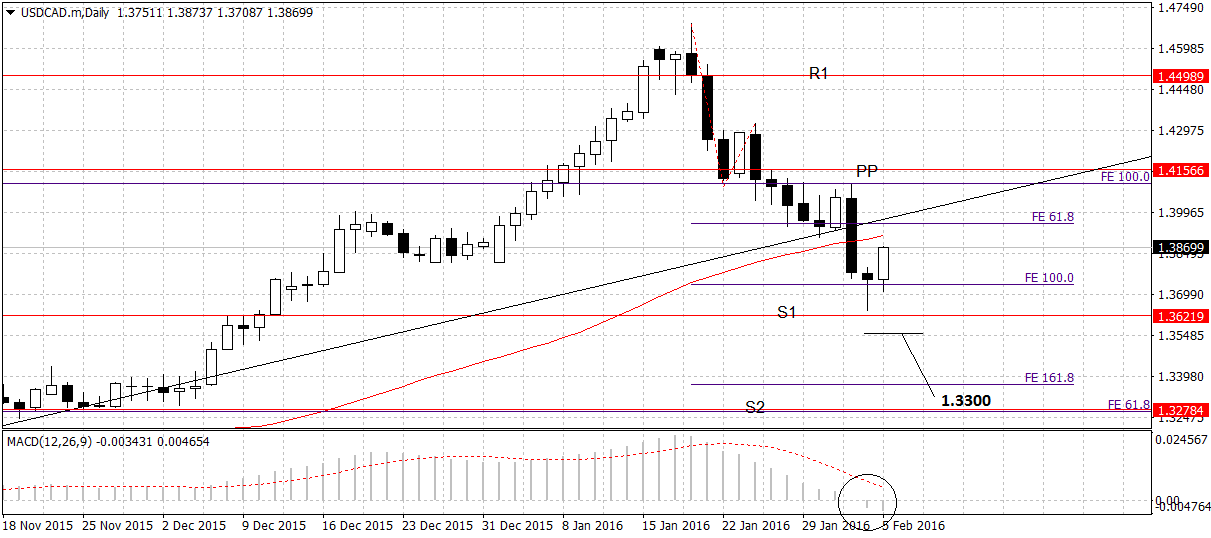

USD to CAD Technical Forecast

Looking at the charts, the USD/CAD has extended its down-trend, breaking clearly below the trend-line and the 50-day MA.

It has rotated after reaching the S1 Monthly Pivot at 1.3622 and put in a good hammer reversal candlestick, followed by an up-day today off the back of stronger U.S data, however, the trajectory of the short-term trend remains bearish.

MACD has turned below the zero-line heralding the onset of a bearish trend.

A move clearly below S1 confirmed by a break below 1.3560, would usher in a new bearish phase, with an end target down at the next major support shelf at 1.3300.

US and Canadian Jobs Data Diverges, Placing Downside Pressure on CAD Outlook

Friday saw the release of Canadian payrolls data at the same time as U.S NFPs. The Canadian data was not as positive as the U.S equivalent and the loonie lost ground as a result – although its short-term down-trend remains intact (see technical analysis below).

The results showed the unemployment rate edge up to 7.2% from 7.1% and overall employment fall by -5.7k, the participation rate remained unchanged and the one bright spot was the 5.6 rise in full-time employed, versus the 11.6 fall in part-timers.

According to National Bank of Canada’s Matthieu Arseneau, the data was not all bad :

“However, all is not bleak as full-time employment rose in January and services-producing industries did not experience for now collateral damages coming from the weaknesses in goods-producing industries. We also take comfort that other provinces, particularly Ontario and BC compensate lately for other provinces weaknesses....”

Arseaneau goes on to discuss the outlook for hiring in 2016 before highlighting the contrast with the U.S:

“All in all, this morning’ report is in line with our view that a hiring spree is very unlikely this year.

“Keep in mind that hiring intentions of businesses were their lowest since the 2008-2009 based on the business outlook survey published in January.

“The profit environment is just not conducive for major gains.

“Canada’s private sector continues to struggle in creating jobs, a sharp contrast with what we observe south of the border (bottom chart).”