Canadian Dollar Defies OPEC Oil Price Slump, Tracks AUD + NZD Higher

The Canadian dollar held its recent ranges against the pound and US dollar despite some poor jobs news out of Canada and a fall in oil prices.

While the Canadian currency managed to keep the USD and GBP around recent ranges, hurdles to any significant CAD strength are however set high.

We also note CAD enjoyed some strength from its commodity dollar bretheren, the AUD and NZD, which both delivered an impressive performance as gold prices were sent higher.

It was reported that 35.7K jobs were lost in Canada in November, well ahead of expectations of a decline of 10K. The Unemployment Rate (Nov) rose to 7.1%, ahead of expectations for it to remain at 7.0%.

In fact it seems the CAD is defying gravity in our opinion as no key data points beat expectations today.

The pound to Canadian dollar exchange rate is trading at 2.0229 while you are likely to pick up a rate in the region of 1.9622 at your bank when transferring money. Independent providers are tighter on their spreads and are seen making payments in the region of 1.9945, a notable saving for savvy market observers.

The US to Canadian dollar exchange rate was seen trading at 1.3362 at the close.

Labour Productivity (QoQ) (Q3) read at 0.1%, analysts had forecast 0.3%, the Participation Rate (Nov) fell to 65.8%, a shade worse than the 65.9% expected.

The Trade Balance (Oct) read at -2.76B, a great deal worse than the decline of -1.70B expected.

The deterioration in the trade balance will likely lead to lower Gross Domestic Product (GDP) growth in the fourth quarter of 2015. RBC Economics estimate a 1.8 percentage point drag on annualised fourth-quarter GDP growth.

However, RBC's Senior Economist Nathan Janzen is upbeat about the outlook:

"We expect some modest slowing in GDP growth in the fourth quarter to a 1.3% rate, in part reflecting the expected quarterly pullback in the real trade balance; however, increasingly, we expect strength in external demand to support exports and offset ongoing weakness in investment in the oil and gas sector, with overall GDP growth strengthening back to an above-potential pace in 2016."

OPEC Sends Oil Prices Lower

There was little support afforded to the Canadian currency by OPEC which sent oil prices 2.7% lower after agreeing to roll over its policy of maintaining crude production in order to maintain market share.

OPEC had been widely expected to stick with its year-old policy, despite pressure from poorer members of the cartel for a cut in output to prop up the price of oil.

This is bad news for Canada's high-cost oil production sector as higher prices are desperately needed to cement long-term viability in this key foreign exchange earning sector.

Heavy Support to Limit CAD Advance

Turning to the headline USDCAD rate, the dollar is likely to hold sway.

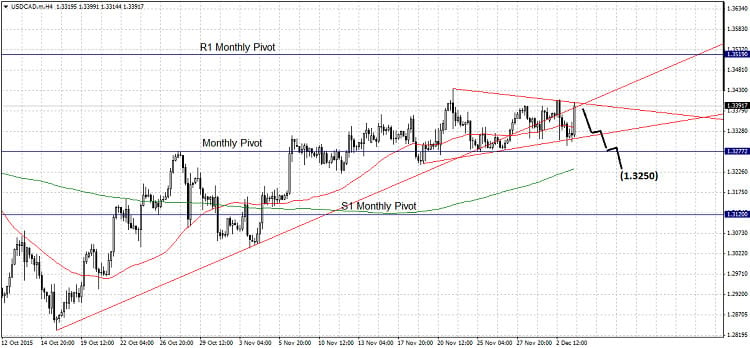

From a technical POV the USD to CAD pair has formed a triangular pattern which appears to be near to concluding, having completed 4 out of its 5 expected legs.

The question now is which way this pattern will break.

Normally I would automatically favour a break in the direction of the trend previous to the formation of the pattern, which would in this case mean a move higher, however, in this case, I’m taking a contrarian view as the chart looks weaker than usual, having recently breached a key trend-line, so in this case I see risks actually tilted slightly to more down-side.

The Monthly Pivot sitting at 1.3270 provides a major support level and is therefore an obstacle to further downside. Even with the sort of volatile price behaviour expected during Friday’s news this level still needs to be respected, and even if there is down-side it may limit its extent.

Further support is also supplied at around 1.3250 by key lows and the 200-4hr MA, making the road lower a potentially ‘bumpy ride’.

As far as fundamentals go a decision by OPEC to limit supply would be the sort of news which could lead to a strong move lower. Such a possibility has been raised by reports – which gained fresh credence on Thursday - that Saudi Arabia, the largest oil producer in the world is considering a cap on production in order to prevent further price erosion.

A continuation of the bullish trend is preferred, as such a move would gain traction from a move above the 1.3435 highs, although, sharp volatility could reverse moves in either direction.