Canadian Dollar Strength Draws Doubters

- Written by: Gary Howes

Image © Adobe Stock

The Canadian Dollar has recovered from its weakest level since 2003, but the recovery is drawing question marks from some analysts.

"We still harbour doubts about a continuation of the recent CAD rally," says John Velis, Americas Macro Strategist at Bank of New York (BNY).

The observation follows a spike in the Dollar-Canadian Dollar exchange rate (USDCAD) on Monday to 1.4793 and associated spikes in non-USD/CAD exchange rates.

BNY thinks Canada is caught in tariff limbo, negatively impacting investor sentiment.

"Currency volatility is extraordinary and CAD's carry-to-volatility return since the beginning of the year is among the worst of the 30 or so currencies we characterise as the set of 'expanded majors,' ranking fifth worst. Not that the Canadian dollar is a strong carry currency, but the risk-reward of trying to trade Canada since January 1 is highly unattractive presently," explains Vallis.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

The Canadian Dollar has recovered from the worst excesses of Monday's selloff to USD/CAD 1.4346, with GBP/CAD paring to 1.79 and EUR/CAD to 1.49.

The relief buying follows the last-minute avoidance of U.S.-Canada trade tariffs that were due to come into effect this week, sparking the start of a North American trade war.

Trump and Trudeau agreed to suspect the tariffs to allow negotiators to work towards a new trade deal, with feedback expected at the beginning of March.

"From a fundamental perspective, it still seems too early for long-term investors to aggressively buy the CAD as trade tensions might get worse before they get better. However, given depressed sentiment and stretched positioning, starting to build small long positions offers an attractive reward-to-risk ratio," says Chester Ntonifor, Foreign Exchange Strategist at BCA Research.

📈 Q2 Investment Bank Forecasts for GBP vs. CAD. See the Median, Highest and Lowest Targets for the Coming Months. Request your copy now.

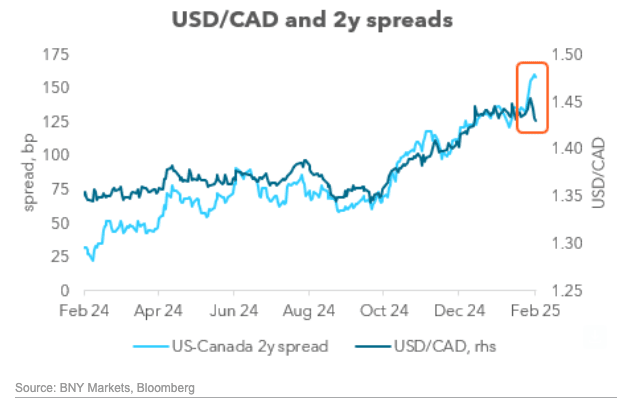

However, BNY thinks the Canadian Dollar is also at risk of dislocation in its relationship with two-year bond yields.

The bank's research shows a "remarkable" correlation between USD/CAD and the differential between U.S. and Canadian two-year yields.

"We think this correlation will reassert itself soon, considering the 2y yields reflect relative monetary policy expectations. The Bank of Canada is still quite likely to be more aggressive on rates owing to differing local macroeconomic fundamentals," warns Vallis.

Image courtesy of BNY.

The implication is that CAD weakness will extend even as trade relations normalise.

Analysts at Goldman Sachs previously estimated that the Canadian Dollar could weaken by around 13% to a permanent 25% across-the-board tariff if the currency followed the typical response to a change in the Terms of Trade.

A lower initial tariff on energy products, which account for around a quarter of Canada’s exports to the US, lowers that estimate slightly, but given the uncertainties at play Goldman still thinks that is the

right ballpark as a theoretical final resting place.

Analysts at the Wall Street bank are also watching yield differentials, noting that in the first trade war, USD/CAD would regularly trade at a 4-5% premium to rate differentials, but lately that has hovered around 1-2%.

"Taken together, we think USD/CAD will likely move about 3-5% higher from Friday’s close in the coming

days, assuming no significant progress in the ongoing negotiations," says Goldman Sachs.